The S&P/ASX 300 Index (ASX: XKO) is down 0.1% today despite some heavy lifting from ASX 300 stock Macquarie Technology Group Ltd (ASX: MAQ).

Shares in the data centre, cloud, cyber security and telecom company closed yesterday trading for $71.20. At the time of writing in late morning trade on Thursday, shares are swapping hands for $79.40, up 11.5%.

This comes following the release of the ASX tech share’s half-year results for the six months ending 31 December (1H FY 2024).

Read on for the highlights.

ASX 300 stock soars on continued profitability growth

- Revenue of $181.3 million, up 5.1% on 1H FY 2023

- Earnings before interest, taxes, depreciation and amortisation (EBITDA) of $53.0, up 3% year on year

- Net profit after tax (NPAT) of $14.8 million, up 74% on 1H FY 2023 ($8.5 million)

- Operating cash flows of $49.5 million

What else happened during the half year for Macquarie Technology?

The ASX 300 stock is enjoying a strong run today after announcing its eighteenth consecutive half-year of profitable growth.

Macquarie Technology attributed the 74% year on year increase in NPAT over the six months to increased earnings, lower interest costs since the paying down of its debt facility in June, and lower depreciation and amortisation levels.

The company reported holding $86 million in cash and deposits, an improvement from 1H FY 2023 due to positive operating cash flow.

Capital expenditure for six months came in at $18.5 million, down from $33.2 million in the prior corresponding period. This was comprised of $9.1 million in growth capex; $6.0 million in customer related capex; and $3.4 million in maintenance capex.

What did management say?

Commenting on the results sending the ASX 300 stock soaring today, chairman Peter James said:

This result represents our eighteenth consecutive half of EBITDA growth, a strong result underpinned by continued growth in cloud and cyber megatrends, and the outstanding customer experience reflected in our high net promoter score.

Macquarie Technology CEO David Tudehope added:

We are pleased to have secured the IC3 Super West DA. With anticipated demand from the AI megatrend, we could increase the IT load of IC3 Super West from 38MW to 45MW. This would take the campus from 56MW to 63MW. Access to 63MW of power is available upon opening of IC3 Super West.

What’s next for Macquarie Technology?

Looking at what could impact the ASX 300 stock’s performance in the months ahead, the company forecasts the FY 2024 EBITDA will be approximately $108 million to $111 million. This includes Macquarie Data Centres’ EBITDA of $34 million to $35 million.

Site preparation and early works are currently underway to prepare the Macquarie Park Data Centre Campus for IC3 Super West. Debt refinancing is to be undertaken in line with the requirements of that project.

Management said they will continue to invest across the group to drive future profitable growth.

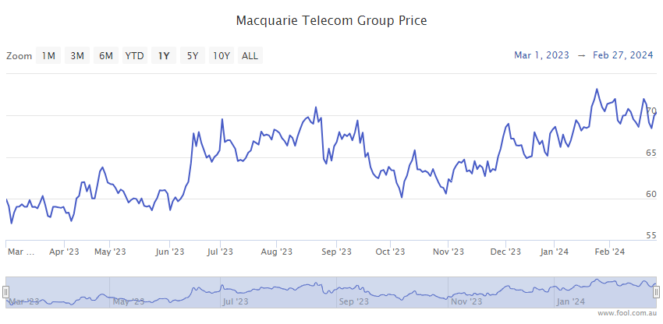

How has the ASX 300 stock been tracking?

It’s been a good year for Macquarie Technology shareholders.

With today’s intraday boost factored in, the ASX 300 stock is up 33% in 12 months.

The post This ASX 300 stock just jumped 12%! Here’s why appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- These ASX tech shares could rise 18% to 30% this year

- ASX passive income seekers: Invest $10,000 for $520 in monthly income

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/WRCto8B

Leave a Reply