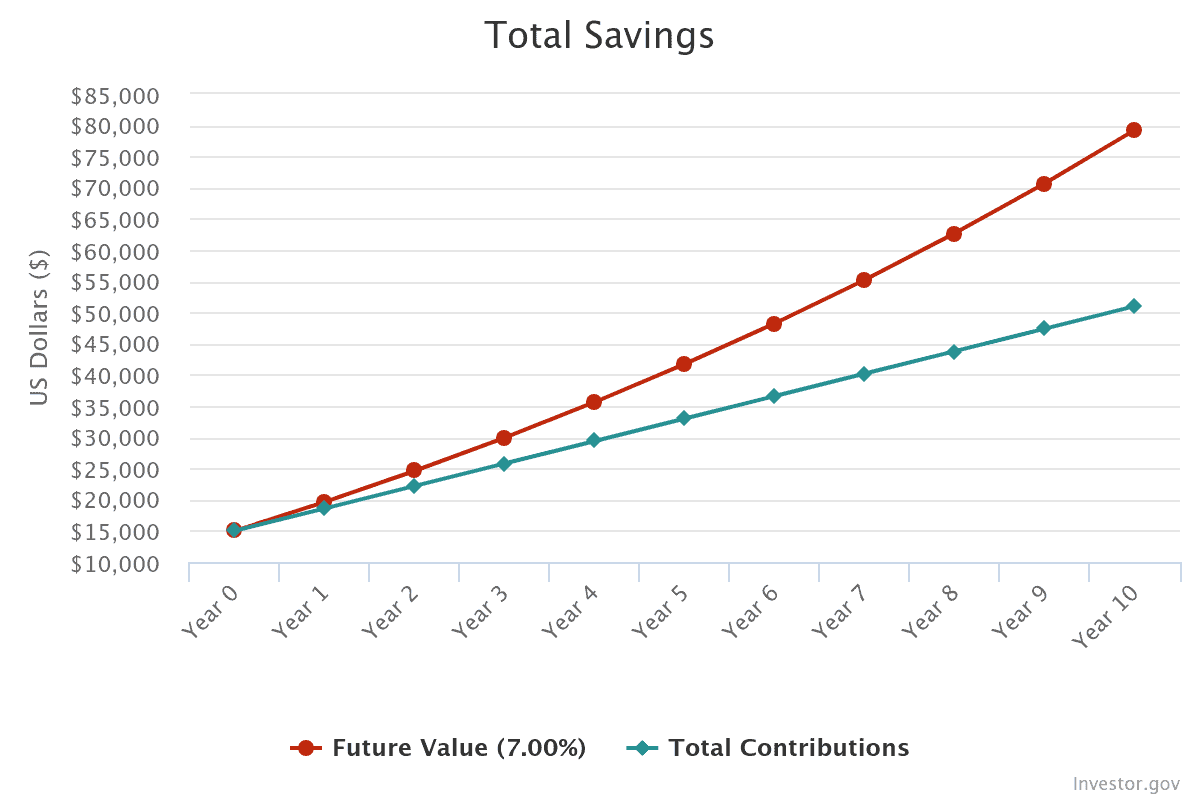

Risk-averse investors tend to favour term deposits for their perceived certainty. But, as we covered this week, the ‘safe’ returns delivered by term deposits can be eroded when inflation is running hot.

It’s true that market volatility may not impact savings accounts and term deposits to the same degree as ASX shares. But, considering the S&P/ASX 200 Index (ASX: XJO)’s ability to deliver a net average annual return of 11.23% (over 10 years, including dividends), how much profit are you prepared to sacrifice for a smooth sail?

The Aussie share market is home to many high-quality, well-established companies with proven track records for delivering growth. And while past performance is no guarantee of future outcomes, creating a diversified portfolio of ASX blue-chip stocks can go a long way to reducing your risk exposure.

On that note, we asked our Foolish writers which ASX shares they think offer the best alternative investment to a term deposit right now.

Here is what they told us:

6 ASX stock tips for faint-hearted investors in March 2024

- Rural Funds Group (ASX: RFF), $810.01 billion

- Growthpoint Properties Australia Ltd (ASX: GOZ), $1.85 billion

- New Hope Corporation Ltd (ASX: NHC), $3.72 billion

- Metcash Ltd (ASX: MTS), $4.24 billion

- Woolworths Group Ltd (ASX: WOW), $39.48 billion

- Telstra Group Ltd (ASX: TLS), $43.44 billion

(Market capitalisations as of market close 22 March 2024).

Why our Foolish writers think you should buy these ASX shares instead of investing cash in the bank

Rural Funds Group

What it does: Rural Funds is a real estate investment trust (REIT) that owns different types of farms, including cattle, almonds, macadamias, and vineyards.

By Tristan Harrison: The farms owned by Rural Funds Group are spread across different states and climactic conditions, creating diversification for its portfolio. Furthermore, most of the REIT’s tenants are large entities, with some being listed on the ASX or on international bourses.

Rural Funds is currently paying an annualised distribution of 11.73 cents per unit, which translates into a distribution yield of 5.61% on current pricing.

