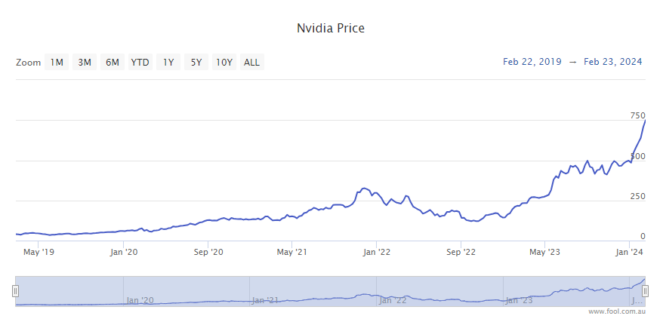

The Nvidia Corp (NASDAQ: NVDA) share price closed last night at US$785.38, up 16.4% after the semiconductor company delivered a cracking quarterly update that included a 769% net income increase.

Say, what? Yep, that isn’t a typo.

Following the results, several brokers have laid out their predictions for the Nvidia share price from here.

And one analyst is tipping the stock will get to US$1,400… within just 12 months.

Nvidia share price on fire

Hans Mosesmann, senior research analyst at Rosenblatt Securities, appears to have the highest 12-month target price on Nvidia at the moment.

He thinks the stock can almost double within the next 12 months to US$1,400 per share.

That’s a pretty remarkable prediction for a company that already has a market cap of US$1.94 trillion.

Then again, the Nvidia share price has more than tripled over the past year. So, in a historical context, you could say Mosesmann’s tip of a near-doubling over the next year sounds like a slowdown!

For the record, this time last year the Nvidia share price was about US$232.

That’s pretty staggering growth.

What else is staggering is Nvidia’s results for 4Q FY23 and the full year reported yesterday.

Let’s recap.

Astonishing 4Q FY23 results send Nvidia shares 16% higher

For the three months ended 31 December, Nvidia reported:

- Revenue up 265% year over year to US$22.1 billion

- Gross margin up 12.7% to 76%

- Net income up 769% to US$12.3 billion

- Earnings per share (EPS) up 765% to US$4.93

For the full year 2023, Nvidia reported:

- Full-year revenue up 126% to a record of US$60.9 billion

- Gross margin up 15.8% to 72.7%

- Net income up 581% to US$29.76 billion

- Earnings per share up 586% to US$11.93

Nvidia’s founder and CEO, Jensen Huang, commented: “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.”

The company expects 1Q FY24 revenue to go higher still, to $24 billion (+/- 2%), with an improved gross margin in the range of 76.3% to 77%.

And all of this good news has market analysts in a bit of a lather.

Most brokers raise 12-month share price targets

Most brokers raised their 12-month price targets on Nvidia overnight and maintained their buy ratings.

Here is a selection of the most bullish predictions:

- Rosenblatt Securities raised its price target to US$1,400, up from US$1,100 (maintain buy)

- Keybanc raised its Nvidia share price target to US$1,100, up from US$740 (maintain overweight)

- Benchmark raised its price target to US$1,000, up from US$625 (maintain buy)

- Bernstein raised its price target to US$1,000, up from US$700 (maintain outperform)

- Bank of America raised its price target to US$925, up from US$800 (maintain buy)

- Truist raised its price target to US$911, up from US$691 (maintain buy)

- TD Cowen its Nvidia share price target to US$900, up from US$700 (maintain outperform)

- Wolfe raised its price target to US$900, up from US$630 (maintain outperform)

A couple of brokers were a little more conservative on Nvidia’s share price trajectory from here:

- UBS lowered its price target to $800, down from $850 (maintain buy)

- Deutsche Bank raised its price target to $720, up from $560 (maintain hold rating)

- Morgan Stanley raised its price target to $795, up from $750 (maintain overweight)

Nvidia’s place in the world

As my colleague Seb points out, Nvidia’s market cap is larger than many countries’ entire economies.

However, Nvidia still isn’t as big as Microsoft Corp (US$3 trillion) and Apple Inc (US$2.82 trillion).

Globally, Nvidia is the world’s fourth-most valuable listed stock.

The post Is the Nvidia share price on course to reach US$1,400? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why are ASX tech shares booming on Friday?

- Nvidia stock pops 10% after-hours following ‘insane result’

- Could Nvidia become the most valuable stock on earth?

- 3 things ASX investors should watch this week

- Buy and hold these ASX ETFs for 10 years or more

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Motley Fool contributor Bronwyn Allen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Apple, Bank of America, Microsoft, Nvidia, and Truist Financial. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool Australia has recommended Apple and Nvidia. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/wxb8k7W

Leave a Reply