For just $2,000, you can start an investment portfolio that will pay you a flow of passive income.

Moreover, you could cash in a chunky dividend yield of 11%.

Don’t believe me? Check this out.

Reduced dividend, but still 11.9% yield

In recent times, Yancoal Australia Ltd (ASX: YAL) has developed a reputation as one of the largest dividend payers on the ASX.

The coal mining outfit, however, last month downgraded its latest distribution.

The 32.5-cent final dividend due to be paid in April is less than half the 70 cents paid at the same time last year.

However, the yield still stands at an amazing 11.9%, fully franked no less.

While the coal market can be notoriously cyclical, Yancoal has done all it can under its control by improving production in each successive quarter in 2023.

“We expect to carry this operational momentum into 2024,” said chief executive David Moult during reporting season.

“The group is in a robust financial position, with no external loans, $1.8 billion of franking credits available, and a net cash balance that we expect will increase each month.”

It’s no wonder all four analysts covering the stock are rating it as a buy, as shown on CMC Invest.

Passive income machine

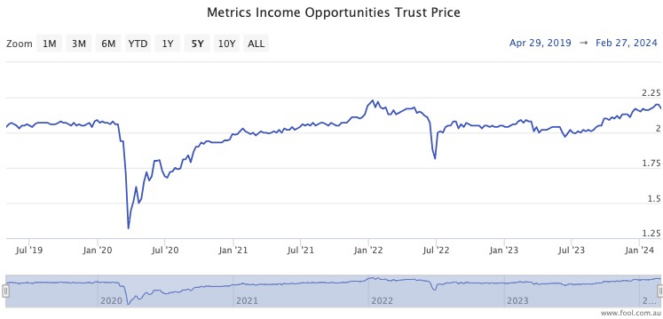

Metrics Income Opportunities Trust (ASX: MOT) is not widely discussed in the financial press, but it has been going about its business with aplomb the last five years.

In fact, ever since its recovery from the COVID-19 crash, the trust has managed to maintain its share price without much volatility, all while paying out a monthly dividend.

Yes, you read that right. It pays an income each calendar month.

Right now, the last 12 payouts are equating to an unfranked yield of 9.2%.

While there is some criticism of the opaque nature of its unlisted investments in “private credit and other assets”, its track record can’t be denied.

Grab the cash now, or later

So at current prices, you could buy 456 shares in Metrics Income Opportunities Trust for $1,000 and 171 Yancoal shares with the other grand.

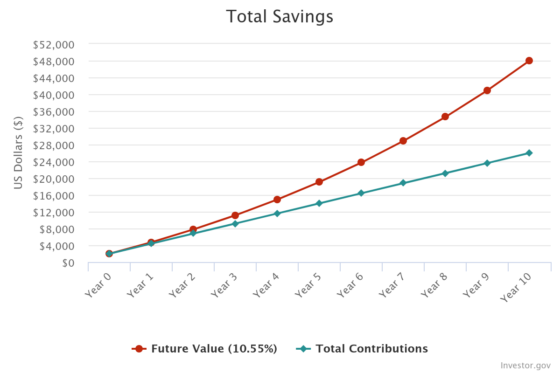

And with a combined yield of 10.55%, that’s $211 of annual passive income from an outlay of just $2,000.

That will pay for a nice birthday present for your spouse, the car registration, or your mobile phone plan each year.

However, if you reinvest the returns and add a further $200 to the portfolio each month, you could be really raking it in after a little while.

Ten years of such restraint, assisted by monthly compounding, will see the nest egg grow to more than $48,000. And that’s just from dividend income, not counting capital gains.

From then on, if you stop reinvesting the 10.55% yield, you have yourself $5,064 in your pocket every year.

The post $2k buys me 627 shares in 2 ASX passive income shares yielding 11% combined appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/klgyN4E