ASX reporting season was fascinating to me, with a number of businesses reporting financials that were stronger than previously thought. I’m going to write about two ASX stocks that seem like bargains to me.

The economy and households overall seem to have done better than expected, though there is pain in some places.

With retail spending holding up quite well and the economy strengthening in the coming years, I think a couple of these ASX retail shares look like good buys.

Universal Store Holdings Ltd (ASX: UNI)

The Universal Store share price is down 22% from February 2023 and it’s down 45% from November 2021. I think it looks great value considering its result and potential growth.

This business operates premium youth fashion brands, with the primary business being Universal Store. It operates the THRILLS and Worship brands within the CTC business, and it’s rolling out Perfect Stranger as a standalone retail store

Universal Store’s FY24 half-year result showed 8.5% overall sales growth to $158 million, with Universal Store sales down 1.4% to $133.2 million, Perfect Stranger sales up 59.7% to $6.6 million and CTC sales up 4.2% to $25.3 million.

It also reported an 80 basis point (0.80%) increase in the gross profit margin to 59.7%. Statutory net profit after tax (NPAT) grew by 16.7% to $20.7 million, while underlying earnings before interest and tax (EBIT) increased by 8.1% to $30.8 million, despite all of the spending on opening new stores.

It opened six new stores during the first half â the store opening program is one of the main reasons I think the company has a promising future as it increases scale.

The ASX stock impressively grew its interim dividend by 18% to 16.5 cents.

According to the projections on Commsec, the ASX retail share is valued at under 13 times FY24’s estimated earnings and 10 times FY26’s estimated earnings. It could pay a grossed-up dividend yield of 9.6% in FY26.

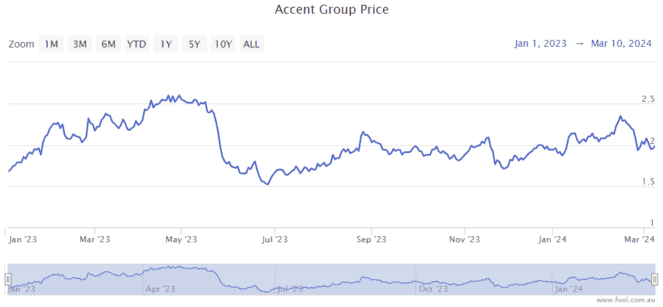

Accent Group Ltd (ASX: AX1)

Accent acts as the distributor of a number of global shoe brands including Skechers, Vans, Kappa, Hoka, Dr Martens and CAT. It’s also responsible for its own businesses including The Athlete’s Foot, Stylerunner, Glue Store and Nude Lucy.

The Accent share price is down 16% from 14 February 2024 and down 24% from 19 April 2023.

Keeping in mind that HY24 was a 26-week period and HY23 was a 27-week period, owned sales fell 2% to $733 million, gross profit increased 0.6% to $414.9 million, the ASX stock’s EBIT dropped 21% to $72.3 million and net profit after tax declined 27.6% to $42.2 million.

Sales and net profit declining is not exactly a positive. But, I believe it’s a cyclical decline that can turn around in FY25 onwards. It’s also opening up a compelling valuation to buy at. Total owned sales in the year to date at the end of January were up 1.6%.

It continues to open new stores that can boost sales in the short term and the longer term, which can help with total sales and operating leverage.

According to Commsec’s numbers, the Accent share price is valued at 14 times FY25’s estimated earnings and 12 times FY26’s estimated earnings. It could pay a grossed-up dividend yield of 10.3% in FY26.

The post I think these ASX stocks are bargain buys after reporting season appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 3 ASX dividend shares to buy with ~5% yields for an income boost

- Forget term deposits and buy these ASX dividend stocks

- Buy these ASX dividend stocks with yields of 5% to 7.5%

- How investing $100 per week can create $2,000 in annual ASX dividend income

- Why Accent, Cettire, Dicker Data, and Iress shares are dropping today

Motley Fool contributor Tristan Harrison has positions in Accent Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended Accent Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/Ty5SdRg