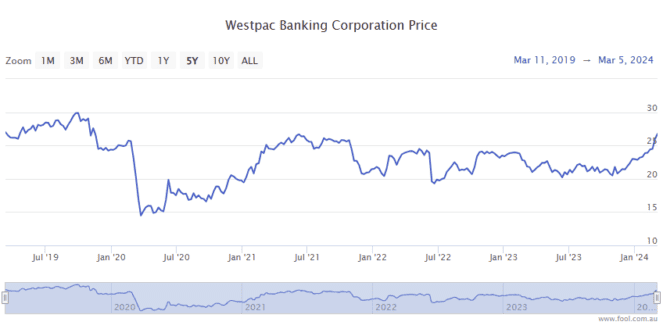

Westpac Banking Corp (ASX: WBC) shares hit new 52-week highs today.

At time of writing on Thursday afternoon, shares in the S&P/ASX 200 Index (ASX: XJO) bank stock are up 0.1% trading for $26.96 apiece.

That sees shares up 28% in just the past six months.

And the big four bank stock could get more support amid the ongoing $1.5 billion on market share buyback.

Atop from the potential for these kinds of outsized capital gains, Westpac shares are also popular among passive income investors for their reliable, twice yearly fully franked dividends.

Westpac paid an interim dividend of 70 cents per share on 27 June. And the bank delivered a final dividend of 72 cents per share on 19 December, just in time for Christmas!

Pleasingly for passive income investors, the full year’s $1.42 per share payout was up 13.6% from the prior year.

At the current share price, this sees Westpac shares trading on a fully franked trailing yield of 5.3%.

So, how are some income investors earning a dividend yield of almost 10%?

Buying Westpac shares when fear grips the markets

The answer lies in their timing.

Specifically, in buying stock when everyone else was gripped by fear during the early months of the COVID-19 pandemic.

Atop involving a significant element of luck, this also required some very serious bravery from investors who grabbed Westpac shares after the brutal six week sell off in February and March 2020.

Now, trying to time the market and get in on the lows can easily backfire.

Many investors might find the stock they thought had reached its lows will continue to fall far more. Hence the term ‘catching a falling knife’.

Others might find themselves still sitting on the sidelines long after the stock has bottomed and is on its way towards new highs.

But for investors who bought Westpac shares on 27 March 2020, the rewards have been ample.

Having crashed 42% in a month, the ASX 200 bank stock closed the day trading for $14.89 a share.

That means investors who bought on the day will now be earning a fully franked dividend yield of 9.5% from those shares.

Not to mention that they’ll have watched their bargain basement Westpac shares gain 81% since then.

The post A 10% dividend yield from Westpac shares? Here’s how these income investors achieved it! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why are the big 4 ASX 200 bank shares leaping to new 52-week highs today

- How investing $100 per week can create $2,000 in annual ASX dividend income

- Is the blistering rally in ASX 200 bank shares overdone?

- Forget Westpac and buy these ASX dividend shares

- Is it too late to buy Westpac shares at a fresh 52-week high?

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/saJ6YXF

Leave a Reply