The Coles Group Ltd (ASX: COL) share price is seesawing on Thursday. This comes as the supermarket operator faces a challenging period ahead, with the latest COVID-19 outbreak causing supply issues.

At the time of writing, Coles shares are swapping hands for $17.67 apiece, down 0.23%. However, they have been as low as $17.61 and as high as $17.77 during morning trading.

In contrast, the broader the S&P/ASX 200 Index (ASX: XJO) is trading at 7,478.6 points, down 1.15%.

Coles reintroduces product limits amid staff shortages

Investors don’t appear unduly concerned by the negative news surrounding the supermarket giant, with the Coles share price holding its own.

A strong rise in COVID-19 cases has forced thousands of people to isolate at home while waiting for their results. This has created a huge disruption to Coles’ supply chain as a majority of its staff are reportedly obeying stay-at-home orders.

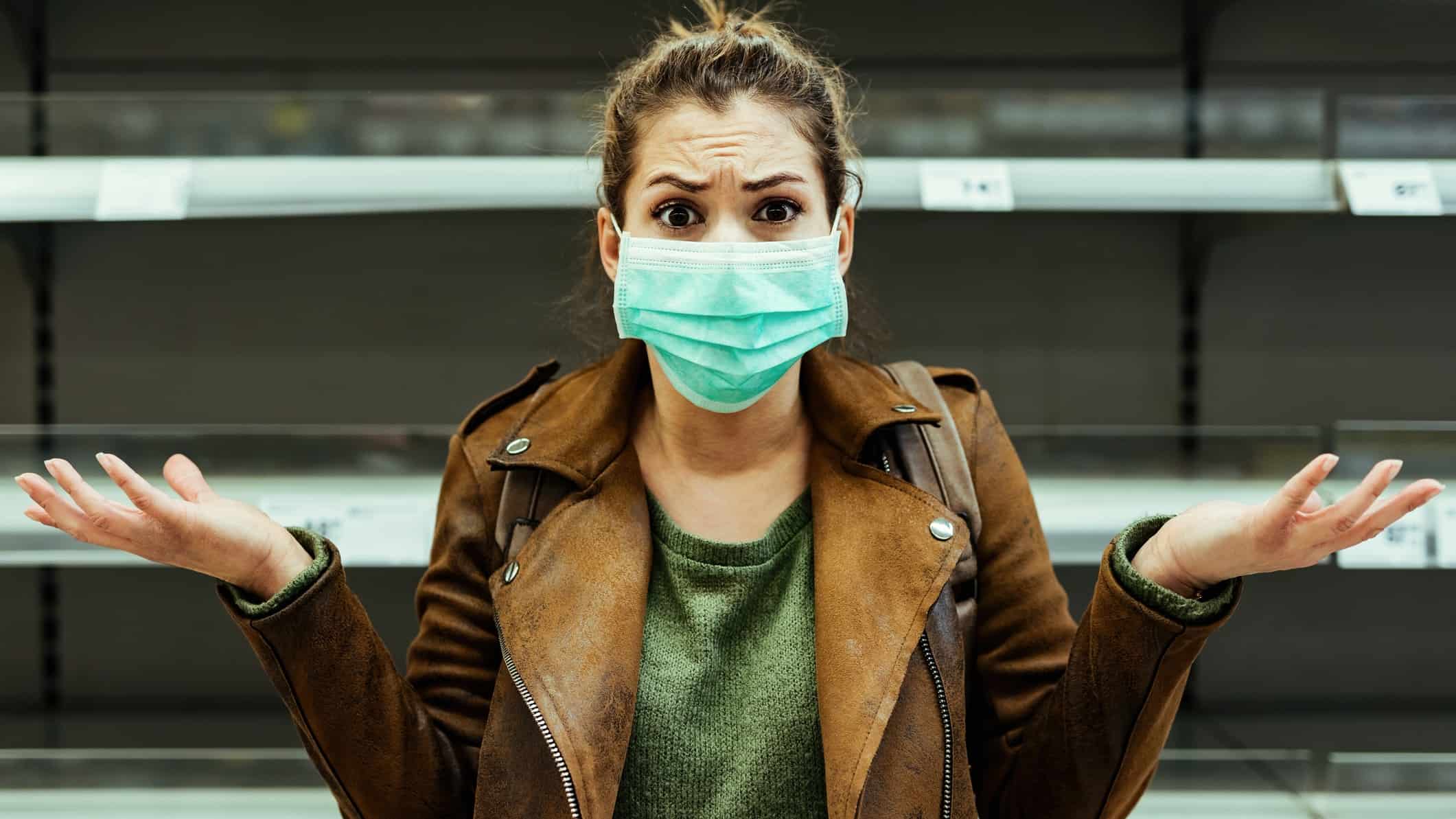

Notably, Coles shelves have been laid bare across thousands of stores in Australia. In response, the company has brought back product limits on certain meats as well as rapid antigen tests.

According to media outlets, the company is operating on skeleton staff at its distribution centres.

Coles chief operations officer Matt Swindells commented:

It’s probably going to take a few weeks for us till we fully recover. What we really need to do is make sure that the team members that are isolating are able to get tested, to get checked and then to safely return back to work quickly.

The latest COVID-19 figures have continued to surge with more than 207,600 active cases in New South Wales and 61,100 cases in Victoria. This is a sharp increase from this time last year when the country had been effectively managing the pandemic.

About the Coles share price

It’s been a rollercoaster ride for the Coles share price over the last 12 months, posting a loss of around 4%.

Based on today’s price, Coles commands a market capitalisation of roughly $23.6 billion, with approximately 1.33 billion shares on hand.

The post Own Coles (ASX:COL) shares? The retailer is warning of ‘difficult weeks’ ahead appeared first on The Motley Fool Australia.

Should you invest $1,000 in Coles right now?

Before you consider Coles, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Coles wasn’t one of them.

The online investing service he’s run for nearly a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of August 16th 2021

More reading

- What’s dragging on the Coles (ASX:COL) share price this week?

- Analysts name 2 top ASX dividend shares to buy now

- Here are 2 ASX dividend shares to buy in 2022

- Top ASX shares to buy in 2022

- The ASX share market coverage that captivated readers in 2021

Motley Fool contributor Aaron Teboneras has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia owns and has recommended COLESGROUP DEF SET. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

from The Motley Fool Australia https://ift.tt/3JGQoW9

Leave a Reply