Did you hear that?

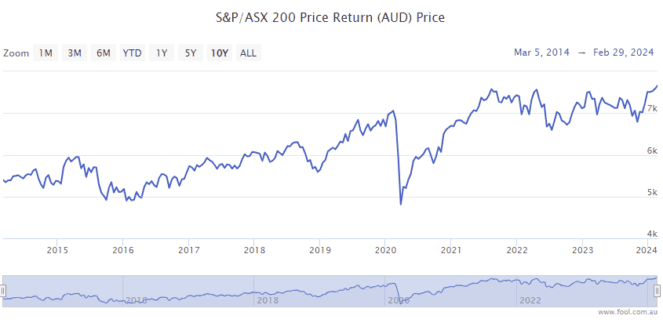

That was the sound of the S&P/ASX 200 Index (ASX: XJO) rocketing into new all-time high territory.

It’s the kind of record investors â save short sellers, perhaps â love to see reset.

At the time of writing in morning trade on Friday, the ASX 200 is up 0.3% at 7,718.4 points. That’s down from 7,737.4 points just a few minutes ago, which as of now, stands as the new ASX 200 record intraday high.

The prior intraday record was set last month, on 2 February. The ASX 200 reached an intraday high of 7,703.8 points on the day and notched a record closing high of 7,699.4 points.

That means if the benchmark index can maintain its current levels, or rises higher, today will also usher in a new closing high.

And, pleasingly, these records have been resetting fast of late.

The all-time closing high of 7,628.9 points achieved in August 2021, on the other hand, maintained its record spot for two and a half years!

What’s sending the ASX 200 into record territory?

There are a number of factors helping drive the benchmark index to new highs.

On the domestic front, we’ve seen some very solid earnings results from most of the Aussie blue-chip stocks. And with many beating expectations, investors have been hitting the buy button.

The ASX 200 also is catching some tailwinds out of the United States.

Part of this is fuelled by the ongoing AI stock boom, which saw the tech-heavy Nasdaq Composite Index (INDEXSP: .INX) close up 0.9% overnight for its own record closing high.

And part of it comes as inflation in the world’s top economy increasingly looks to be coming back to earth.

The personal consumption expenditures (PCE) index data out of the US indicated inflation is still running above the Federal Reserve’s target range of 2%. However, it was within economists’ consensus expectations. And investors are now upping their bets that the world’s most influential central bank could start cutting interest rates as early as June.

Commenting on the US PCE data sending the Nasdaq and ASX 200 to new all-time highs, LPL Financial’s Quincy Krosby said (quoted by Bloomberg):

For markets keenly focused on when the Fed will transition towards easing rates, this report will help restore confidence that it isn’t ‘if’ the Fed will begin to cut rates in 2024, but ‘when’.

The post Boom! ASX 200 rocketing into new all-time highs on Friday appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why this ASX 300 share is leaping 14% despite being branded a ‘sell’

- Why are Core Lithium shares jumping 12% on Friday?

- Why is the Ampol share price tumbling 5% on Friday?

- Guess why this ASX battery materials share is surging 14% today

- Life360 share price rockets 24% after smashing FY23 earnings expectations

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/FBVkhE7

Leave a Reply