Many people would argue that there is no such thing as intrinsic value for a company or an ASX stock.

The idea is that shares are worth whatever investors are willing to pay for them. Full stop.

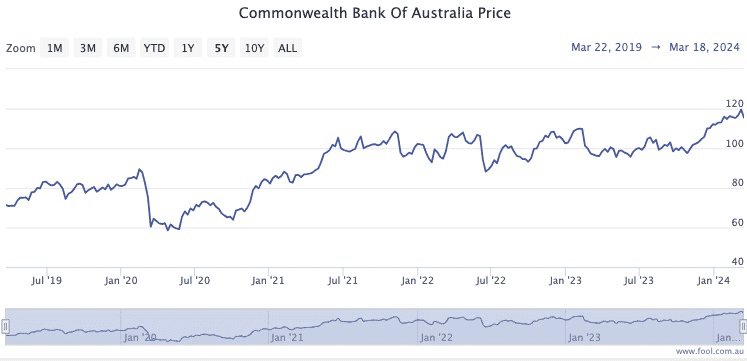

Take Commonwealth Bank of Australia (ASX: CBA), for example.

The stock has doubled since COVID-19 and has rocketed 21% since late October.

Even after all that the stock pays out a respectable 3.9% dividend yield, which is fully franked no less.

The “no intrinsic value” camp would say that if the bank’s business outlook is fine, then it’s still not too late to buy now.

I would argue otherwise.

Expensive compared to peers

Even though CBA does have the largest revenue and customer base, you wouldn’t get many arguments from any expert that the major four banks are very similar.

And the price-to-earnings (P/E) ratio would suggest Commonwealth has the highest valuation out of them all plus Macquarie Group Ltd (ASX: MQG).

| Bank | PE ratio |

| Commonwealth Bank | 20.4 |

| Macquarie Group | 18 |

| National Australia Bank Ltd (ASX: NAB) | 14.8 |

| Westpac Banking Corp (ASX: WBC) | 13.6 |

| ANZ Group Holdings Ltd (ASX: ANZ) | 12.7 |

The local banking sector is as static as it gets.

There isn’t a massive group of Australians who are not in the banking system, so growing the industry as a whole is nigh on impossible.

Ever since the government decided that it would not allow further rationalisation of the industry further than four big banks, the market share of each has not changed a great deal.

So if the valuation is already higher than the others, I am reluctant to buy CBA shares right now.

That’s not to say I wouldn’t buy it in the future, but I would need a significant discount to current levels.

Professional investors unanimously agree with this assessment. According to broking platform CMC Invest, none of the 17 analysts who study Commonwealth Bank rate the stock as a buy at the moment.

The post I wouldn’t touch CBA shares with a 10-foot bargepole! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 2 top ASX 200 shares to buy now for $1,000 a month in passive income

- If I’d put $5,000 in CBA shares at the start of 2024, here’s what I’d have now

- Why are ASX investors so obsessed with dividends?

- What’s going so wrong for ASX 200 shares on Friday?

- If you’d put $1m into shares vs property at the start of COVID, how much would you have now?

Motley Fool contributor Tony Yoo has positions in Macquarie Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Macquarie Group. The Motley Fool Australia has positions in and has recommended Macquarie Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/rojJWk9

Leave a Reply