For many non-investors, and indeed novice ASX investors, the extraordinary power of compounding is hard to wrap their heads around.

As an example, they might see a 7% annual return on an investment and think that’s nothing impressive.

But that level of compound annual growth rate (CAGR), kept up for 10 years, will see your money double.

This is amazing to many people.

Becoming an ASX investor is more important than 20% CAGR

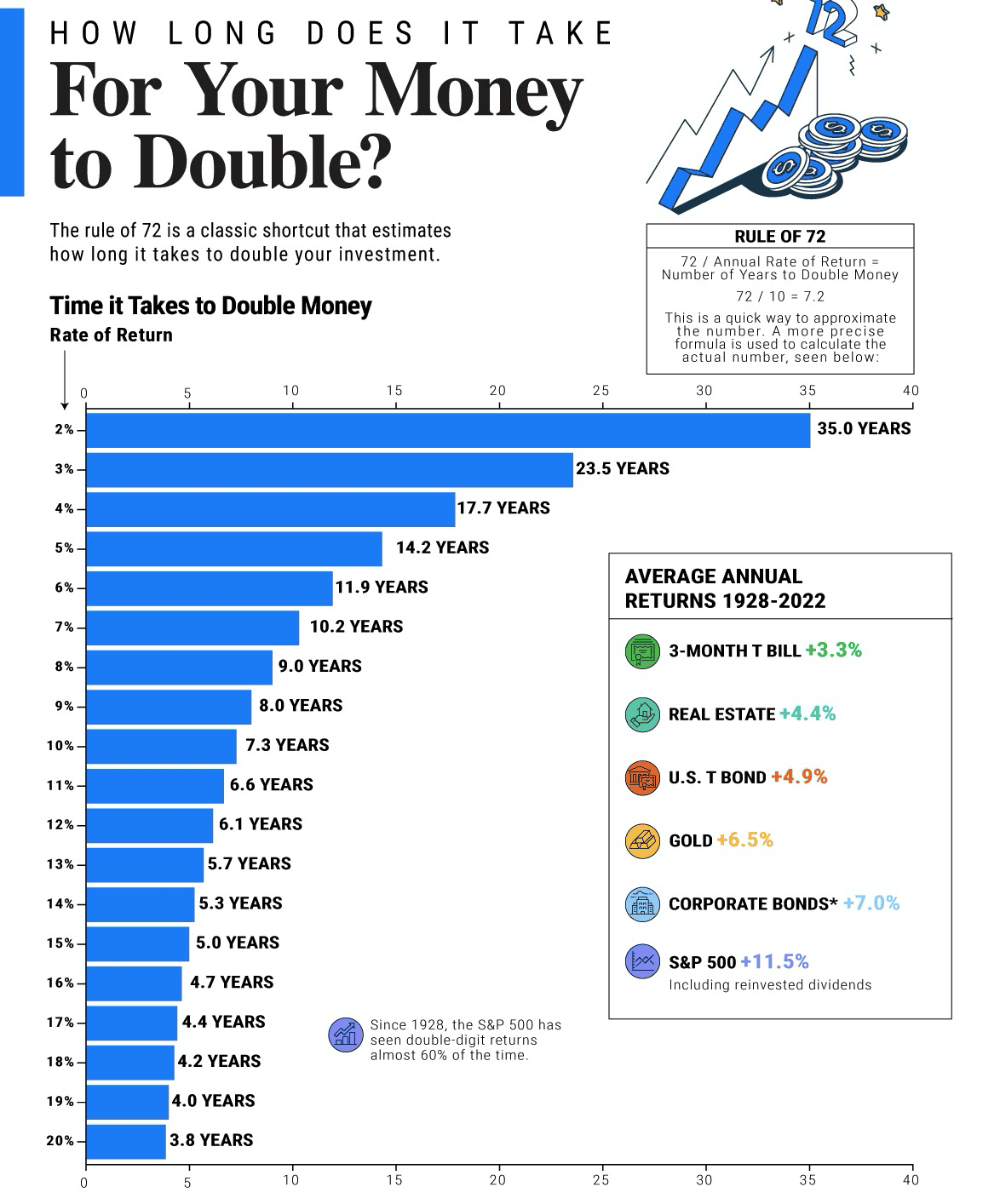

So to visually show off the incredible prowess of compounding, Visual Capitalist recently published a graphic that showed how long it takes for your money to double for various levels of CAGR:

The fascinating observation here is that each percentage point higher from 0% through to 7% makes a huge difference to how fast your investment will become twice the size.

Improvements in the CAGR beyond that don’t make as large an impact.

For example, 15% CAGR will double your nest egg in five years. But it takes an unbelievable 19% annual return to reduce that down just to four years.

But if an ASX investor can improve the portfolio’s performance from 2% to 6%, it cuts down the time from a whopping 35 years to 11.9 years.

It just goes to show that being invested is more critical than nabbing double-digit growth rates. Going from 0% to 7% has a far larger impact on your wealth than improving from 7% to 14%.

Do you want to wait 6.4 years or 120?

Visual Capitalist financial writer Dorothy Neufeld pointed out that this huge difference in the lower percentages is what makes stocks such an attractive investment in the long term.

“Consider if an investor put their money in the S&P 500 Index (SP: .INX). Historically, it has averaged 11.5% returns between 1928 and 2022. In 6.4 years, their money would double, assuming these average returns.

“If they were to put this money in a savings account, where the average savings rate is 0.6%, it would take 120 more years for their money to reach this potential.”

She added that, if inflation is taken into account, money stored as cash actually shrinks in value.

“Historically, inflation has averaged 3.3% over the last century.”

The post How long does it take for an ASX investor to double their money? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why these 3 ASX 200 shares grabbed the Motley Fool’s headlines this record-breaking week

- 2 excellent ASX ETFs to buy and hold for a decade

- 3 ASX 200 shares that could rise 20% to 50%

- Why you need to stop meddling with your ASX shares

- 3 ASX shares you can confidently invest $500 in right now

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/c5BULiM

Leave a Reply