Like the rest of the big four banks, Westpac Banking Corp (ASX: WBC) shares are a popular option for passive income.

The banking giant’s shares feature heavily in income portfolios and superannuation funds across the country.

But for those that don’t already own Westpac stock, is it a buy now, hold, or sell now following its update this month?

Let’s see what analysts are saying about Australia’s oldest bank.

Should you buy Westpac stock for passive income on the ASX?

The broker community remains divided on whether you should be buying Westpac shares following its quarterly update.

UBS and Morgan Stanley, for example, currently have the equivalent of sell ratings on its shares with price targets of $20.00 and $21.70, respectively.

Over at Goldman Sachs, Citi, and Morgans, its analysts have hold/neutral ratings with price targets ranging from $22.25 to $23.54.

Whereas Ord Minnett and Macquarie are currently the most positive brokers out there with the equivalent of buy ratings and price targets of $28.00 and $25.00, respectively. Though, it is worth noting that Westpac’s shares have recently surpassed Macquarie’s price target.

What about income?

One thing that the brokers do agree on is that Westpac is likely to provide investors with a decent source of passive income in the near term.

Analysts are forecasting fully franked dividends in the range of $1.42 to $1.46 per share in FY 2024. Based on the current Westpac share price of $26.20, this will mean dividend yields of 5.4% to 5.6%.

And in FY 2025, the forecast dividend widens to a range of $1.39 to $1.50 per share. This equates to yields of 5.3% to 5.7%.

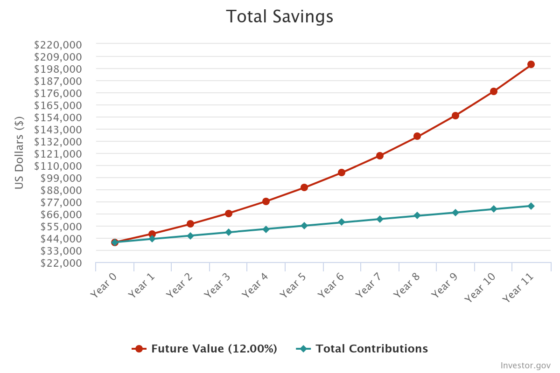

This means that if you were to invest $10,000 into Westpac’s ASX shares, you would expect to receive passive income in the region of $550 in both FY 2024 and FY 2025.

The post ASX passive income: Is Westpac stock a buy, sell, or hold? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Should ASX income investors buy Westpac shares for dividends?

- How these 4 ASX 200 shares just gained major broker upgrades

- Are Westpac shares a buy following the bank’s results?

- High rates, falling profits: Why are ASX bank shares losing out this reporting season?

- Why are Westpac shares leaping ahead of rival ASX 200 bank stocks on Monday?

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Motley Fool contributor James Mickleboro has positions in Westpac Banking Corporation. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Goldman Sachs Group and Macquarie Group. The Motley Fool Australia has positions in and has recommended Macquarie Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/qMTcVKS