ASX growth shares that are soaring rapidly are obviously exciting and rewarding to own.

But, of course, one must always remember with reward comes risk. Not every hyper-growth stock you buy will end up a 10-bagger. Probably not even the majority of them.

If it were easy, then everyone would be doing it, and we’d all be billionaires.

But if you keep the risks in mind and do careful research then you can make some educated guesses as to which stocks will end up much higher in a few years.

Then you diversify by buying a few of these and see which ones work out.

Here are three high-growth ASX shares that I like at the moment:

A fast recovery from tough times

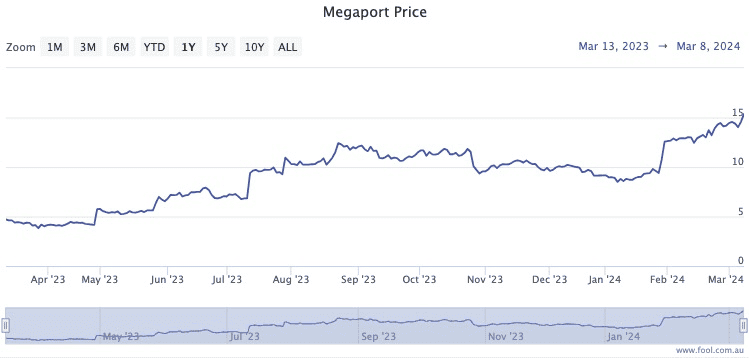

Megaport Ltd (ASX: MP1) is one that I sold off last August. I am embarrassed to say it’s gone from strength to strength since.

In fact, the share price has rocketed 42% since I offloaded it seven months ago.

If you go back to April last year, though, Megaport has returned a stunning 268% for its investors.

The performance is amazing, considering it was only this time last year when the chief executive resigned suddenly, and the market punished the stock.

With a new boss at the helm, the virtual networking provider has convinced investors that it’s successfully cutting costs, increasing profits and expanding its customer base.

A massive 10 out of 15 analysts covering Megaport currently rate it as a strong buy, according to broking app CMC Invest.

All up, Megaport shares are 257% higher now than they were five years ago.

ASX growth shares with all the right signals

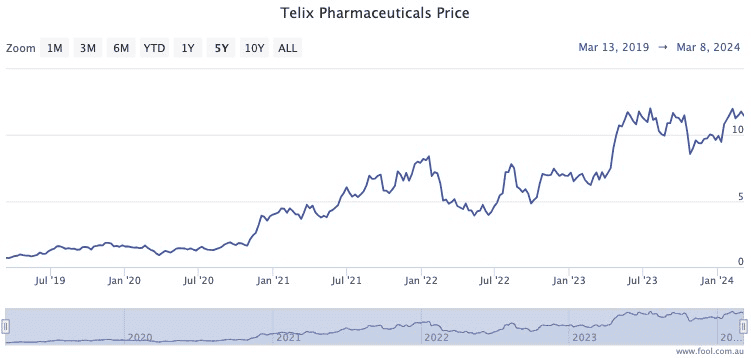

One I’ve pleasingly held onto is Telix Pharmaceuticals Ltd (ASX: TLX).

The cancer drug company has consistently kicked goals over the last five years, showing in its share price returning an incredible 1,578% over that time.

Despite its meteoric rise, the professionals are banking on even more to come.

The analysts at Bell Potter love the Melbourne company’s recently revealed acquisition of Canadian outfit ARTMS Inc.

“The acquisition is crucial for the supply of 89Z and the pending rollout of Zircaix for renal cancer imaging,” the team said in a memo.

“Telix is validating multiple production locations for 89Zr in the US using the ARTMS core technology. The company also owns significant quantities of ultra-pure 89Y, being the raw material for production of 89Zr.”

Tellingly, all eight analysts surveyed on CMC Invest insist Telix is a buy.

Hit the jackpot

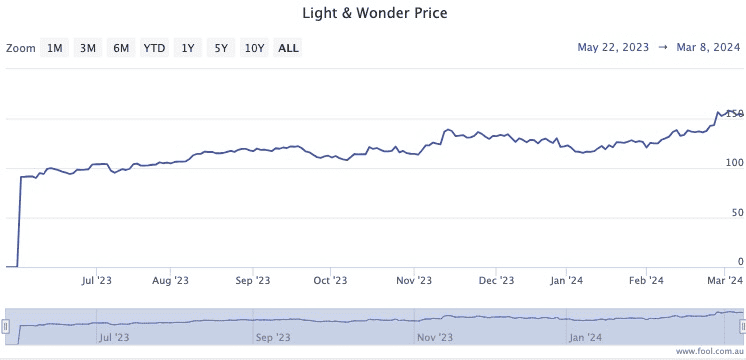

A growth stock that’s caught my attention recently is Light & Wonder Inc CDI (ASX: LNW), which is dual-listed here and on the Nasdaq.

As a poker machine maker, the Las Vegas company is a competitor to Australia’s own Aristocrat Leisure Limited (ASX: ALL).

Light & Wonder was only listed on the ASX last May, but shares have soared 68% from its first-day price.

With a December year-end, the company revealed its 2023 results during reporting season, and its metrics were bullish:

- Revenue up 16% to $2.9 billion

- Net income turned around from a $176 million loss to $180 million gain

- Net cash from operating activities turned around from a $381 million loss to $590 million gain

All eight analysts currently surveyed on CMC Invest rate the stock as a buy.

The post 3 hypergrowth ASX shares to buy in 2024 and beyond appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Guess which 3 ASX All Ords shares are up 60%+ in 2024

- Buy this ASX 200 biotech stock for a 20%+ return

- 5 things to watch on the ASX 200 on Monday

- Here are the top 10 ASX 200 shares today

- Brokers name 3 ASX shares to buy now

Motley Fool contributor Tony Yoo has positions in Telix Pharmaceuticals. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Light & Wonder, Megaport, and Telix Pharmaceuticals. The Motley Fool Australia has recommended Light & Wonder, Megaport, and Telix Pharmaceuticals. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/z0dcqCH

Leave a Reply