Against the grain of a bullish market, there are some quality companies that have dropped out of favour recently.

They might be fighting through a one-off difficulty or adverse external conditions that are out of their control.

Regardless, I think these three cheap ASX shares deserve a fair go because their long-term business prospects remain solid:

Reporting season blues

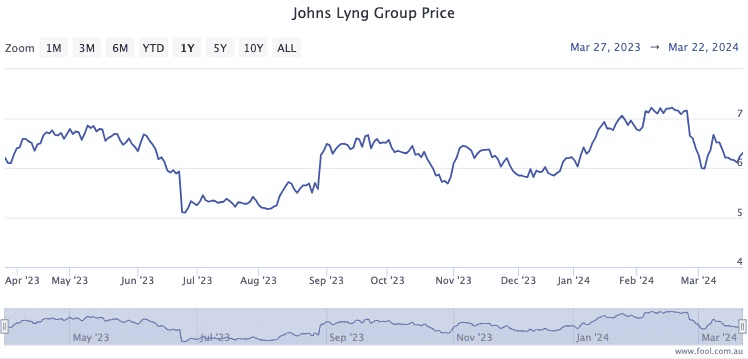

Johns Lyng Group Ltd (ASX: JLG) shares plunged 20% in a single morning late last month after its half-year results were revealed.

That was despite an upgrade guidance for the current financial year.

Sales revenue and net profit after tax (NPAT) for the first half were both down year-on-year, which may have triggered the disappointment.

Five investment houses did cut their share price expectations over the next year, but CMC Invest shows 9 out of 11 analysts still rating Johns Lyng as a buy.

I think it’s an excellent opportunity to pick up a quality company for cheap.

Nothing doing here

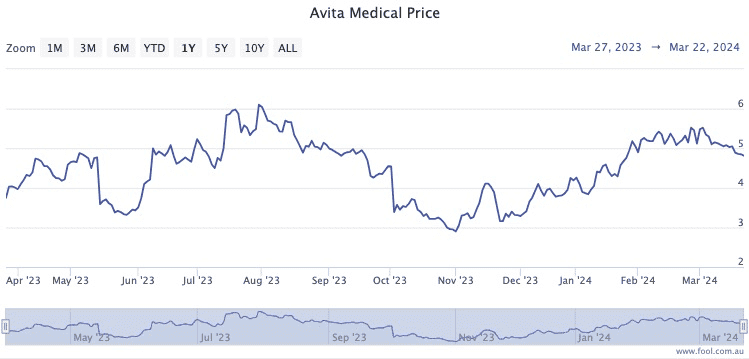

Regenerative medicine producer Avita Medical Inc (ASX: AVH) has seen its share price drop more than 12.3% since market close on 1 March.

No significant news has come out of the company, so one can only assume the valuation is changing from general market movement for biotechs.

If anything, Avita shares should be seeing increased demand because of its addition to the All Ordinaries Index (ASX: XAO) on 18 March.

The professional community is sticking firm on these cheap ASX shares.

Nine out of 10 analysts covering the stock rate it as a buy, according to CMC Invest, with eight of those considering Avita a strong buy.

These cheap ASX shares are still a value buy

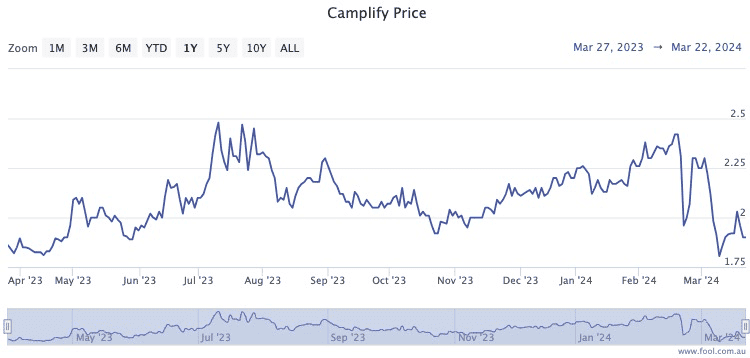

Like Johns Lyng, Camplify Holdings Ltd (ASX: CHL) shares were also burnt during reporting season.

“The stock closed down ~17% on result day, which we largely attribute to some seasonality in Camplify’s key headline metrics (future bookings, gross margins, etc),” said the analysts at Morgans.

With the seasonal nature of the numbers, there has not been much movement in the opinions of fund managers in it for the long haul.

“Our price target remains unchanged and we maintain an add recommendation on the stock,” said the Morgans team.

Indeed all three analysts covering Camplify still rate it as a strong buy, as shown on CMC Invest.

The post 3 struggling ASX shares to buy at a discount appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- New to investing? I’d invest my first $1,000 in ASX shares today!

- I just invested $3,000 into this top ASX 200 stock

- 5 oversold ASX shares to buy in March 2024

- 3 ASX shares I think are set to soar in 2024

- 3 reliable ASX shares you can buy at a discount

Motley Fool contributor Tony Yoo has positions in Avita Medical, Camplify, and Johns Lyng Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Avita Medical and Johns Lyng Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended Camplify. The Motley Fool Australia has recommended Avita Medical, Camplify, and Johns Lyng Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/7Mbq8JF

Leave a Reply