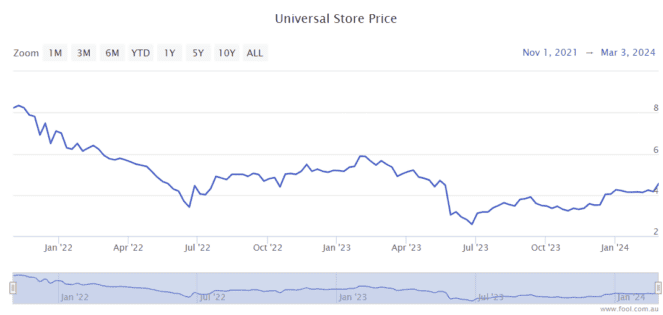

Lake Resources (ASX: LKE) shares have had a year to forget.

And shareholder woes are continuing today.

Shares in lithium stock closed Friday trading for 13.5 cents. In morning trade on Monday, shares are changing hands for 12.7 cents apiece, down 5.9%.

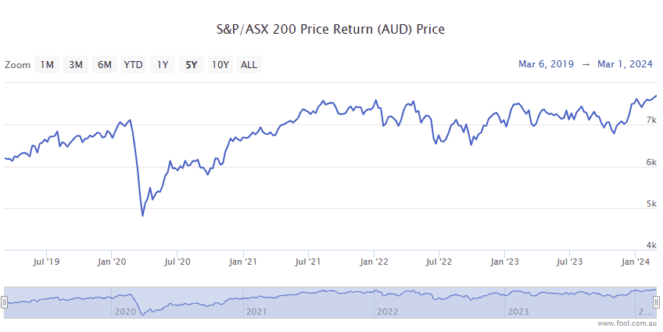

For some context, the All Ordinaries Index (ASX: XAO) is up 0.1% at this same time.

As you can see on the chart above, this puts Lake Resources shares down a painful 80% since this time last year.

The accompanying big fall in the clean lithium developer’s market cap will see the stock removed from the S&P/ASX 300 Index (ASX: XKO), as of 18 March.

That comes as part of the S&P Dow Jones Indices March quarterly review. And it could throw up some medium-term headwinds, as some fund managers restricted to investing in the larger end of the market may no longer be able to hold the stock.

Today the clean lithium developer released an update on its cost cutting program and the search for a strategic partner.

Cost reductions fail to lift Lake Resources shares

In an update that’s failing to lift Lake Resources shares on Monday, the company announced a new round of cost cutting measures.

Lake Resources said it will slash its global workforce by roughly half across its non-core operational and administrative workers. The company will also seek to streamline other general expenditures.

Management said the aim is to reduce expenses by another 30% in the quarter ending 30 June compared to the quarter ending 31 March.

CEO David Dickson remained upbeat about the longer-term prospects of the company’s Kachi project, located in Argentina.

“Despite the current backdrop of depressed short-term lithium pricing, we remain very enthusiastic about the Kachi Project, and its potential to deliver long-term value,” he said.

Dickson added:

We are committed to taking all necessary actions to preserve our financial flexibility while we execute a thorough and prudent strategic partner selection process that results in the best outcome for Lake and its shareholders.

We are focused on delivering the Kachi Project in 2028, which is forecast to align with the start of a prolonged period of structural deficit for battery-grade lithium chemicals.

Lake Resources shares could get a boost down the track if the company is successful in its hunt for a strategic partner at the Kachi Project.

With Goldman Sachs acting as its financial advisor, the company said it is now actively conducting outreach to a wide array of potential strategic partners as it progresses the initial phase of the selection process.

The post Down 80% in a year why are Lake Resources shares tumbling again today? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/ZS1UID6