ASX uranium shares have found favour among many investors over the past year, but there is one particular stock coming out of a trading halt that looks intriguing.

That’s according to Auburn Capital head of wealth management Jabin Hallihan, who rates Deep Yellow Limited (ASX: DYL) as a buy.

“Deep Yellow is a uranium exploration and development company, with operations in Namibia and Australia,” Hallihan told The Bull.

“The company boasts a substantial resource base and aims to achieve uranium production capacity of more than 7 million pounds a year.”

$220 million capital raising

The stock went into a trading halt last Thursday, which was released on Monday morning.

The eventual announcement was that the company had successfully raised $220 million from institutional investors to fund both its Tumas project in Namibia and Mulga Rock in Western Australia.

According to Deep Yellow chief executive John Borshoff, the development is “timed perfectly”.

“The Tumas Project represents a long-life high-quality asset timed to deliver into what is a supply constrained market,” he said in a statement to the ASX.

“The Mulga Rock Project is next in the development schedule and provides a great opportunity to develop our second uranium mine that will also benefit from integrating the value-adding critical minerals and magnetic rare earth elements associated with these deposits.”

The favoured uranium shares in a favoured industry

The uranium industry is bullish at the moment due to many nations reconsidering nuclear as a powerful source of emissions-free energy generation.

And within that industry Hallihan likes Deep Yellow as a buy for those investors willing to take on some risk.

“The company’s experienced management team, coupled with its ambitious production targets and favourable cost projections, make it a speculative buy.”

Broking platform CMC Invest shows four out of five analysts that cover the $936 million small-cap as a buy right now.

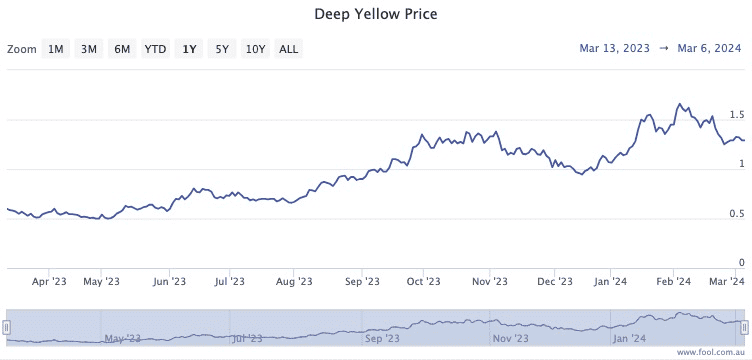

The Deep Yellow share price has more than doubled over the past year.

The post The ASX uranium shares to buy just coming out of a trading halt appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- What’s happening with ASX uranium shares today?

- Why Adairs, BHP, Deep Yellow, and Woodside shares are dropping today

- These are the 10 most shorted ASX shares

- Up 90% in a year, why is this ASX 300 uranium stock suddenly halted?

- What Dutton’s nuclear push could mean for ASX uranium shares

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/VOTonvN

Leave a Reply