If you have $10,000 to invest right now, there are some excellent S&P/ASX 200 Index (ASX: XJO) stocks that can grow that money.

When choosing stocks, I take the view of whether that cash will be invested in companies that will be doing better in 2029 than right now.

Here are two I reckon that are looking pretty damn good at the moment:

Pivoting from cash burner to cash saver

Xero Ltd (ASX: XRO) is an old favourite, but it’s a company that continues to adapt well to changing conditions.

The market has very much appreciated the change in direction that chief executive Sukhinder Singh Cassidy has brought over her 13-month tenure.

She has transformed the mindset of the software business from a grow-at-all-costs startup attitude to a more mature controlled-growth strategy. Costs have been cut in an attempt to increase cash flow and margins.

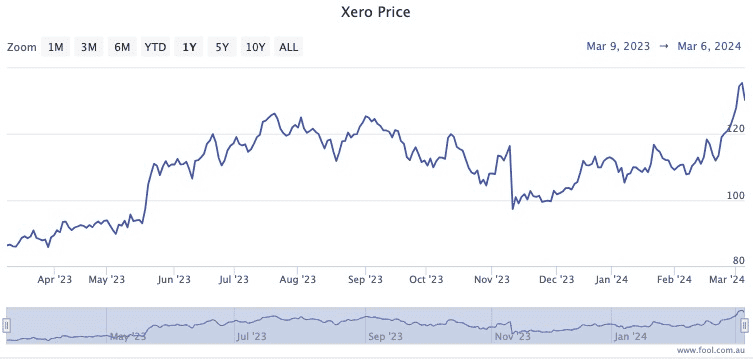

The Xero share price has thus rocketed 70% over the past 12 months.

Singh Cassidy’s work is far from done yet though, so I feel like this is one to buy as a long-term investment.

The chances that the New Zealand tech company will be in better shape in five years’ time compared to now seems reasonably high.

The ASX 200 shares under attack

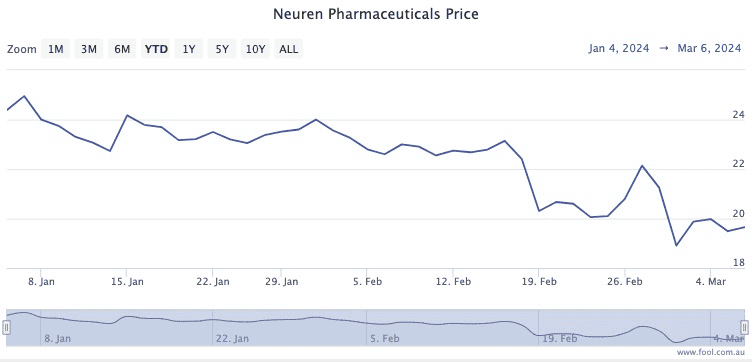

In contrast, Neuren Pharmaceuticals Ltd (ASX: NEU) hasn’t started 2024 in the best way.

The ASX 200 biotech shares are now 20% lower than where they started the year.

A short seller report has had much to do with investors fleeing this Australian company, which develops treatments for rare neurological disorders.

Neuren has a business model where its already commercially approved drug, Daybue, is licenced out to US giant Acadia Pharmaceuticals Inc (NASDAQ: ACAD) for sale to the public.

This brings in revenue for Neuren, which it uses to fund its pipeline of drugs under development and testing.

Last month, US short seller Culper Research did not target Neuren specifically but accused Acadia of understating the side effects of Daybue.

However, fund managers are sticking by the embattled ASX 200 share.

While some have reduced their share price predictions, all six analysts currently surveyed on CMC Invest are still rating Neuren as a buy.

Again, with several products under development, the chance that this company will be bigger and better in five years seems pretty decent.

The post $10k of savings? I’d buy these ASX 200 shares to grow my money appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Beginners: Buy these 2 ASX shares to start your portfolio

- Top brokers name 3 ASX shares to buy today

- 4 Australian shares set to soar in 2024

- Best ASX growth stocks to consider buying in March

- Goldman Sachs has added this ASX 200 tech stock to its APAC conviction list

Motley Fool contributor Tony Yoo has positions in Xero. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Xero. The Motley Fool Australia has positions in and has recommended Xero. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/ygCJcPQ

Leave a Reply