If you always buy the same ASX growth stocks as everyone else, your portfolio will never do better than the market.

Yet some people wait to see others piling onto a stock before buying it themselves.

If you want to branch out a bit, I have one buy suggestion that has struggled in recent times, but could be in for a bull run in the years to come:

Why this ETF is an ASX growth stock

Global X Battery Tech & Lithium ETF (ASX: ACDC) may be an exchange-traded fund (ETF), but it displays growth stock characteristics.

Firstly, its investment theme is very much a forward-looking one.

Electric cars, renewable energy and mobile devices all require high-powered batteries to store power. The demand for such hardware will be enormous in the coming years as the globe battles to reduce carbon emissions.

Secondly, while the fund includes some miners, which can be notoriously cyclical, many of its holdings are growth companies further down the supply chain.

For example, at the time of writing the Global X Battery Tech’s largest investments were:

- HD Hyundai Electric Co Ltd (KRX: 267260)

- Sumitomo Electric Industries Ltd (TYO: 5802)

- Renault SA (EPA: RNO)

- ABB Ltd (SWX: ABBN)

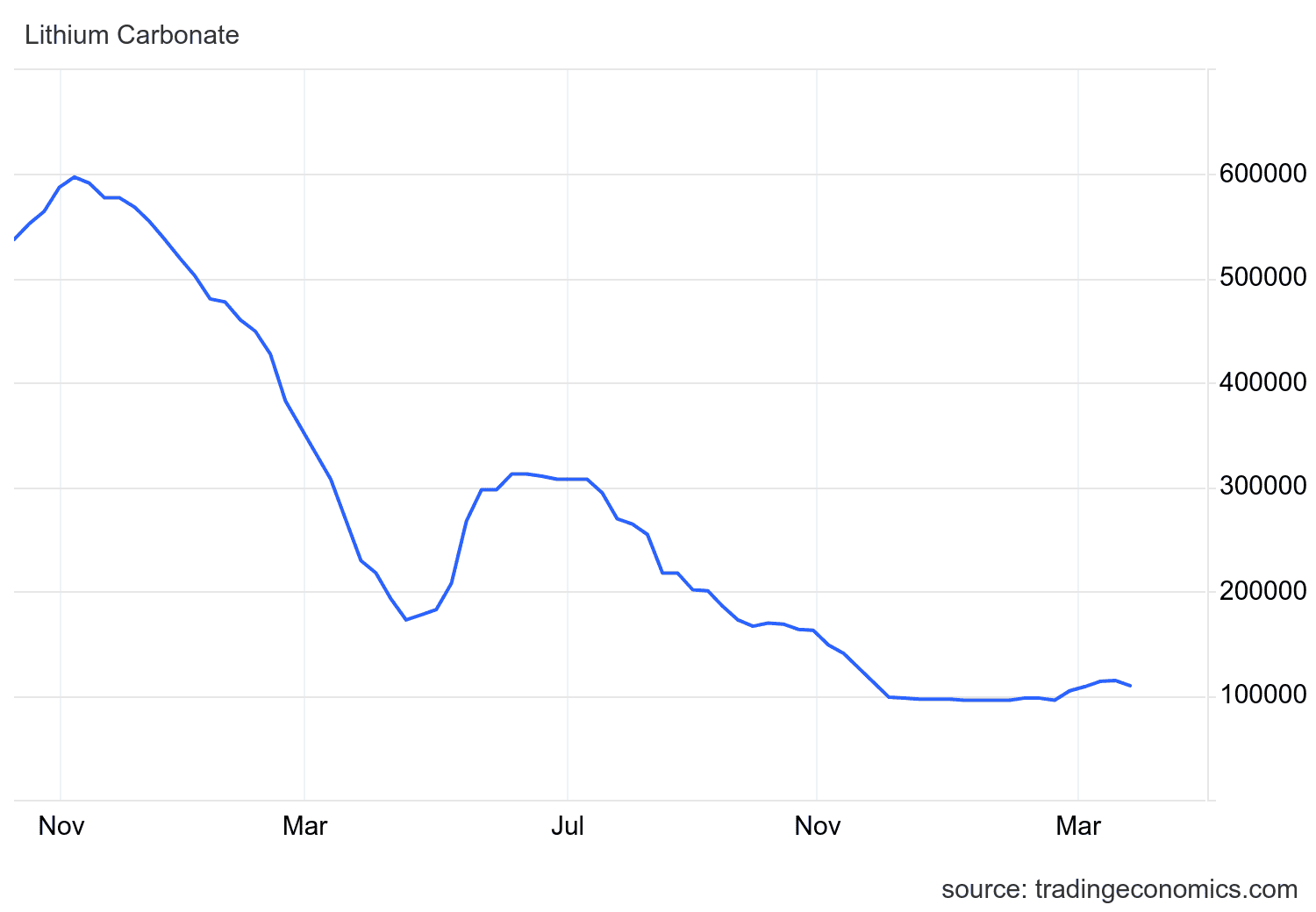

And thirdly, the fund has shown itself to be less volatile than the commodity market.

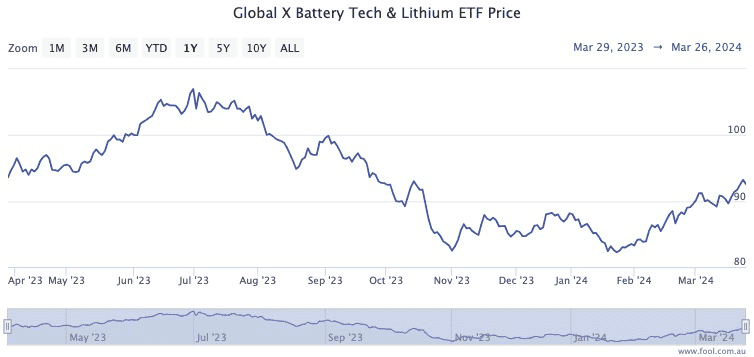

For example, the lithium carbonate price tumbled from almost 600,000 CNY per tonne in November 2022 to now just over 100,000 CNY. In the same period, the ETF has only fallen 0.78%.

Buy it then lock it away

This is why I feel ACDC is an under-the-radar stock to buy right now.

Growth investors aren’t necessarily looking at it because of the depressed lithium market, and is trading at around a 10% discount from June last year.

But long-term visionaries could pounce on this with a goal to hold it for five to ten years. The economic cycle will have played itself out by then and the world will be scrambling even more for sorely needed batteries.

Moreover, you are not having to pick the winners of the battery revolution. The automatic diversification of an ETF renders that dilemma irrelevant.

Despite the 18-month lithium market malaise, the ACDC share price has doubled over the last half-decade.

This ETF has much going for it.

The post 1 under-the-radar ASX growth stock to consider buying now appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Global X Battery Tech & Lithium ETF. The Motley Fool Australia has recommended Global X Battery Tech & Lithium ETF. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/8HgP4XB

Leave a Reply