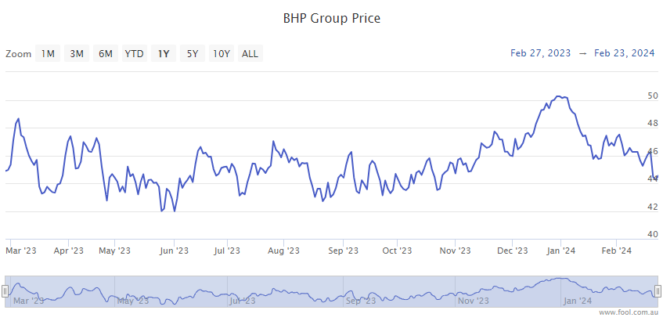

The BHP Group Ltd (ASX: BHP) share price is trailing the S&P/ASX 200 Index (ASX: XJO) today.

Shares in the mining giant are down 0.5% at the time of writing in afternoon trade on Tuesday, more than twice the 0.2% losses posted by the benchmark index at this same time. In earlier trade, BHP stock was down more than 1.2%.

And it’s not just the BHP share price dragging on the ASX 200 today.

The Fortescue Metals Group Ltd (ASX: FMG) share price is down 1.0% and Rio Tinto Ltd (ASX: RIO) shares are also down 1.0%.

So, what’s going on?

BHP share price hit by slumping iron ore outlook

BHP, alongside rivals Fortescue and Rio Tinto, are under pressure today following a 4% overnight drop in iron ore prices. The industrial metal is trading for just over US$115 per tonne, down from US$140 per tonne at the beginning of 2024.

Iron ore counts as the biggest revenue earner for all three ASX 200 miners.

BHP is listed on several international exchanges atop the ASX. And the iron ore price slide saw the BHP share price tumble by 1.9% on the NYSE overnight.

Much of the recent weakness in the iron ore price stems from falling expectations for a big uptick in demand from China, Australia’s top export market for the steel-making metal.

Many analysts had expected steel output in China to rebound following the nation’s Lunar New Year holiday period. But the data shows production remains subdued as China’s steel-hungry real estate sector continues to struggle.

Commenting on the market dynamics pressuring the BHP share price today, ANZ Group Holdings Ltd (ASX: ANZ) analysts said (quoted by Mining.com), “Inventories of iron ore at major Chinese ports rose. Supply concerns also eased, with a cyclone threatening WA ports now tracking away from the state’s iron ore hub.”

Also adding to easing supply concerns is Brazilian iron ore giant, Vale. The company reported that its production remains on track despite inclement weather, while it may also look to boost shipments to markets outside of China.

The post Why is the BHP share price trailing the ASX 200 on Tuesday? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here’s the BHP dividend forecast through to 2026

- Top brokers name 3 ASX shares to buy next week

- Better buy: Fortescue or BHP shares?

- 3 ASX 100 and ASX 200 shares I’d buy now for a $1,820 passive income in 2024!

- Top brokers name 3 ASX shares to buy today

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/q02Gz6w

Leave a Reply