ASX tech shares have been the frontrunner during the share market’s rally to new heights. On a year-to-date basis, the Australian information technology sector is up 16%, nearly twice the return of the runner-up.

It’s a similar scene over in the United States. A surge in appetite for artificial intelligence (AI) has boosted US tech stocks. This is apparent from AI chip makers Nvidia Corp (NASDAQ: NVDA) and Super Micro Computer Inc (NASDAQ: SMCI) being the two best-performing stocks in the S&P500 in 2024.

However, one broker believes the best of times for tech is now at a temporary high.

Finding better value elsewhere

Some like to apply a sector rotation strategy when specific sectors are soaring beyond others. By selling into strength and rotating into weakness, investors hope to maximise returns while reducing downside risk.

The hedge fund behind Goldman Sachs (aka Goldman Sachs Asset Management) is taking this approach to tech. In an interview with Bloomberg, Alexandra Wilson-Elizondo, co-chief investment officer of multi-asset solutions, shared a view that now is the time to take some profits in the sector.

Elaborating on the fund’s current stance, Wilson-Elizondo said:

We like taking profits on technology and moving toward other sectors. the risk-reward profile is skewed to the downside. While we still believe in being long equities and having them in the portfolio, we think that there are some more attractive opportunities to access.

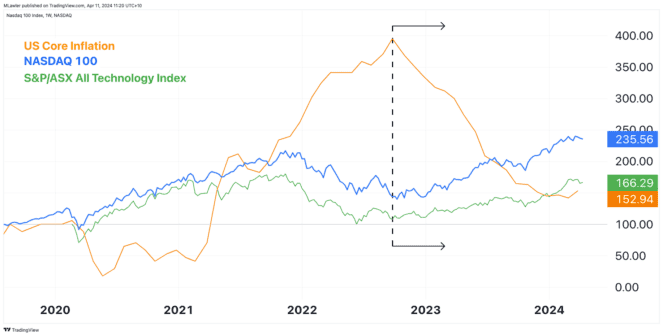

The comments coincide with a recent re-acceleration in US inflation. Year-over-year US inflation for March came in hot at 3.8% overnight. The figure poured cold water on the hopes of an interest rate cut happening soon.

Wilson-Elzondo’s point also speaks to a bigger concern. What if inflation rages back with a vengeance?

As shown above, the strength in US and ASX tech shares is inversely aligned with the fall of inflation. With the NASDAQ-100 Index (NASDAQ: NDX) up 64% since inflation began falling, one wonders what might happen to the tech sector if the recent inversion continues.

Are ASX tech shares the same?

Goldman Sachs Asset Management is explicitly talking about US tech shares. But aren’t ASX tech shares guilty of the same success? It’s the valuation that Wilson-Elizondo points out as a worrying factor on Wall Street.

Let’s look at a valuation comparison between Aussie and US tech giants:

| US tech companies (Magnificent 7) | P/E Ratio | ASX tech shares | P/E Ratio |

| Microsoft Corp (NASDAQ: MSFT) | 38 | Wisetech Global Ltd (ASX: WTC) | 133 |

| Apple Inc (NASDAQ: AAPL) | 26 | Xero Ltd (ASX: XRO) | N/A |

| Nvidia Corp (NASDAQ: NVDA) | 73 | NextDC Ltd (ASX: NXT) | N/A |

| Amazon.com Inc (NASDAQ: AMZN) | 64 | TechnologyOne Ltd (ASX: TNE) | 51 |

| Alphabet Inc (NASDAQ: GOOG) | 29 | Life360 Inc (ASX: 360) | N/A |

| Meta Platforms (NASDAQ: META) | 34 | Megaport Ltd (ASX: MP1) | 261 |

| Tesla Inc (NASDAQ: TSLA) | 40 | Codan Ltd (ASX: CDA) | 26 |

Like our US counterparts, some of our largest tech companies are trading on high price-to-earnings (P/E) ratios.

Future growth can excuse a premium P/E ratio. However, the risk lies in the company living up to those expectations — expectations that could be made harder by a resurgence of inflation.

The post Up 16% in 2024! Are ASX tech shares now overvalued? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- What’s happening with the NextDC share price following today’s $1.3 billion announcement?

- 2 ASX growth shares that could turn $1,000 into $10,000 by 2034

- 4 ASX 200 blue chip shares to buy now

- Top brokers name 3 ASX shares to buy today

- If I invest $10,000 in Wisetech shares, how much dividend income will I receive?

Suzanne Frey, an executive at Alphabet, is a member of The Motley Foolâs board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Foolâs board of directors. Motley Fool contributor Mitchell Lawler has positions in Apple, Meta Platforms, and Tesla and has the following options: long June 2025 $510 calls on Tesla. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Alphabet, Amazon, Apple, Life360, Megaport, Meta Platforms, Microsoft, Nvidia, Technology One, Tesla, WiseTech Global, and Xero. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool Australia has positions in and has recommended WiseTech Global and Xero. The Motley Fool Australia has recommended Alphabet, Amazon, Apple, Megaport, Meta Platforms, Nvidia, and Technology One. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/SunP5Ef

Leave a Reply