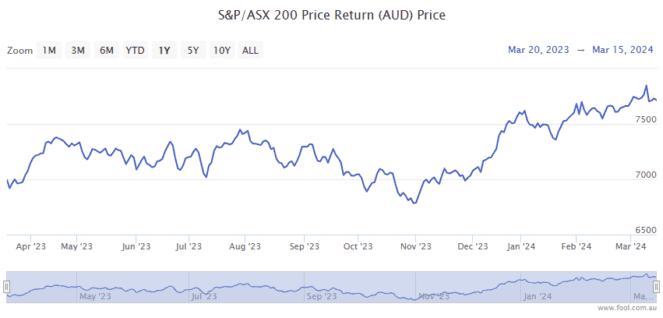

In afternoon trade, the S&P/ASX 200 Index (ASX: XJO) is on course to record small decline. At the time of writing, the benchmark index is down 0.1% to 7,662.4 points.

Four ASX shares that are not letting that hold them back today are listed below. Here’s why they are rising:

Bannerman Energy Ltd (ASX: BMN)

The Bannerman Energy share price is up 6% to $3.18. This has been driven by the release of scoping study results for the uranium developer’s Etango operation in Namibia. The company revealed that two future phase options have been evaluated. These are a post ramp-up expansion in throughput capacity to 16 Mtpa (Etango-XP) or an extension of operating life to 27 years (Etango-XT). Its Executive Chair said: “I am delighted that we have more formally demonstrated the longer-term optionality delivered by our large-scale Etango uranium resource. While the XP and XT cases are readily viable at our base case Etango-8 DFS price assumption of US$65/lb, their economics are clearly supercharged in higher price scenarios.”

Cettire Ltd (ASX: CTT)

The Cettire share price is up 3.5% to $4.16. This morning, the team at Bell Potter reaffirmed their buy rating and $4.80 price target on this luxury products ecommerce company’s shares. It commented: “We think CTT’s ability to outperform their peer group far outweighs others given the ~0.9% market share and further supported by the ongoing consolidation in the luxury e-commerce market.”

TechnologyOne Ltd (ASX: TNE)

The TechnologyOne share price is up almost 3% to $16.95. This has also been driven by a broker note out of Bell Potter this morning. According to the note, its analysts have upgraded the enterprise software provider’s shares to a buy rating with an $18.50 price target. Bell Potter expects a strong half-year result from TechnologyOne in May. It said: “We see the 1HFY24 result as a potential catalyst with an expected strong result and an NRR [net revenue retention] around 115%.”

Zip Co Ltd (ASX: ZIP)

The Zip share price has continued its positive run and is up a further 4.5% to $1.35. This buy now pay later provider’s shares have been on fire this year thanks to its strong first-half performance and takeover rumours. In addition, last week Citi upgraded the company’s shares to a buy rating with an improved price target of $1.40. Citi has been impressed with the company’s performance and particularly its balance sheet improvements.

The post Why Bannerman Energy, Cettire, TechnologyOne, and Zip shares are charging higher appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Ignore the noise and buy this hot ASX growth stock

- This ASX uranium stock is racing 8% higher on big news

- Guess which ASX 200 tech stock has just been upgraded

- 5 things to watch on the ASX 200 on Monday

- If I’d put $5,000 into Zip shares on 9 October, here’s what I’d have now!

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Motley Fool contributor James Mickleboro has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Technology One and Zip Co. The Motley Fool Australia has recommended Cettire and Technology One. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/2rgZDGM