If you’re interested in adding some ASX exchange traded funds (ETFs) to your portfolio in March, then it could be worth getting better acquainted with the three listed below.

Here’s what sort of companies you will be investing in if you buy these ETFs:

ETFS Battery Tech & Lithium ETFÂ (ASX:Â ACDC)

If you’re confident on the outlook of electric vehicles and lithium, then the ETFS Battery Tech & Lithium ETF could be the one for you. Rather than having to decide which ASX lithium share to buy, you can own a group of them in one fell swoop. This ETF invests in companies throughout the lithium cycle, including mining, refinement and battery production.

Vanguard Australian Shares Index ETF (ASX: VAS)

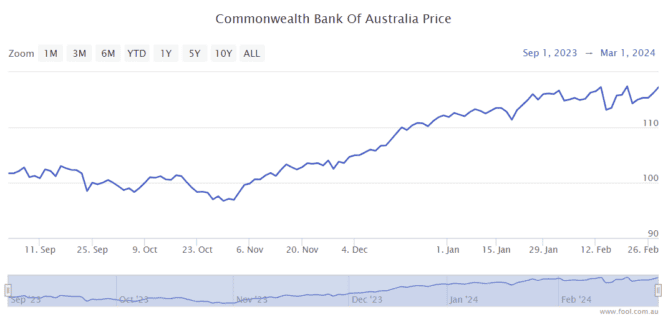

If you want an easy way to invest in the Australian share market, then the Vanguard Australian Shares Index ETF could help you do it. It is a low-cost, diversified, index-based exchange-traded fund that aims to track the ASX 300 index. This means you’ll be buying a diverse group of 300 shares such as footwear retailer Accent Group Ltd (ASX: AX1), miner BHP Group Ltd (ASX: BHP), and banking giant Commonwealth Bank of Australia (ASX: CBA).

Vanguard MSCI Index International Shares ETFÂ (ASX: VGS)

Alternatively, if you want to invest globally, then the Vanguard MSCI Index International Shares ETF could be the answer. This popular ETF gives investors easy access to approximately 1,500 of the world’s largest listed companies from major developed countries. This allows you to gain exposure to global economic growth. It also means you can almost instantly diversify a portfolio. That’s because among its holdings are companies from sectors ranging from technology to financials and healthcare to energy.

The post 3 excellent ASX ETFs to buy in March appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 14% in 4 months: How has the Vanguard Australian Shares ETF (VAS) managed it?

- Top ASX shares to buy in March 2024

- How to build a second retirement fund outside of superannuation

- How much would I need to invest in ASX shares for a retirement income of $80,000 per year?

- 4 ASX ETFs to supercharge your wealth

Motley Fool contributor James Mickleboro has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Global X Battery Tech & Lithium ETF. The Motley Fool Australia has recommended Accent Group, Global X Battery Tech & Lithium ETF, and Vanguard Msci Index International Shares ETF. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/CtJI1nB