Often the dilemma with stocks that have very high dividend yields is that there could be concerns about the business outlook.

But just occasionally you come across an ASX stock that’s fallen in price, making it cheap and supercharging the dividend yield, but has a bright future ahead.

It’s that rare find that’s in the sweet spot.

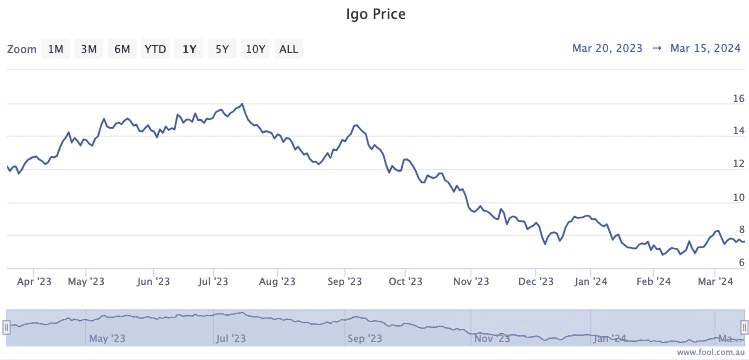

Multi-mineral producer IGO Ltd (ASX: IGO) has seen its share price tumble more than 53% since July.

As a consequence, its yield now stands at a mouthwatering 9.6%.

Is this a trap or have we found the end of the rainbow?

Why has this dividend stock struggled?

Although IGO has a record of extracting nickel, copper, and cobalt, its market fortunes are overwhelmingly dominated by the headline-grabbing lithium business.

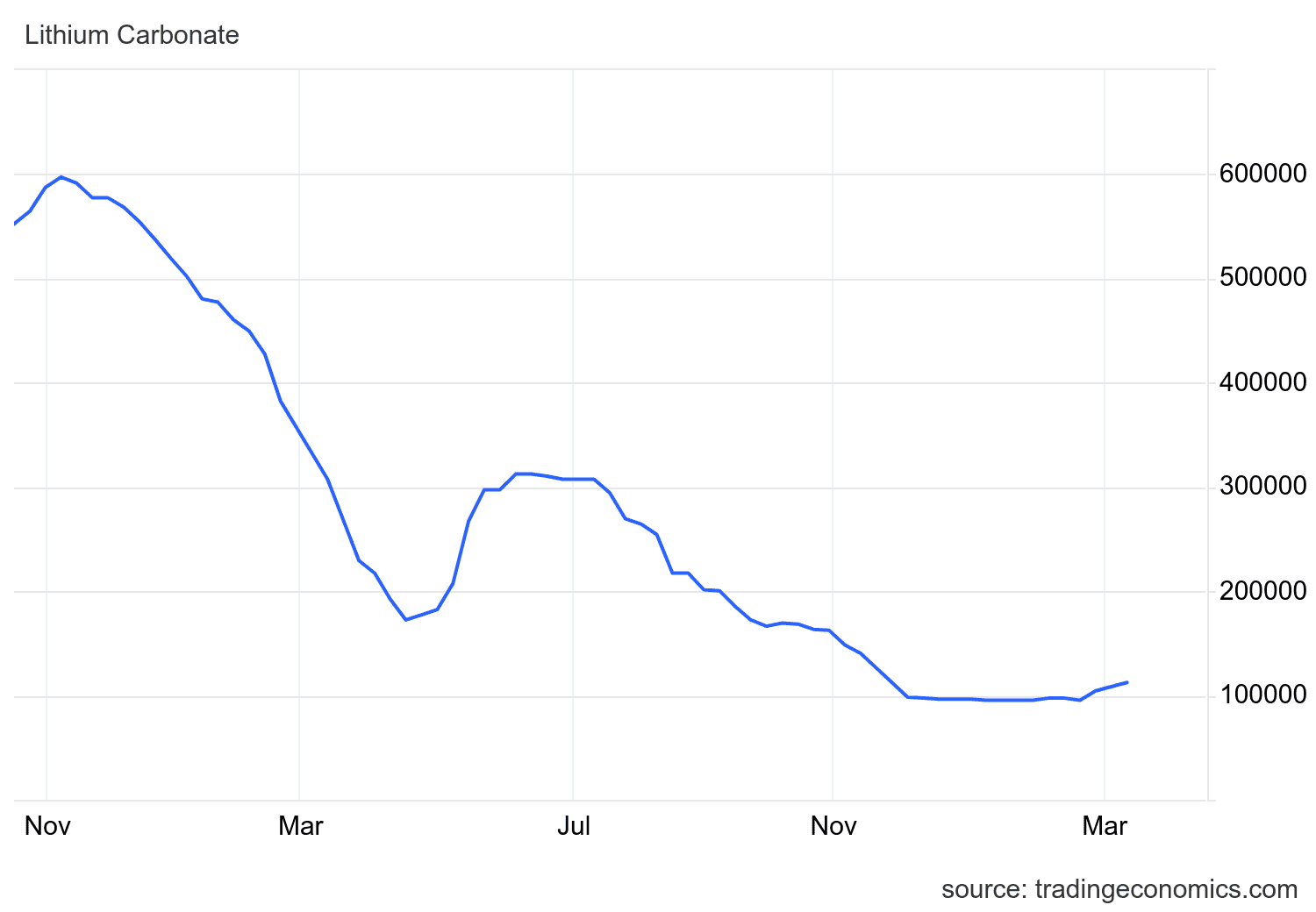

And global lithium prices have plummeted.

In November 2022, a tonne of lithium carbonate was fetching almost 600,000 CNY. Just 16 months later, you’d be lucky to sell it for 113,000 CNY.

The problem has been that China’s consumers are locking up their wallets, dampening demand for electric cars in that country.

Western markets have not helped either, with billions of consumers crushed by inflation-busting interest rate rises.

So that’s the bad news.

Has IGO bottomed now?

Now for the good news.

Lithium demand, in the long run, is expected to be strong.

In the coming years the world will need many new batteries to cope with the electrification of millions of engines that used to run on fossil fuels.

It’s not just about nations altruistically reducing their carbon footprint. Recent wars in Europe and the Middle East have reminded all and sundry that depending entirely on imported oil and gas is a risky move.

IGO Ltd, as one of the smaller miners, has done well to keep production going. Some other players, such as Core Lithium Ltd (ASX: CXO) have been forced to stop because producing lithium has become uneconomical.

Just last month the team at Blackwattle picked IGO as the lithium stock to buy for those wanting to get into lithium for cheap right now.

“We believe IGO provides investors with exposure to the best lithium mine in the world, Greenbushes, which is producing at a cost still well below current weak spodumene prices.”

And many of their peers agree.

According to broking platform CMC Invest, nine out of 18 analysts are recommending IGO as a buy right now.

So yes, this could be a rare time that a falling stock with a high dividend could be a wise buy.

The post A 10% yield but down 53%! Time for me to buy more of this hidden ASX gem? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here are the top 10 ASX 200 shares today

- IGO share price marching higher despite trading ex-dividend today

- 5 things to watch on the ASX 200 on Tuesday

- 13 ASX 200 shares with ex-dividend dates next week

- Why the 2024 outlook for these rebounding ASX 200 lithium shares looks ‘better than market expectations’

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/8aYqvsg