Many Australians believe passive income is a privilege that only wealthy people have access to.

But in reality it’s not.

Buying just a handful of ASX shares could start your own experience of receiving money in return for no work.

Check out this hypothetical:

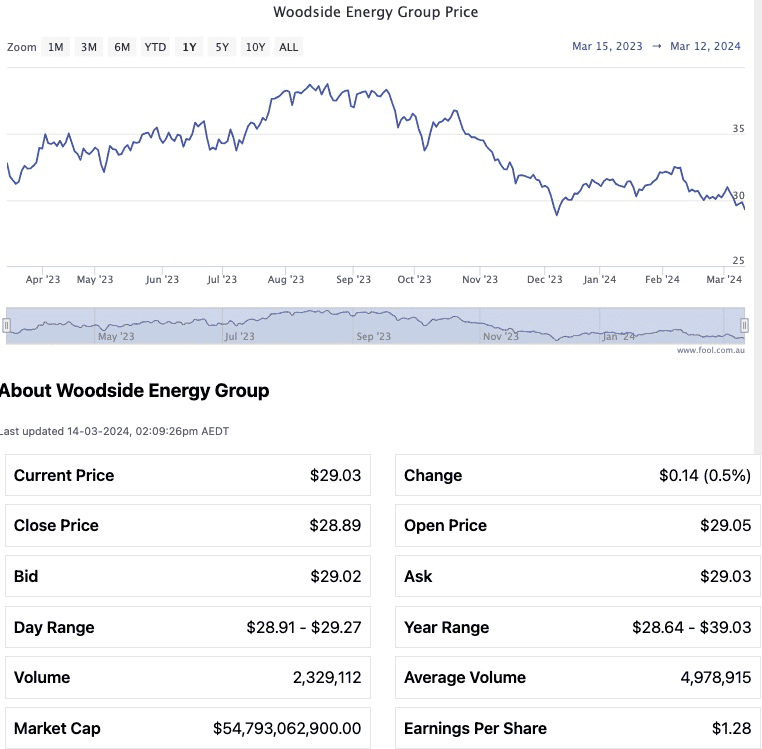

Here’s what Woodside shares could provide you

Woodside Energy Group Ltd (ASX: WDS) is an Australian oil and gas producer.

Yes, the world is quite rightly trying to move away from fossil fuels. But the infrastructure necessary to generate enough power from renewable energy sources to completely take over is many years, or even decades, away.

In the meantime, a fast-growing middle class population in countries like India, China and Brazil are demanding living standards that those of us fortunate enough to be in the West have enjoyed for decades.

All this requires energy.

Up until a few months ago, the Woodside dividend yield was incredibly up in double digits. The coming April dividend has brought it down to a more sane 7.5%.

So if you have an empty portfolio and as the first move you buy 350 Woodside shares, you will have spent just a touch over $10,000.

If the company can maintain the current yield, by the end of the first year you will have pocketed about $760.

That’s your first passive income!

Patience = even larger passive income

What if you want a bigger flow of income?

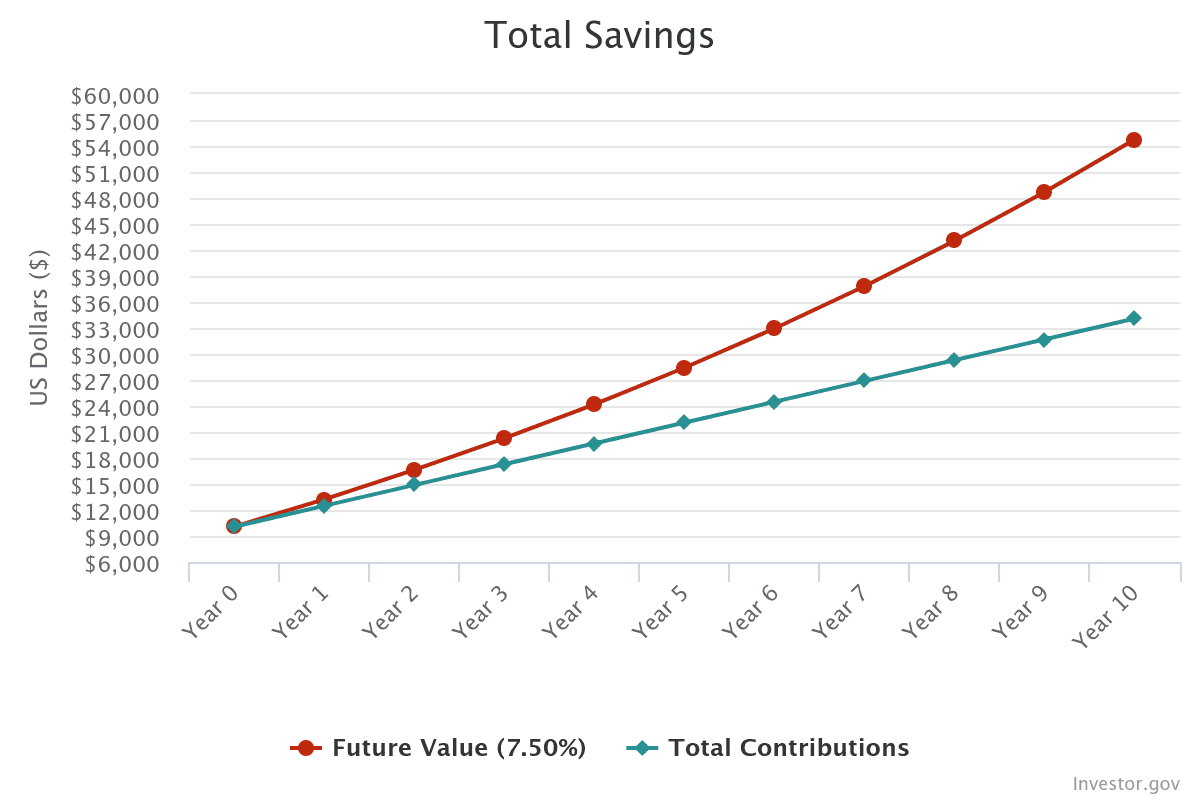

Then, keep reinvesting those dividends, continue saving, and let the portfolio grow for a few years.

After 10 years of adding $200 monthly and compounding at 7.5% each year, your Woodside shares could be worth a tidy $54,769.

That means that from the 11th year, you could cash in an average of more than $4,100 of annual passive income.

That could buy you a nice holiday for your family each year that is effectively free.

The post Buying 350 Woodside shares in an empty investment portfolio would give me a $760 income in year one appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 oversold ASX shares to buy in March 2024

- Here are the top 10 ASX 200 shares today

- Woodside share price slips despite oil hitting 2024 highs

- 5 things to watch on the ASX 200 on Thursday

- At $29, I think the Woodside share price could be 20% undervalued!

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/L7eMNCJ

Leave a Reply