Domino’s Pizza Enterprises Ltd (ASX: DMP) shares haven’t exactly shot the lights out so far in the new year.

Since the opening bell on 2 January, shares in the S&P/ASX 200 Index (ASX: XJO) fast food pizza retailer are down a painful 27%.

Most, if not all, of that pain can be blamed on a trading update from 25 January.

That update indicated strong sales growth for the company at its operations in Germany, Australia and New Zealand. However, the pizza retailer saw same store sales in Japan, Taiwan, Malaysia and France fall.

Investors reacted by sending Domino’s shares down 31.1% on the day.

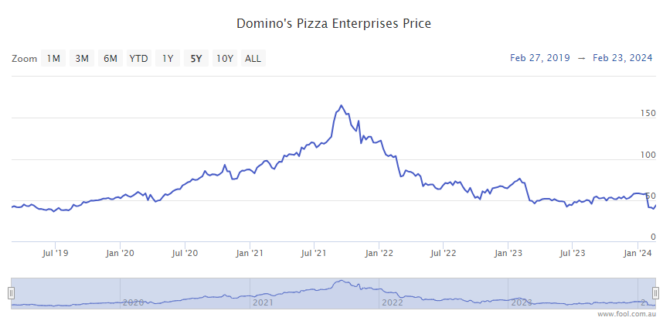

As you can see in the above chart, despite gaining 10% since 25 Janaury, the stock remains down 73% from its mid-September 2021 highs.

That big fall, and the potential for a strong rebound, has put the ASX 200 pizza company on Vertium Asset Management founder Jason Teh’s radar. Teh likes to invest in beaten down companies in the early stages of a turnaround phase.

And that turnaround could already be in the early stages for Domino’s Pizza.

While Domino’s last week reported its Asian businesses continued to struggle over 1H FY 2024, the company’s Australia and New Zealand segment enjoyed the strongest top line growth in six years.

And momentum for that turnaround appears to be building.

In the first seven weeks of calendar year 2024, same stores sales growth increased 8.4% in Australia and New Zealand and 0.3% in Asia, while growth slipped 0.6% in Europe.

The company also offers some handy passive income. Domino’s shares trade on a 2.3% dividend yield.

Domino’s shares in ‘early days’ of turnaround

According to Teh (courtesy of The Australian Financial Review), “You can already see some signs of recovery with the new products that were launched in Australia, and same store sales are improving.”

And it’s that concentration on targeted product offerings that Teh believes will drive the turnaround for Domino’s shares, with the recent success in the company’s Australia and New Zealand stores serving as a guide to improving its international sales.

According to Teh:

The overseas markets haven’t delivered yet. But it’s still early days with all turnarounds. It takes time to see the results of the strategy, but lessons learned in Australia will be taken to overseas markets.

Then there’s Domino’s CEO Don Meij.

Meij has held that title since 2002. And in 2005 he oversaw Domino’s listing on the ASX.

As legendary investor Warren Buffett famously said, “A great manager is as important as a great business.”

And Teh believes Meij fits that bill.

“I’m willing to definitely give him a little bit of a benefit of the doubt that he will be able to execute this turnaround strategy. If it was a brand-new CEO, you just don’t know as well,” he said.

In Monday afternoon trade, Domino’s shares are down 0.7% at $43.22 apiece.

The post Down 27% in 2024, this leading fund manager forecasts a big turnaround for Domino’s shares appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 25 ASX 200 shares with ex-dividend dates next week

- Here’s how these 3 ASX 200 shares just earned substantial broker upgrades

- Here are the top 10 ASX 200 shares today

- Why Bega Cheese, Domino’s, Lovisa, and Universal Store shares are rocketing today

- Why Codan, Domino’s, Lottery Corp, and Wisetech shares are storming higher today

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Domino’s Pizza Enterprises. The Motley Fool Australia has recommended Domino’s Pizza Enterprises. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/EVlBnIe

Leave a Reply