This is a historic month for Australians.

For the first time in living memory, the Reserve Bank of Australia will hand down a scheduled interest rate decision that’s not on the first Tuesday of the month.

The central bank is now running on a reformed calendar, which means the board will reveal its judgement at 2:30pm this Tuesday.

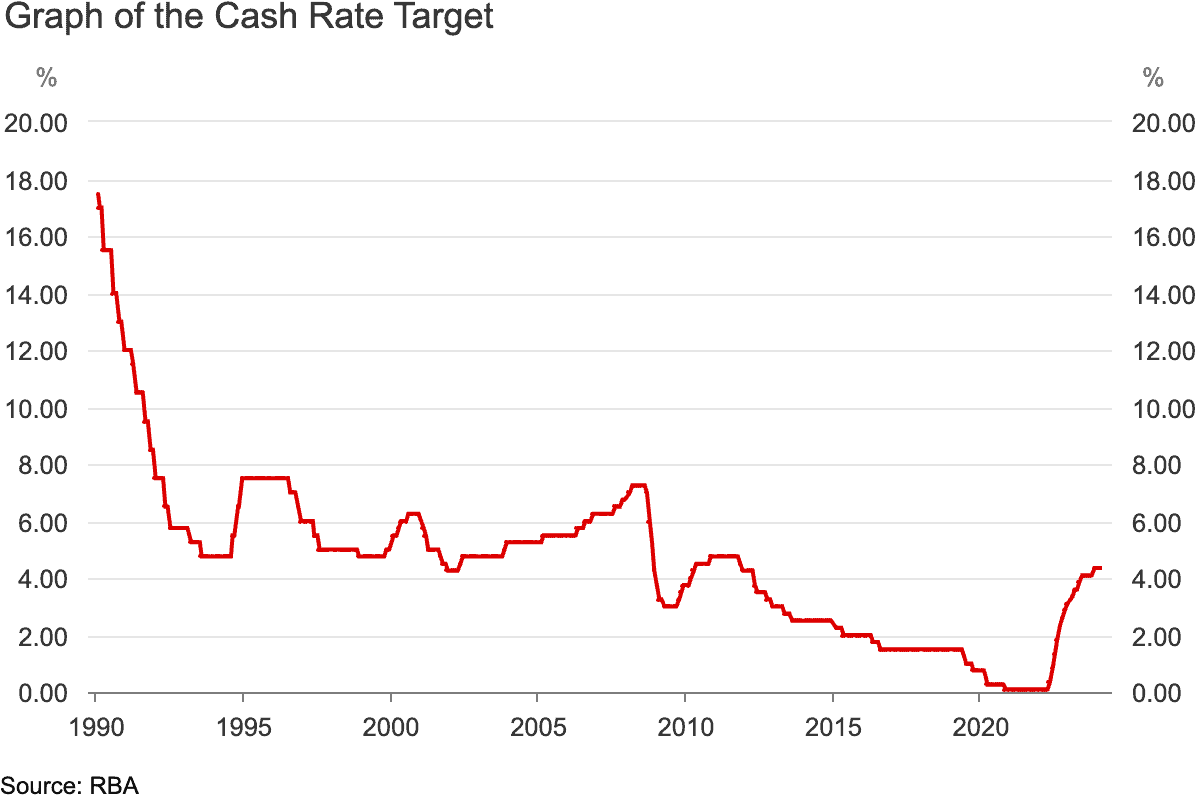

It’s fair to say share markets and mortgage holders alike are waiting keenly for rate relief after a tough couple of years.

So what do the experts think will happen?

Interest rates guessing game

According to a survey of economists conducted by comparison site Finder, all 41 experts are tipping that the Reserve Bank will leave interest rates on hold on Tuesday.

So with Tuesday’s decision seemingly a foregone conclusion, the next question is when will the rates come down?

That is where the experts start disagreeing.

While rate rises might be done, QIC chief economist Matthew Peter reckons the RBA will still be cautious about inflation in the coming months.

“Elevated migration, coming tax cuts and ongoing wage increases will stop the RBA from easing back on monetary policy until later this year.”

Some have gone even further, with a quarter of the economists tipping rate cuts won’t come until next year or beyond.

July tax cuts could replace rate cuts

Corinna Economic Advisory economist Saul Eslake pointed out that the coming stage 3 tax cuts could act as relief for consumers, so that the Reserve Bank will not have to touch rates.

“Australian households will, on 1st July, be getting income tax cuts which, in terms of their impact on aggregate household cash flows, are equivalent to two 25 basis point rate cuts, which households in the Euro area, UK, Canada, US and NZ will not be getting.”

Bendigo and Adelaide Bank Ltd (ASX: BEN) chief economist agreed.

“The stage 3 tax cuts are a welcome first step in the need for broad based tax reform.

“They will provide some modest fiscal stimulus that makes a rate cut this year less likely, but still should allow rate cuts in 2025.”

This is why, in many ways, the RBA governor’s press conference on Tuesday afternoon will be more important for stocks than the actual rate decision.

The market is desperate to hear what the central bank’s outlook and intentions are, so the words of Michele Bullock could really rock ASX shares either way.

The post ASX shares could get rocked Tuesday. Here’s why appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Mineral Resources share price marching higher on new lithium project acquisition

- ‘Housing AND Super’, not ‘Housing OR Super’

- Aussie Broadband share price tumbles after telco told to sell $47 million stake in a competitor

- Why Westpac shares could suffer from a ‘significant reset’

- Guess which ASX 200 tech stock has just been upgraded

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has positions in and has recommended Bendigo And Adelaide Bank. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/UPvLXxJ

Leave a Reply