This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Amazon (NASDAQ: AMZN) is getting a lot of attention after announcing a 20-for-1 stock split on March 9. Shareholders must approve the move on a vote on May 25 before it can go into effect.

Regardless, the change will not impact ownership percentages for shareholders. But there are more prominent reasons to be excited about Amazon stock. Keep reading to find out what those are.

1. Amazon web services is accelerating

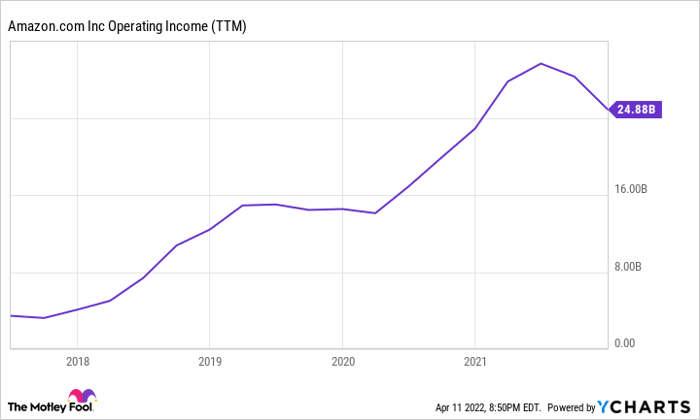

Amazon reports operating-income results from three distinct segments: North America, international, and Amazon Web Services (AWS). In the year ended Dec. 31, Amazon reported $24.9 billion in operating income. Of that total, $18.5 billion came from AWS.

Similarly, in 2020, Amazon earned $22.9 billion in operating income, and $13.5 billion was derived from AWS. The coronavirus pandemic accelerated the adoption of cloud computing, and as a result, AWS is thriving.

AMZN Operating Income (TTM) data by YCharts.

Fortunately for shareholders, the trend is unlikely to reverse because for businesses, the move to cloud computing replaces a considerable, upfront fixed cost with a smaller recurring cost, based on usage. In its fourth-quarter ended Dec. 31, AWS generated $17.8 billion in revenue. That was up by 40%, compared to the same quarter of the prior year. What’s more, AWS has grown revenue at an accelerating rate for four consecutive quarters.

Businesses typically sign long-term contracts with Amazon for cloud services. As of Dec. 31, 2021, the average length of these long-term contracts was 3.8 years.

It’s not like there was a boom during the pandemic that will quickly snap back in the aftermath. The value of these contracts is increasing, too. As of Dec. 31, the total value of long-term contracts for cloud services was $80 billion. That figure is up sharply from the $50 billion total at the end of 2020.

2. Amazon is becoming a dominant force in advertising

The second reason to get excited about Amazon stock is its growing revenue from advertising. In the fourth quarter, Amazon generated $9.7 billion in ad revenue. That was up by 33% from Q4 in 2020.

The company is home to more than 200 million Prime members who have access to fast and free shipping on millions of items. Plus, millions more shoppers get fast and free shipping on orders over $25. Both groups of shoppers have payment information on file and are one click away from purchasing. It’s no surprise that marketers would be wildly interested in gaining the attention of this powerful buyer network.

In 2021, advertisers spent $763 billion globally, which increased 22.5% from 2020. In recent years, marketers have been allocating more dollars to digital channels because of the ease of measurement and higher return on investment. Digital’s share of overall ad spending totaled 64.4% in 2021, up from 52.1% in 2019. According to GroupM, 85% of digital advertising outside China will go to Facebook, Alphabet‘s Google, and Amazon.

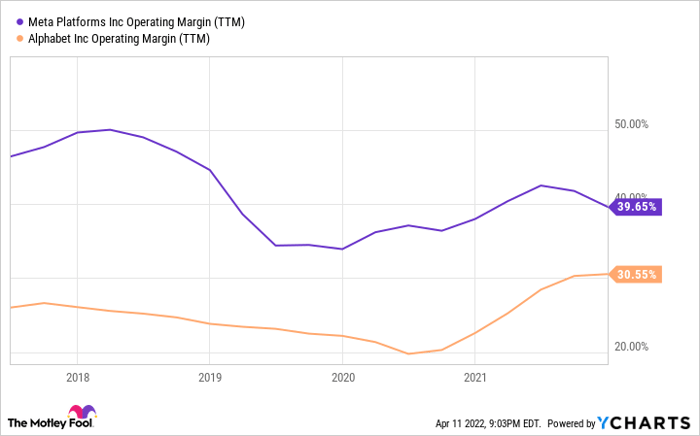

FB Operating Margin (TTM) data by YCharts.

Like cloud services, advertising revenue is lucrative and drives higher profit margins than Amazon’s retail-sales segment. If you need proof of that, consider Alphabet‘s and Meta Platforms’ operating profit margins over the past several years.

The proliferation of Amazon’s web services and advertising revenue — two areas with high profit margins — is undoubtedly more to get excited about than the upcoming stock split.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Forget the stock split — 2 bigger reasons to be excited about Amazon stock appeared first on The Motley Fool Australia.

Should you invest $1,000 in Amazon right now?

Before you consider Amazon , you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Amazon wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of January 13th 2022

More reading

- Shopify, Alphabet, Amazon, and Tesla stocks are splitting — which ones are the best buys?

- Is Amazon stock a buy this month?

- Why Amazon stock slipped on Monday

- Why Amazon stock slumped today

- 3 charts that show why Amazon is an unstoppable growth stock

Parkev Tatevosian owns Alphabet (C shares), Amazon, and Meta Platforms, Inc. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. owns and has recommended Alphabet (A shares), Amazon, and Meta Platforms, Inc. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended Alphabet (C shares). The Motley Fool Australia has recommended Alphabet (A shares), Alphabet (C shares), Amazon, and Meta Platforms, Inc. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from The Motley Fool Australia https://ift.tt/4EBYVZG

Leave a Reply