Looking for dazzling dividend shares on the ASX without stepping into a yield trap can be a challenge, but there are some companies out there that offer high yields and strong growth potential.

One such company that I believe could be flying under the radar is Motorcycle Holdings Ltd (ASX: MTO).

Sitting at a market capitalisation of roughly $115 million, the motorcycle dealership operator rarely features in headlines. However, I’d rather invest based on performance metrics than attention metrics. After all, it’s the profits that will determine long-term returns, not the number of mentions.

The company’s shares have experienced a landslide over the past year, falling 46% amid crimped spending due to higher interest rates.

Now at $1.59 apiece, touting a tantalising dividend yield of more than 10%, and a solid history of top-line growth, could Motorcycle Holdings be one the best-kept secrets among ASX dividend shares?

Understanding the business

Motorcycle Holdings started its life as a single dealership in 1989. Today, the company owns and operates more than 40 locations across Australia and New Zealand — capturing nearly 14% of the national market.

The company is taking a roll-up approach to a heavily fragmented industry. According to its 2022 annual report, Motorcycle Holdings estimates there to be around 700 dealerships across Australia. Aside from itself, there are only three operators that own more than four locations.

A prime example of this approach to growth is the most recent acquisition of Mojo Motorcycles, completed in October last year. The deal brings several new brands under the Motorcycle Holdings umbrella, increasing its exposure to agriculture and scooter markets.

On 27 February, the company posted revenue of $277.5 million for the first half of FY23 — up 17% on a statutory basis. Growth was aided by a $27.7 million contribution from the Mojo acquisition with only two months of being on the company’s books.

However, net profit after tax (NPAT) sank 17% to $10.5 million and shareholders raised concerns as national unit sales declined.

Could it be a cheap ASX dividend share?

I like to look at an investment from several different angles when assessing whether or not a company is ‘cheap’. Firstly, how does it compare to its peers on trailing fundamental metrics?

While there may not be other listed motorcycle dealers, car dealership operators are a close match.

As noted below, Motorcycle Holdings currently commands the highest gross margins, lowest earnings multiple, and highest dividend yield.

| ASX-listed company | Gross margins | Price-to-earnings

(P/E) ratio |

Price-to-book

(P/B) ratio |

Dividend yield |

| Motorcycle Holdings | 27% | 5 | 0.6 | 10.1% |

| Eagers Automotive Ltd

(ASX: APE) |

19% | 11 | 2.8 | 5.3% |

| Peter Warren Automotive

Holdings Ltd (ASX: PWR) |

19% | 7 | 0.9 | 9.4% |

| Autosports Group Ltd

(ASX: ASG) |

21% | 6.4 | 1.0 | 8.3% |

Secondly, I want to explore the future potential of this ASX dividend share. This due diligence can help avoid stumbling into a dividend trap.

Ultimately, I want to gain an understanding of the company’s potential future earnings profile. If earnings suddenly fall away, there is a greater risk of dividends getting slashed — turning that generous yield into a piddly payout.

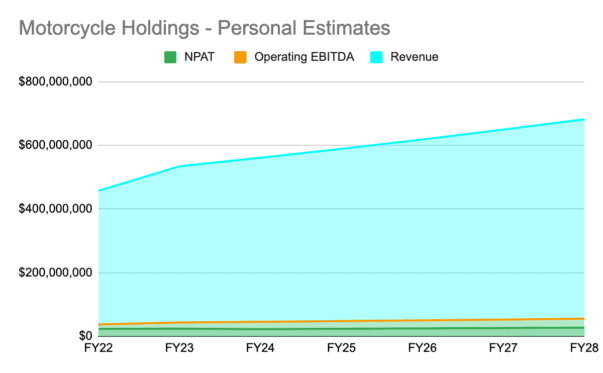

Based on my assumptions, I think Motorcycle Holdings will be able to grow its NPAT to approximately $27 million by FY28 and generate more than $680 million in revenue (shown above).

I personally believe these estimates are conservative. Though, as a base case, it gives me confidence in future dividends.

Furthermore, if the company can achieve this and trade on a P/E ratio of roughly eight times, its future valuation could be 75% higher.

Where there could be flaws

No sound investment is made without considering how it could come apart at the seams. While my above projections may look rosy, there are risks that could turn those numbers into mush.

The most obvious risk to Motorcycle Holdings and its ASX dividend share status is a weak economic environment. The Harley-Davidson quickly moves down the priority list if Aussies need to hunker down for some tough financial times — hurting the company’s sales in the process.

Another risk factor is the razor-thin margins associated with the dealership industry.

The projections above assume 4.5% profit margins in FY23 and 4% for each year after. Even a small variation of 1% can drastically change earnings, leaving the company susceptible to dividend cuts.

Would I buy this ASX share for the dividends?

I must admit, the tight margins are not akin to what I would normally look for in a long-term, marketing-beating investment. It tends to indicate a lack of pricing power and/or a highly competitive industry.

In saying that, Motorcycle Holdings’ management holds a lengthy track record of successful growth through consolidation. The co-founder and CEO, David Ahmet, has substantial skin in the game with a 16% stake and comes across as an extremely passionate and intelligent operator.

Personally, I do like the prospects of this ASX dividend share given the headroom for growth.

The post Could this high-yielding dividend share be the best-kept secret on the ASX? appeared first on The Motley Fool Australia.

Should you invest $1,000 in Motorcycle Holdings Limited right now?

Before you consider Motorcycle Holdings Limited, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Motorcycle Holdings Limited wasn’t one of them.

The online investing service heâs run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

See The 5 Stocks

*Returns as of March 1 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 3 dividend stocks with the biggest ASX 200 yields. Time to buy?

- Why the outlook for these ASX 200 lithium shares could be ‘very favourable’

- Fundie says buy these 2 ASX 200 shares that have the planets aligned

- Stay away from this ASX sector (and buy this one instead): expert

- 5 things to watch on the ASX 200 on Wednesday

Motley Fool contributor Mitchell Lawler has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/1wxpTYF

Leave a Reply