The S&P/ASX 200 Index (ASX: XJO) has started the week positively. In afternoon trade, the benchmark index is up 0.5% to 7,811.3 points.

Four ASX shares that are rising more than most today are listed below. Here’s why they are climbing:

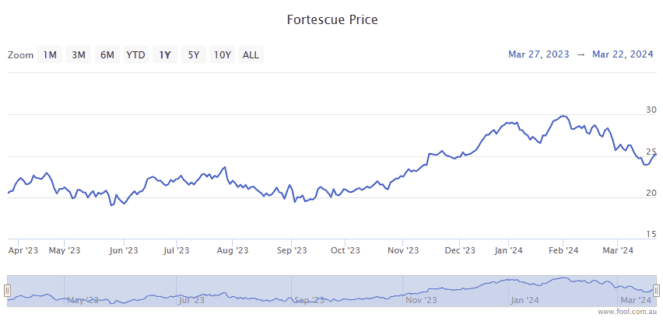

Fortescue Ltd (ASX: FMG)

The Fortescue share price is up 3% to $25.40. This may have been driven by news that the mining giant’s recently deployed electric excavator has now moved one million tonnes of material since going into action. Importantly, management advised that at times the electric excavator was performing better than its diesel equivalent.

Gold Hydrogen Ltd (ASX: GHY)

The Gold Hydrogen share price is up 14% to $1.47. This morning, this natural hydrogen and helium exploration and development company announced strong results from its Ramsay 1 and Ramsay 2 well testing. According to the release, the test confirmed up to 17.5% purity for helium, which ranks amongst the highest purity levels globally.

MMA Offshore Ltd (ASX: MRM)

The MMA Offshore share price is up 11% to $2.61. This follows news that the marine service provider has received and accepted a takeover offer. According to the release, the company has entered into a binding scheme implementation deed with Cyan MMA Holdings for the proposed acquisition of all its shares via a scheme of arrangement. The board unanimously recommends shareholders vote in favour of the $2.60 cash per share offer at the scheme meeting. Though, with its shares now trading above the offer price, it’s possible that some investors believe a competing bid will materialise.

Sims Ltd (ASX: SGM)

The Sims share price is up almost 3% to $12.22. This morning, analysts at UBS upgraded the scrap metal company’s shares to a buy rating with an improved price target of $14.50. The broker believes that its outlook is improving and highlights the discount its shares trade at compared to book value.

The post Why Fortescue, Gold Hydrogen, MMA Offshore, and Sims shares are pushing higher appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Fortescue share price leaps 5% as electric machinery makes a milestone

- Guess which ASX 300 stock is rocketing 10% on a $985 million cash bid!

- Here’s how the ASX 200 market sectors stacked up last week

- Are dividends your thing? Then you’ll love these 2 high-yield ASX shares

- Is the worst of the selling now over for ASX iron ore shares?

Motley Fool contributor James Mickleboro has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended Mma Offshore. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/Hy3PX2G