It has been a great time to be an investor in the ASX share market. Lots of businesses have seen their share prices climb â I think there are some that can keep rising and outperforming.

ASX shares that are delivering good underlying operational growth are appealing to me because I think they can keep driving shareholder value higher.

Despite their recent strong performance, I rate the ASX shares below as buys.

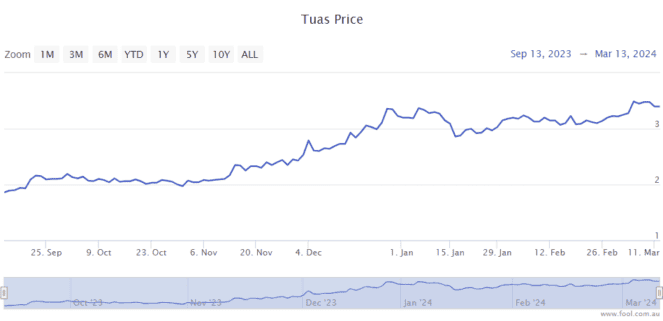

Tuas Ltd (ASX: TUA)

The Tuas share price has climbed 82% in the last six months.

The Asian ASX telco share is making great progress â in FY23 it generated $86.1 million of revenue and $31.1 million of earnings before interest, tax, depreciation and amortisation (EBITDA). Then, in the first quarter of FY24, it made $26.7 million of revenue and $11 million of EBITDA.

If we annualise those quarterly numbers, it’s already on track to deliver good growth compared to FY23.

But, I don’t think it’s finished growing â the business reported ongoing active services growth â it has added more than 50,000 active services each quarter in the last three quarters. The average revenue per user (ARPU) keeps growing too â FY23 ARPU was $9.37, while the FY24 first quarter ARPU was $9.53.

If users, ARPU and profitability keep growing, I think the ASX share has a very promising future. Growth into other Asian countries is also a possibility, in my mind.

Nick Scali Limited (ASX: NCK)

Nick Scali is a growing furniture retailer, which operates both the Nick Scali business and Plush. The Nick Scali share price is up 33% from 1 December 2023 as it recovers from investor pessimism about retail spending and the economy due to the cost of living.

But, things are looking more positive for the company with the economy remaining resilient and demand holding up. In its HY24 result, the company reported that written sales orders of $58.9 million were up 3.6% compared to January 2023.

It has a promising future with its ongoing store rollout for both of its businesses in Australia and New Zealand. Online sales growth is also promising because of the high potential profit margin.

Nick Scali normally has a generous dividend yield, which can add to the potential returns.

GQG Partners Inc (ASX: GQG)

GQG is a large and growing fund manager that offers investors a few different investment strategies, including US shares, global shares, international shares and emerging market shares. The GQG share price is up around 40% in six months.

It has done an impressive job of outperforming its global benchmarks over the long term with its investment funds, which are attracting net funds under management (FUM) inflows every month.

In the ASX share’s update for February 2024, GQG revealed its FUM had grown to US$137.5 billion, up from US$127 billion at January 2024. For the year to date, meaning the first two months of 2024, it saw US$3 billion of net inflows.

If FUM keeps rising, then growing revenue and profit can keep powering the business higher, in my opinion.

The post I think they can! 3 ASX shares that can keep chugging higher appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 3 high-yield ASX dividend shares that pay cash every quarter

- Got $10,000 to invest? How to turn it into monthly income

- Why Cettire, GQG, Mesoblast, and Nine Entertainment shares are falling today

- Up 7%: This All Ords stock reported some big ASX news today

- Cash kings: 2 top ASX dividend shares that pay quarterly

Motley Fool contributor Tristan Harrison has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended Nick Scali. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/pSUXq8j

Leave a Reply