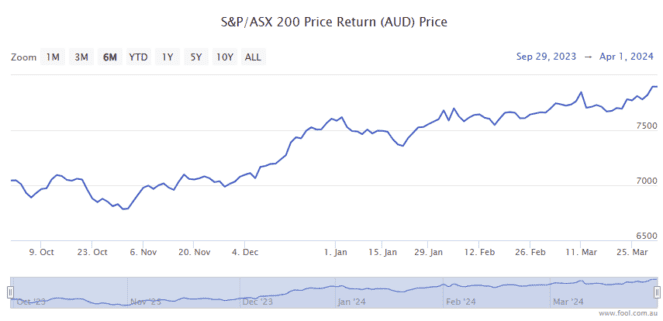

S&P/ASX 200 Index (ASX: XJO) investors were treated to a series of record-breaking highs in March.

The month just past saw the Aussie benchmark index set a series of new intraday highs as well as a number of fresh record-closing highs.

March started in good form, with the ASX 200 setting a new intraday high of 7745.6 points on Friday, 1 March.

And after breaking records throughout the month, March ended on another bang with the index hitting a new intraday high of 7901.2 and finishing at a new closing high of 7896.9 points.

That sees the index of the top 200 listed Aussie stocks up 2.6% for the past month and up a whopping 16.5% since 31 October.

Investors looking to mirror this performance could consider buying into all 200 companies.

Or they may wish to consider investing in a single stock that has been successful at closely tracking the returns of the ASX 200.

What’s been driving the ASX 200 to new record highs?

Investors have been piling back into the Aussie stock market in line with bullish animal spirits in the United States’ markets. That enthusiasm also saw the S&P 500 Index (SP: .INX) notch a series of new record highs in March.

The ASX 200 has been getting its own lift as inflation begins to fall back towards the RBA’s target range, bolstering the odds for interest rate cuts in 2024.

Company earnings have also held up strongly despite some macroeconomic headwinds.

And there are signs that China’s economy may be set for a rebound following a year of tepid growth. That could offer a big boost for Aussie companies focused on exports.

One stock to track the top 200

The stock in question is the BetaShares Australia 200 ETF (ASX: A200).

The exchange-traded fund (ETF) aims to track the performance of the ASX 200. And it’s been doing just that.

Since 31 October the ASX 200 has gained 17.9%, slightly outpacing the gains of the benchmark index.

A200 also pay quarterly dividends, partly franked. The ETF currently trades on a trailing yield of 3.6%.

Its top three holdings are BHP Group Ltd (ASX: BHP), Commonwealth Bank of Australia (ASX: CBA) and CSL Ltd (ASX: CSL). As you’d expect these also count among the biggest listed companies in Australia.

Importantly, as fees can take a sizable bite out of your returns, the ASX ETF also comes with a very low annual fee of 0.04%.

As always, if you’d rather buy individual stocks that could outperform the benchmark, make sure to do your own thorough research first.

If you’re not comfortable with that or are short on time, then simply reach out for some expert advice.

The post How to tap into the record-breaking ASX 200 performance with just one stock appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Tuesday

- Buy these fantastic blue chip ASX 200 shares in April

- 5 top ASX dividend shares to buy right now

- Why it’s a great day to own BHP shares

- Own CBA shares? It’s payday for you!

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended CSL. The Motley Fool Australia has recommended CSL. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/WOfQtmi

Leave a Reply