On Monday, the S&P/ASX 200 Index (ASX: XJO) started the week with a solid gain. The benchmark index rose 0.5% to 7,811.9 points.

Will the market be able to build on this on Tuesday? Here are five things to watch:

ASX 200 expected to fall

The Australian share market is expected to fall on Tuesday following a relatively poor start to the week on Wall Street. According to the latest SPI futures, the ASX 200 is poised to open the day 17 points or 0.2% lower. In late trade in the United States, the Dow Jones is down 0.4%, the S&P 500 is down 0.2%, and the NASDAQ is 0.1% lower.

Pilbara Minerals rated as a hold

Pilbara Minerals Ltd (ASX: PLS) shares could be fully valued according to analysts at Bell Potter. This morning, the broker has responded to its downstream announcement by retaining its hold rating and $3.55 price target. This is 9% lower than where the lithium miner’s shares currently trade. It said: “We retain our hold recommendation on valuation grounds.”

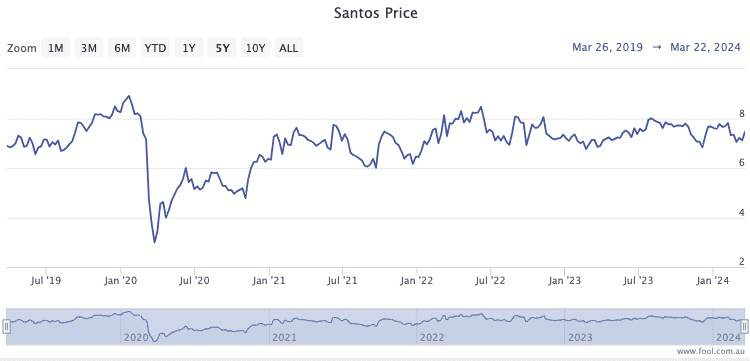

Oil prices rebound

ASX 200 energy shares Santos Ltd (ASX: STO) and Karoon Energy Ltd (ASX: KAR) could have a better session on Tuesday after oil prices rebounded overnight. According to Bloomberg, the WTI crude oil price is up 1.8% to US$82.05 a barrel and the Brent crude oil price is up 1.6% to US$86.80 a barrel. Oil prices rose amid reports that Russian refineries have been hit by attacks.

Premier Investments results

The Premier Investments Limited (ASX: PMV) share price will be on watch today when the retail conglomerate releases its half-year results. Management is guiding to Premier Retail EBIT for the 26-week period ending 27 January to be approximately $200 million. Goldman Sachs has suggested that there could be some gross margin surprise thanks partly to easing global freight costs.

Gold price rises

ASX 200 gold shares including Evolution Mining Ltd (ASX: EVN) and Regis Resources Limited (ASX: RRL) could have a good session after the gold price pushed higher on Monday. According to CNBC, the spot gold price is up 0.6% to US$2,173 an ounce. Rate cut bets gave the precious metal a boost.

The post 5 things to watch on the ASX 200 on Tuesday appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- The ASX 200 stock that could get second time lucky

- Here are the top 10 ASX 200 shares today

- How these ASX 200 energy shares could unexpectedly burn brighter

- If I were Warren Buffett, I’d buy these ASX shares in a heartbeat

- These ASX 200 mining stocks could rise 40% to 50%

Motley Fool contributor James Mickleboro has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Goldman Sachs Group. The Motley Fool Australia has recommended Premier Investments. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/uDeAMp0