This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Many investors may feel they have missed the boat with Tesla (NASDAQ: TSLA). While the stock has been up over 1,800% in the last three years, it has dropped more than 25% since early January. That shouldn’t be too much of a surprise, however, with the stock valued for much success coming into this year.Â

But investments should be made looking forward, not back. Tesla, and the EV sector in general, is entering a new phase, and the company is positioning itself to continue to lead the way forward. While returns over the coming years may not match prior results, Tesla has a lot of irons in the fire. It’s worth looking closely at whether now is a good time to invest.

Expanding product lineup

The second quarter was a challenging one for Tesla. Global supply chain snarls and rising raw material costs particularly impacted its two new factories that are in the midst of ramping up in Texas and Germany. Production at its Shanghai factory, as well as consumer demand, was hindered by lockdowns as China continued to implement its zero-COVID policy.Â

But with all those headwinds, Tesla still grew second-quarter sales by 42% year over year and generated $621 million in free cash flow. That’s not bad for what constituted a tough quarter. And the company is making headway in growing its product portfolio. CEO Elon Musk said the Tesla Semi truck would begin deliveries as soon as this year, and the Cybertruck pickup model should still be on track to launch next year, too. Beyond that, a lower-priced EV is expected to be added to its product portfolio as it reduces costs.Â

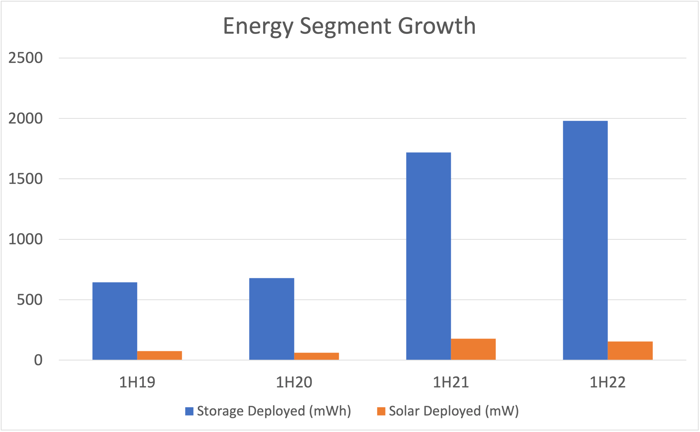

Tesla’s energy segment is also ramping up production. Its gigafactories haven’t just increased battery production to support Tesla’s vehicle manufacturing growth. The company has been increasing production of battery storage and solar systems that it sells separately to customers. The below chart shows the comparable growth in the first six-month periods of the years since 2019. In its second-quarter report, the company said it continues to ramp up Megapack storage production as customer interest “remains strong and well above our production rate.”

Data source: Tesla. Chart by author.

Roadway ahead

One crucial negative for investors has always been the company’s valuation. If, as analysts believe on average, one assumes earnings in the back half of 2022 are 50% higher than the first half, Tesla stock is trading at a price-to-earnings (P/E) ratio of about 75 based on this year’s earnings.Â

But the company is working to bring costs down. In a recent investor conference, Tesla head of investor relations Martin Viecha said Tesla’s cost per vehicle was $84,000 in 2017 and has dropped to $36,000 per vehicle more recently. Continuing that trend will allow Tesla to get into the lower-priced EV market that should help create mass penetration for the EV sector.Â

The company recently filed documents saying it is evaluating the potential to build a lithium hydroxide refining facility on the gulf coast of Texas. That would be another way to streamline its supply chain and control costs. The company said commercial operations could begin by the fourth quarter of 2024 if the project moves forward.

That could also help Tesla benefit from incentives included in the Inflation Reduction Act. The new law already gave Tesla a boost, as it resumes some tax credits that had expired for consumers buying new EVs. Tesla was well past the previous limitation that ended those credits after a manufacturer sold more than 200,000 vehicles. Lower-priced vehicle models and more of its supply chain based in the U.S. will also help it meet eligibility requirements.

The future certainly looks bright for Tesla. While a P/E above 70 is an extremely high valuation, if the company continues to grow at or near 50% for several more years, that won’t seem so rich. For investors looking years or decades down the road, buying Tesla right now could make good sense.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Should you invest in Tesla shares right now? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.* Scott just revealed what he believes could be the “five best ASX stocks” for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now

See The 5 Stocks *Returns as of September 1 2022

More reading

- Tesla is exploring building a lithium refining plant in Texas

- Why Tesla thumped the market today

- Why Tesla shares popped today

- Why Tesla stock dropped today

- Better buy: Tesla stock or a Nasdaq index fund?

Howard Smith has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Tesla. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from The Motley Fool Australia https://ift.tt/pjz9TmR

Leave a Reply