It was not even on the agenda three years ago, but now there is much talk about nuclear power.

Russia’s invasion of Ukraine in 2022, the ongoing conflict in the Middle East, plus the imperative to reduce carbon emissions are all combining to force nations to reconsider their energy security.

Even in Australia, where by law nuclear power plants are banned, one side of politics is pushing hard for the solution.

Former chief scientist Alan Finkel last week explained some of the advantages of nuclear power.

“The volume of fuel is small, with only one tonne of uranium needed to produce the same amount of electricity as 100,000 tonnes of black coal,” Finkel said in the The Sydney Morning Herald.

“The land footprint is only about three square kilometres for a one-gigawatt nuclear plant versus about 60 square kilometres for a three-gigawatt solar plant that would generate the same annual output.”

Shaw and Partners senior investment advisor Jed Richards is bullish on the ASX uranium sector for this precise reason.

“Australia is closer to accepting nuclear power than ever before. China’s demand for uranium is enough to drive profitability,” Richards told The Bull.

And there is one uranium stock that he would buy right now.

The uranium shares that are ‘our preferred exposure’

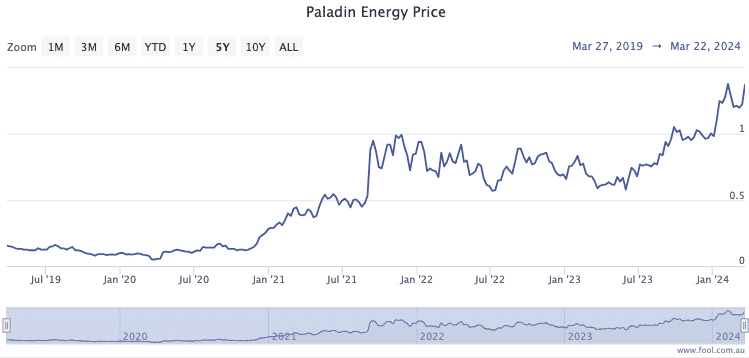

Richards calls Paladin Energy Ltd (ASX: PDN) the “premium and most liquid stock in the uranium sector”.

“It remains our preferred exposure to an improving uranium market.”

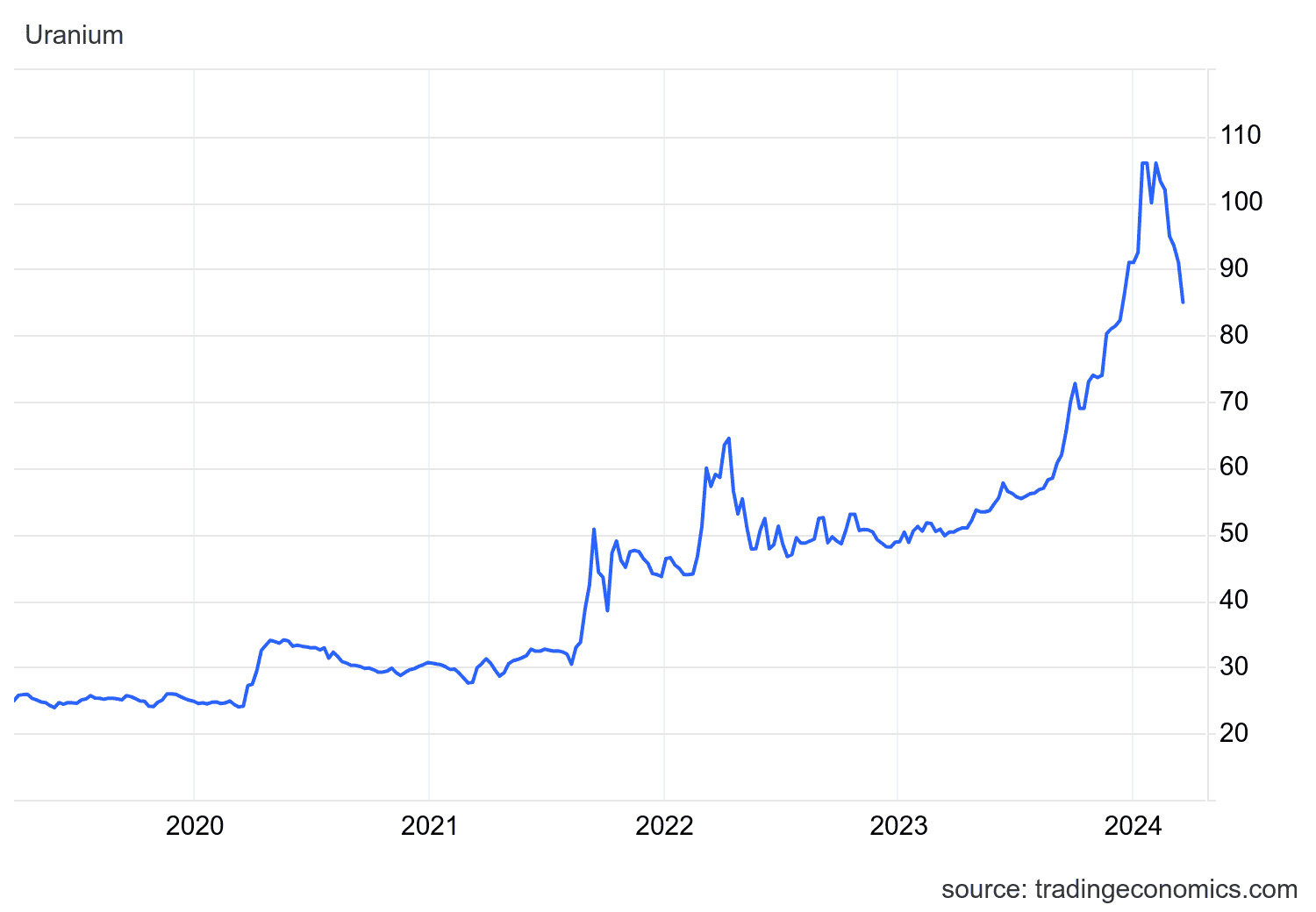

The stock has risen a spectacular 149% over the past 12 months, which is an even steeper climb than the global uranium price.

“The shares have performed strongly in the past year, and we expect this favourable momentum to continue.”

The analysts at Blackwattle are also bullish on Paladin, as they said in a memo to clients earlier this year.

“The market for uranium remains in a significant deficit and is expected to remain that way for the rest of the decade.

“This places restart projects like Paladin in a great position to capitalise on the high prices that are needed to incentivise additional supply to enter the market.”

The support is unanimous in the professional community.

Broking platform CMC Invest currently shows all eight analysts covering Paladin stock rating it as a strong buy.

The post Uranium is set to boom, and this is the ‘premium’ ASX stock to buy appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- ASX energy shares losing charge amid fresh warnings of gas supply shortfalls

- ‘We have reached a bottom’: 5 ASX uranium shares leaping higher this week

- Here are the top 10 ASX 200 shares today

- Here are the top 10 ASX 200 shares today

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/0D4lBvL

Leave a Reply