With the S&P/ASX 200 Index (ASX: XJO) rising 13.8% over the four months, many of the more obvious quality stocks have become expensive.

As such, it’s not a bad idea to check out the shares that are struggling right now to see if there is a bargain to be bagged for long-term investors.

Here are two that Shaw and Partners portfolio manager James Gerrish and his team have identified:

‘A good outcome for shareholders’

Diversified mining company South32 Ltd (ASX: S32) has seen its share price decline almost 12% so far this year.

It’s a painful 37.3% fall if you go back 12 months.

Gerrish admitted the February results didn’t flatter, but feels the outlook is positive.

“They reported solid earnings, a slight beat on low expectations but costs remained an issue, which has led to the stock drifting lower,” he said in his Market Matters newsletter.

“We expect a production uplift in the 2H of FY24, and higher production will help with unit costs, putting them in a better position.”

There was an intriguing catalyst last week as well.

“The main news⦠was the sale of their Illawarra Met Coal operation for up to US$1.65 billion ($2.54 billion).”

The critical detail was that there is a large upfront cash payment of US$1.050 billion, with US$250 million deferred and a US$350 million conditional component.

“The price is a great one and a good outcome for shareholders given the operational complexities and risks, along with rehab liabilities at IMC.

“We like the risk-reward on offer by South32 below $3, with a 20% to 30% bounce being our preferred scenario.”

The South32 share price closed Tuesday at $2.94.

These ASX shares might have taken enough punishment

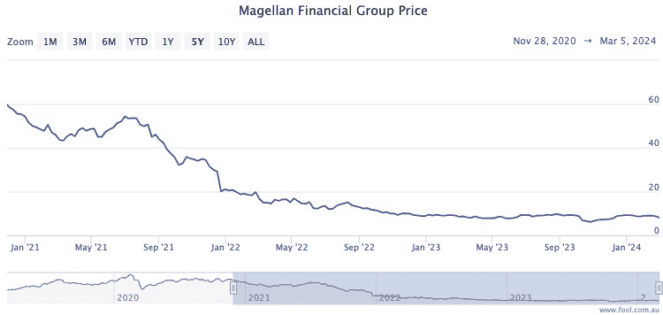

After the hammering it’s taken the last few years, it might take some courage to buy Magellan Financial Group Ltd (ASX: MFG).

But Gerrish’s team feels like the time is right with the price hovering in the low $8s.

“Market Matters continues to see attractive value in the individual components of MFG, including the much-discussed potential capital management due to the company’s strong balance sheet with cash and investments amounting to over 50% of its market cap, in our view.”

Last month the investment firm reported a “solid first-half beat”.

“The profit of $93.5 million was well ahead of the $66 million consensus estimate,” said Gerrish.

“Although it was driven by capital gains rather than a strong operational performance from the fund manager.”

His team also likes the appointment of the new boss.

“We liked the announcement that Sophia Rahmani, a well-credentialed leader from boutique fund manager Maple-Brown-Abbott, would take on the CEO role.

“Now back around $8, following a solid result, it’s looking increasingly attractive.”

The post 2 ASX shares with attractive ‘risk-reward’ balance to buy right now appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Leading brokers name 3 ASX shares to buy today

- 34 ASX 200 shares with ex-dividend dates next week

- Guess which ASX 200 mining stock could offer a 22% return

- Here are the top 10 ASX 200 shares today

- South32 share price jumps on $2.5b coal sale

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/Kqd4PYG

Leave a Reply