There haven’t been many months that have been positive for the Core Lithium Ltd (ASX: CXO) share price lately.

And barring an absolute miracle this afternoon, March certainly won’t be one of them.

As things stand, the Core Lithium share price is on course to record a monthly decline of 27%.

Why is the Core Lithium share price being hammered again?

It has been an eventful month for this lithium miner, but sadly not in a good way.

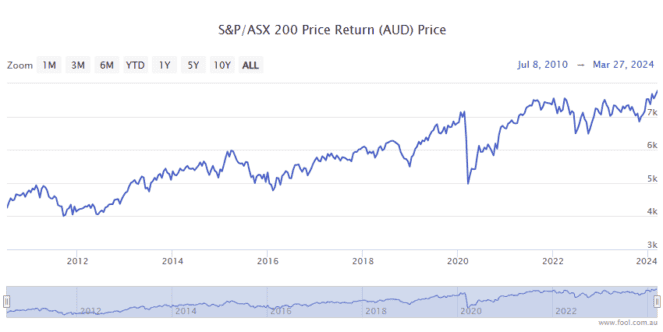

This month, the lithium miner was dumped out of the ASX 200 index, saw its CEO exit immediately out of the blue, and posted a big half-year loss.

In respect to the latter, Core Lithium reported first-half revenue of $134.8 million but a loss after tax of $167.6 million.

This reflects a 75% decline in its spodumene concentrate realised price to US$2,098 per tonne, its decision to suspend production, a non-cash impairment of $119.6 million, and provisions for onerous contracts of $27.6 million.

What’s next?

The bad news is that the few brokers that still cover the company don’t see value in the Core Lithium share price despite its fall from grace.

For example, earlier this month, Citi retained its sell rating and slashed its price target down to 11 cents.

Goldman Sachs also remains bearish. Its analysts reiterated their sell rating and cut their price target to 13 cents.

Goldman appears to believe that lithium prices will stay at levels that are not workable for Core Lithium for some time to come.

As a result, the broker is forecasting revenue of just $18 million in FY 2025 and then $34 million in FY 2026. This compares unfavourably to the revenue of $134.8 million it generated during the first six months of FY 2024.

These certainly are tough times for Core Lithium and its share price. If there isn’t a significant uptick in lithium prices in the near term, the next couple of years could be very bleak for shareholders.

The post The Core Lithium share is down 27% in March: What’s next? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why Telstra and these ASX 300 stocks just hit 52-week lows

- 3 reasons to sell Core Lithium shares

- These are the 10 most shorted ASX shares

- What is the current lithium price?

- Why Block, Core Lithium, Fisher & Paykel Healthcare, and Virgin Money are rising today

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Motley Fool contributor James Mickleboro has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Goldman Sachs Group. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/5HpLDwv