The Ioneer Ltd (ASX: INR) share price is shooting 27% higher on Monday morning. Moments after the opening bell, the ASX lithium share is fetching 58 cents apiece.

Ioneer was revealed as the recipient of a colossal funding agreement from the United States Department of Energy (DOE) Friday night.

A monumental US$700 million (A$1 billion) conditional commitment has been offered to the company by the DOE to assist in funding the development of its Rhyolite Ridge lithium-boron project in Nevada.

Shareholders of the lithium project developer will be watching intently today to see if the company can extend its 20% rally year-to-date. The benchmark-beating performance is a breath of fresh air for shareholders considering Ioneer shares were among the worst-performing ASX-listed lithium names in 2022.

Bringing new supply to the growing demand

On Friday, the Loan Programs Office of the DOE announced its latest funding proposal to help address supply for the domestic electric vehicle (EV) battery supply chain.

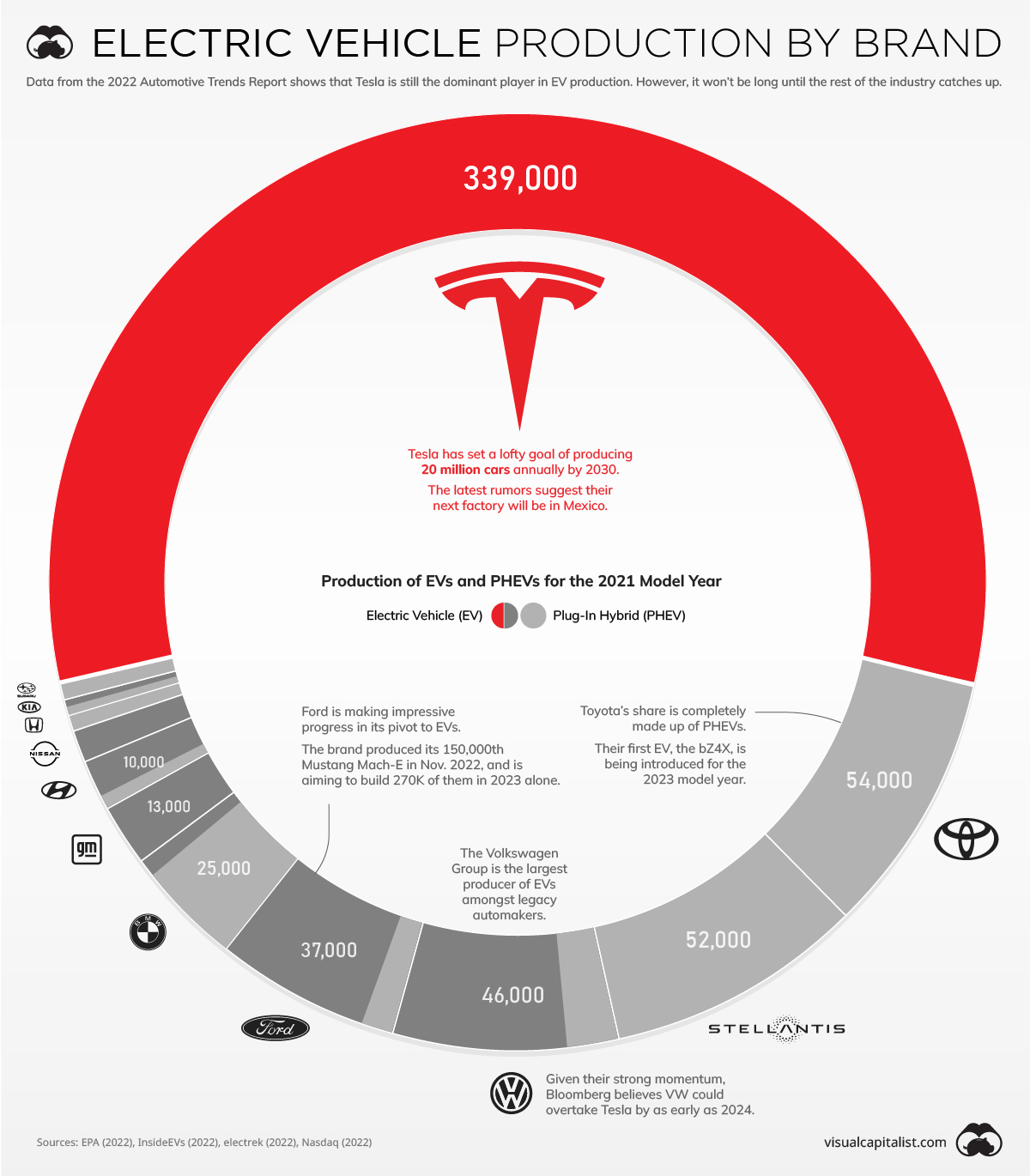

According to the release, the loan would finance the on-site processing of lithium carbonate which could potentially support the production of approximately 370,000 EVs annually. For context, 588,000 EVs and plug-in hybrid EVs were produced in the United States in 2021, the majority of which were made by Tesla Inc (NASDAQ: TSLA), as shown below.

The billion-dollar US government deal is the largest achieved by any Australian company. Other notable mentions include Novonix Ltd (ASX: NVX) with its US$150 million grant and Lynas Rare Earths Ltd (ASX: LYC) US$120 million department of defence contract — but Ioneer takes the cake.

In the announcement, the LPO highlights the criticality of adding in a new lithium supply, noting:

The urgency to secure critical materials for batteries is expected to rapidly increase in the coming years as demand for lithium is projected to exceed current global production by 2030. This is subsequently causing U.S. auto manufacturers to seek a robust domestic supply of critical materials to keep pace with the increased demand.

The ASX lithium share already has offtake agreements in place with Ford Motor Company (NYSE: F) and Toyota.

What’s next for this ASX lithium share?

While a billion-dollar loan is a cause for celebration, Ioneer still needs to meet some conditions before basking in glory. Before the company can commence construction of its Esmeralda County plant, it must complete engineering and feasibility studies.

If Ioneer successfully progresses to plant construction, the loan will go a long way to covering the expected US$785 million in construction costs. Furthermore, if Ioneer can get up and running, it would join Esmeralda Country neighbour, Albemarle Corporation (NYSE: ALB), which is currently the only operating lithium plant in the US.

The current Ioneer share price of 46 cents values this ASX lithium share at a market capitalisation of $955 million. In comparison, lithium giant Albemarle towers over the Aussie competition with a US$28.4 billion market cap.

The post Guess which ASX lithium share just rocketed 27% on a $1 billion US Government loan appeared first on The Motley Fool Australia.

FREE Beginners Investing Guide

Despite what some people may say – we believe investing in shares doesn’t have to be overwhelming or complicated…

For over a decade, we’ve been helping everyday Aussies get started on their journey.

And to help even more people cut through some of the confusion “experts’” seem to want to perpetuate – we’ve created a brand-new “how to” guide.

Yes, Claim my FREE copy!

*Returns as of January 5 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

Motley Fool contributor Mitchell Lawler has positions in Albemarle, Lynas Rare Earths, and Tesla. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Tesla. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/n6UDKfZ

Leave a Reply