Tech shares led the ASX 200 market sectors for the third consecutive week, with an extraordinary 7.97% gain over the past five trading days.

Over the past three weeks, the S&P/ASX 200 Information Technology Index (ASX: XIJ) has lifted by an astounding 19.75%.

We’re catching tailwinds from the US, with the ongoing AI stock surge and strong results from the global mega-techs this earnings season pushing the NASDAQ to a new record high today.

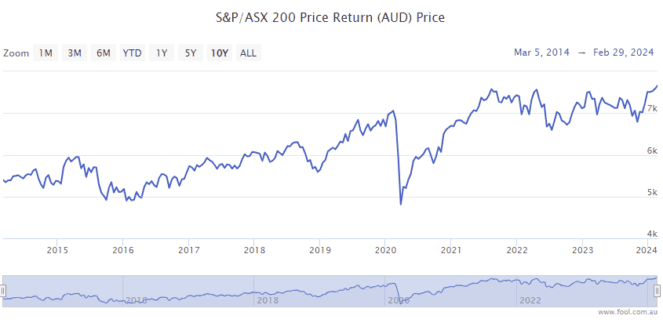

The S&P/ASX 200 Index (ASX: XJO) also lifted this week, up 0.94% over five days to also finish at its own record high of 7,745.6 points on Friday.

Solid earnings results from some ASX majors in the final full week of earnings season, coupled with good news out of the US on inflation today, pushed the ASX 200 to its new all-time peak.

Eight of the 11 market sectors finished the week in the green.

Let’s recap.

Tech shares led the ASX sectors again this week

Among the ASX 200 tech shares reporting results this week was Life360 Inc (ASX: 360). Life360 shares surged 47% over the past five days, largely in response to today’s full-year FY23 report.

Adjusted EBITDA came in at US$20.6 million, well ahead of the guidance range of US$12 million to US$16 million. Investors are loving the outlook, too. Life 360 management is guiding adjusted EBITDA in the range of US$30 million to US$35 million for FY24. The Life360 share price closed at $11.30 on Friday.

Nextdc Ltd (ASX: NXT) shares also surged 9.43% this week to close at $16.77 on Friday.

This followed the company’s half-year results being released on Tuesday. NextDC reported a 31% bump in revenue and a 5% improvement in EBITDA.

The biggest ASX 200 tech share, Wisetech Global Ltd (ASX: WTC) also had a good week. Wisetech shares gained 6.16% gain to close at $94.29 on Friday.

In other news, Xero Limited (ASX: XRO) released its FY25-27 strategy update yesterday, and top broker Goldman Sachs named the company its preferred Australia/New Zealand tech share.

Goldman rates Xero a buy with an improved 12-month share price target of $152, up from $141. The Xero share price closed the session on Friday at $134.93.

ASX 200 market sector snapshot

Here’s how the 11 market sectors stacked up this week, according to CommSec data.

Over the past five days:

| S&P/ASX 200 market sector | Change this week |

| Information Technology (ASX: XIJ) | 7.97% |

| Consumer Staples (ASX: XSJ) | 2.59% |

| A-REIT (ASX: XPJ) | 2.34% |

| Consumer Discretionary (ASX: XDJ) | 2.24% |

| Materials (ASX: XMJ) | 1.52% |

| Financials (ASX: XFJ) | 1.37% |

| Industrials (ASX: XNJ) | 0.53% |

| Energy (ASX: XEJ) | 0.4% |

| Communication (ASX: XTJ) | (0.54%) |

| Healthcare (ASX: XHJ) | (0.79%) |

| Utilities (ASX: XUJ) | (1.04%) |

The post Here’s how the ASX 200 market sectors stacked up this week appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here are the top 10 ASX 200 shares today

- 34 ASX 200 shares with ex-dividend dates next week

- How ASX shares vs. property performed in February

- Brokers name 3 ASX shares to buy now

- Why Core Lithium, Life360, Syrah, and Xero shares are jumping today

Motley Fool contributor Bronwyn Allen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Altium, Goldman Sachs Group, Life360, WiseTech Global, and Xero. The Motley Fool Australia has positions in and has recommended WiseTech Global and Xero. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/msfAzyj