The Fortescue Ltd (ASX: FMG) share price is up by 1% after the ASX mining share reported its FY24 first-half result.

Fortescue share price rises on strong result

- Revenue increased by 21% to US$9.5 billion

- Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) grew by 36% to US$5.9 billion

- Net profit after tax (NPAT) grew 41% to US$3.3 billion

- Free cash flow increased 68% to US$2.66 billion

- Net debt improved 45% to $569 million

- Interim dividend increased by 44% to A$1.08 per share

Fortescue’s profitability soared after the average revenue it achieved rose by 24% to US$108.19 per dry metric tonne (dmt). The production (C1) costs only rose by 2% to US17.77 per wet metric tonne. It sold 95.2mt of ore, which was a 2% reduction compared to the prior corresponding period.

The ASX iron ore share said it has had a strong focus on productivity and efficiency

What else happened in the FY24 first half?

Iron Bridge, a high-grade project that Fortescue had been working on for a long time, achieved its first shipment of high-grade magnetite concentrate in September 2023.

The Fortescue share price could be heavily influenced by the success (or failure) of the green energy division which is looking to produce green hydrogen. In the last several months, the company has announced a final investment decision on the Phoenix hydrogen hub in the US, the Gladstone PEM50 project in the US and a green iron trial commercial plant in the Pilbara. The EU awarded Fortescue’s Holmanset project a grant of â¬204 million.

The company also launched Fortescue Capital, which is a green energy investment accelerator, headquartered in New York City.

What did Fortescue management say?

The Fortescue Metals CEO Dino Otranto said:

Fortescue’s performance in the first half of FY24 has been excellent, with the team achieving our second highest first half shipments while maintaining our strong focus on safety and keeping our costs low.

Whether it’s through our first green energy projects, our diversification into the high grade segment of the iron ore market through Iron Bridge, or expansion of our global footprint with the Belinga Iron Ore Project in Gabon, we remain committed to creating value for all our stakeholders.

What’s next for Fortescue?

The company is making ongoing decarbonisation progress, including ongoing construction of a 100MW solar farm and testing of the first battery electric haul truck prototype in the Pilbara.

Work is underway at Iron Bridge to replace the high-pressure section (65km) of the Canning Basin raw water pipeline to de-risk and improve the performance. The installation is scheduled to be completed by mid-2025 and isn’t expected to impact Iron Bridge’s ramp-up. This comes with an estimated cost for Fortescue of US$100 million, with most of that cost coming in FY25.

Fortescue share price snapshot

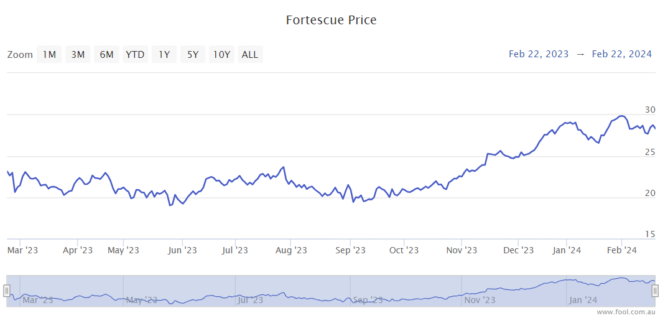

In the past six months, the Fortescue share price has risen by 34%, compared to a rise of just 7% for the S&P/ASX 200 Index (ASX: XJO).

The post Fortescue share price rises on huge 41% profit growth in FY24 half-year result appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- The Fortescue share price is down almost 10% in February, time to buy?

- Will Fortescue stock be worth more than CBA by 2026?

- ASX mining shares up amid Labor plan to spend multibillions on renewables revolution

- Which ASX 200 large-cap shares offer the best dividend yields in 2024?

- 16% gross yield: The 3 hottest high-dividend ASX stocks to buy right now

Motley Fool contributor Tristan Harrison has positions in Fortescue. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/NDoZShK

Leave a Reply