Can lightning hit twice in the same spot?

The old cliche suggests it doesn’t, but scientifically lightning certainly can and does strike twice in the same place.

If you’re on the scientists’ side, it might be time to consider buying Santos Ltd (ASX: STO).

Curious? Read on.

The ASX 200 marriage that never was

Late last year, the oil and gas giant explored whether it would merge with its larger S&P/ASX 200 Index (ASX: XJO) rival Woodside Energy Group Ltd (ASX: WDS).

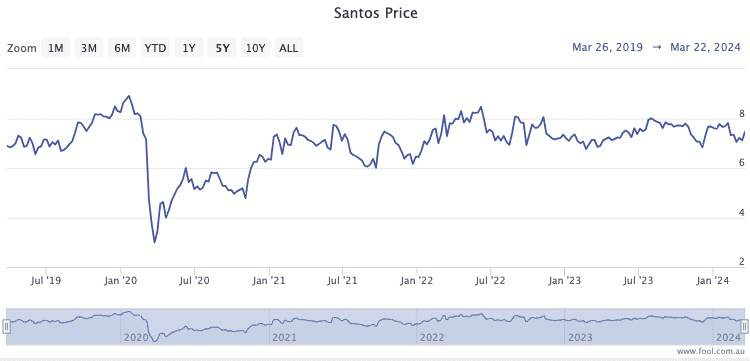

The Santos share price had been stagnant for the past half-decade, and this deal was meant to be the light at the end of the tunnel for its long-suffering shareholders.

The price-to-earnings (P/E) ratio sits at half of Woodside’s.

Unfortunately, last month the merger talks were terminated. Neither side has publicly revealed the reasons the deal fell over.

The Santos share price immediately sank 8% when that news came.

Then just to rub salt into the wound, the shares plunged again after its 2023 full year result failed to impress investors.

Both underlying net profit after tax (NPAT) and free cash flow from operations headed 42% for the year.

Ouch.

Could the romance be rekindled?

Despite these events, Shaw and Partners senior investment advisor Jed Richards right now thinks Santos is the far stronger buy than Woodside.

“The future growth prospects pipeline is far stronger for Santos than Woodside Energy, in my view,” Richards told The Bull.

And he reckons the Woodside marriage story is not over yet.

“Santos has positioned itself well over the past few years to be an attractive addition for Woodside.

“Although the last round of negotiations hasn’t resulted in a merger, I expect this strategy will be addressed again in the future.”

It seems Richards is not the only professional keen on Santos right now.

According to broking platform CMC Invest, 13 out of 17 analysts currently rate the energy stock as a buy.

The post The ASX 200 stock that could get second time lucky appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- How these ASX 200 energy shares could unexpectedly burn brighter

- 2 of the best ASX 50 shares to buy now

- 5 things to watch on the ASX 200 on Monday

- Buy Westpac and this ASX dividend giant

- ASX energy shares losing charge amid fresh warnings of gas supply shortfalls

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/jPFy4er

Leave a Reply