The Brickworks Limited (ASX: BKW) share price reset its all-time record high again on Tuesday.

Brickworks shares hit a new peak of $30.35 in intraday trading, up 1.2% on yesterday’s closing price.

The Brickworks share price finished the session at $30.27 on Tuesday, up 0.93%.

The building materials stock has been on a run lately, despite no news out of the company in 2024 as yet.

However, Brickworks is due to report its 1H FY24 earnings on 21 March, so watch this space.

In the meantime…

Why is the Brickworks share price at a record high?

The outlook on housing is positive, and this has lifted the share prices of many building materials stocks.

Over the past three months:

- The Brickworks share price is up by almost 20%

- The CSR Ltd (ASX: CSR) share price is up by almost 50%

- The Boral Ltd (ASX: BLD) share price is up by almost 25%

- The Adbri Ltd (ASX: ABC) share price is up by almost 50%

- The James Hardie Industries plc (ASX: JHX) share price is up by almost 25%

- The Reece Ltd (ASX: REH) share price is up by almost 45%

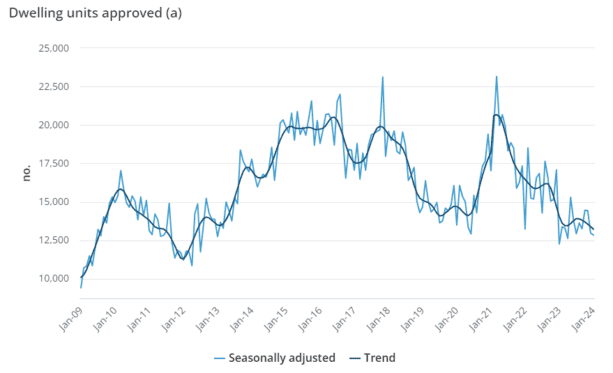

The Australian building industry had a very tough time after the world came out of COVID lockdowns.

New home approvals initially rebounded strongly, but then came a major disruption to global supply chains, significant inflation worldwide, and relentlessly rising interest rates.

In Australia, shipping costs went up, the price of materials went up, and building projects were delayed due to a lack of skilled labour.

Many small builders went under because they couldn’t afford to complete fixed-price projects amid rapidly rising costs.

Project delays and rising costs led to less demand for new homes, as shown below.

Source: Australian Bureau of Statistics

Things are settling down now.

Interest rates are likely to decrease soon, and there is plenty of building work in the pipeline as the world tries to catch up on pent-up demand for new housing and other infrastructure.

This means there is likely to be a strong demand for building materials over the next few years.

Investors are picking up on this and buying ASX shares with exposure to this trend, like Brickworks shares.

Overseas buyers snapping up ASX building materials companies

Three ASX building materials companies are currently under takeover, indicating confidence in the building sector at a global scale.

The prospective buyers of these ASX companies are offering a premium to shareholders, too.

CSR has entered into a binding scheme implementation deed with the French building giant Saint-Gobain (LSE: COD), which is offering a 33% premium.

Adbri has done the same with Irish supplier CRH PLC, which is offering a 41% premium.

Boral has received a takeover offer from major shareholder Seven Group Holdings Ltd (ASX: SVW).

Subject to conditions, Seven’s offer of up to $6.25 per share represents a near-7% premium on the closing Boral share price the day before the announcement.

The post Why did the Brickworks share price just smash another record? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Seeking retirement income from ASX bank shares at 52-week highs? What I’d buy instead

- How did the Brickworks share price just hit an all-time high?

- Buying Soul Patts shares? Here’s what you’re really buying

- How I built $5,000 of passive income starting with $0

- Owners of Brickworks shares haven’t seen a dividend cut for 47 years!

Motley Fool contributor Bronwyn Allen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Brickworks. The Motley Fool Australia has positions in and has recommended Brickworks. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/YznUx53

Leave a Reply