Attractively, rental income continues to grow through rent increases built into the company’s contracts. Rural Funds also invests in its farms to improve productivity, which in turn increases rental (and capital) value.

For all these reasons and more, I think the ASX 300 stock offers far better long-term investment prospects than a term deposit.

Motley Fool contributor Tristan Harrison owns shares of Rural Funds Group.

Growthpoint Properties Australia Ltd

What it does: Growthpoint Properties is a real estate investment trust (REIT) that invests in industrial and office assets.

By Tony Yoo: With a stunning dividend yield of 8.27%, this stock flogs any term deposit for income returned each year.

Admittedly the share price has dropped 17.45% over the past 12 months, but with interest rate relief possibly not too far away, optimism abounds about the property sector.

Indeed, broking platform CMC Invest shows five out of seven analysts rating Growthpoint Properties as a strong buy right now.

Last month’s business update showed the net tangible assets standing at $3.75 per share, which means the current stock price is trading at about a 34% discount.

Motley Fool contributor Tony Yoo does not own shares of Growthpoint Properties Australia Ltd.

New Hope Corporation Ltd

What it does: New Hope is a leading Australian coal miner. The company currently operates two open-cut coal mines: New Acland in Queensland and Bengalla in New South Wales.

By Bernd Struben: With coal prices coming down from their record highs, so too have New Hope’s dividend payments. But with shares in the ASX 200 miner also down 14.73% in 2024, I believe the stock represents good value. And it still offers term-deposit-busting yields.

New Hope’s reduced interim dividend came out at 17 cents per share. Atop the 30 cents per share final dividend, the stock currently trades on a fully franked trailing yield of 15.91%.

The miner remains well funded, with available cash of $480 million as at 31 January.

And I believe coal prices will surprise to the upside in the half-year ahead. That’s based on my expectations of a soft landing for the global economy and a stronger-than-expected rebound from China’s industrial sector.

Motley Fool contributor Bernd Struben does not own shares of New Hope Corporation Ltd.

Metcash Ltd

What it does: Metcash is the little-talked-about rival to the big dogs within the food, liquor, and hardware retailing space. Except, at 5,412 storefronts strong, Metcash is no small fry. You’ll know the company through brands such as IGA, Bottle-O, Cellarbrations, Mitre 10, Home Timber & Hardware, and Total Tools.

By Mitchell Lawler: If I stashed my cash in something other than inflation-crippled savings, my go-to would be a company operating in a stable, needs-based industry â and hey, bingo! Food, beverages, and building goods are about as primitive and needs-driven as it gets.

I’d opt for Metcash over Woolworths or Coles Group Ltd (ASX: COL) as calls to break up the bigger players grow louder. A bill proposing stronger government powers to take a scalpel to corporations through divestiture powers will hit the Senate floor soon.

A smaller opponent like Metcash could benefit from such a move. Plus, Metcash’s 5.67% dividend yield puts a term deposit rate to shame.

Motley Fool contributor Mitchell Lawler does not own shares of Metcash Ltd.

Woolworths Group Ltd

What it does: Woolworths is the retail giant responsible for 1,400 stores across its Woolworths Supermarkets (Australia), Countdown Supermarkets (New Zealand), and BIG W brands.

By James Mickleboro: With the supermarket giant’s shares dropping to a 52-week low last week, I think now is a great time for investors to invest. Particularly given that concerns over inquiries into price gouging and anti-competitive behaviour claims have driven this weakness.

Goldman Sachs believes the selling has been an overreaction, noting that similar inquiries over a decade ago had no real impacts on the retailer’s earnings. In light of this, the broker continues to forecast solid earnings and dividend growth out to at least FY 2026.

With respect to the latter, Goldman expects fully franked dividends per share of $1.09 in FY 2024, $1.17 in FY 2025, and $1.27 in FY 2026. And with Goldman having a conviction buy rating and a $40.40 price target on Woolworths shares, some big gains could be on the cards for investors.

Motley Fool contributor James Mickleboro does not own shares of Woolworths Group Ltd.

Telstra Group Ltd

What it does: Telstra is the market-leading telco in Australia. It has the largest share of the mobile network, as well as fixed-line internet services.

By Sebastian Bowen: I think Telstra is one of the most attractive income investments out of the entire ASX 20 right now. For one, this company has a highly defensive earnings base, with customers unlikely to stop paying for Telstra services, regardless of the economic weather.

After a few years of dividend stagnation, Telstra has been raising its payouts over the past two years. However, the telco’s share price has been subdued over the past few months. This has resulted in a fully franked dividend yield of more than 4.52% at recent pricing.

I’d rather have that over a term deposit any day.

Motley Fool contributor Sebastian Bowen owns shares of Telstra Group Ltd.

The post Top ASX shares to buy instead of a term deposit in March 2024 appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Goldman Sachs Group. The Motley Fool Australia has positions in and has recommended Coles Group, Rural Funds Group, and Telstra Group. The Motley Fool Australia has recommended Metcash. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/aJbr06G