Some investors may be looking for regular income. A salary can certainly provide that consistent level of income. But can ASX shares also provide monthly income?

I can understand why people want monthly income â a lot of household expenditure is monthly like the mortgage or rental payment. Various other bills come regularly, food is a very regular purchase. Regular investment cash flow could help with that.

There are very few ASX investments that pay monthly, and I don’t like all of them. Furthermore, the investment needs to make sense, the dividend income shouldn’t be the only important factor to consider.

But, if we create a $10,000 portfolio of ASX shares that pay quarterly, then there is a way to create that monthly income.

Regular dividend payers

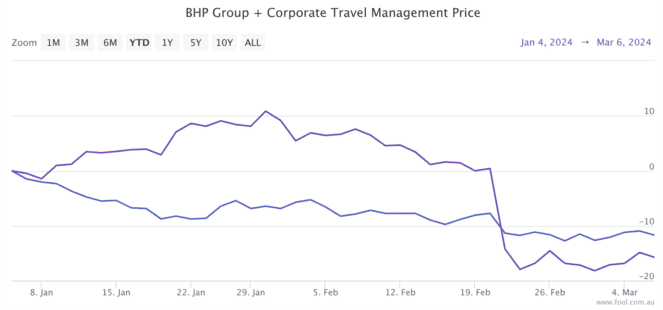

One option is Rural Funds Group (ASX: RFF), a real estate investment trust (REIT) that owns farmland including almonds, macadamias, cattle and vineyards.

Rural Funds pays a distribution every three months in January, April, July and October.

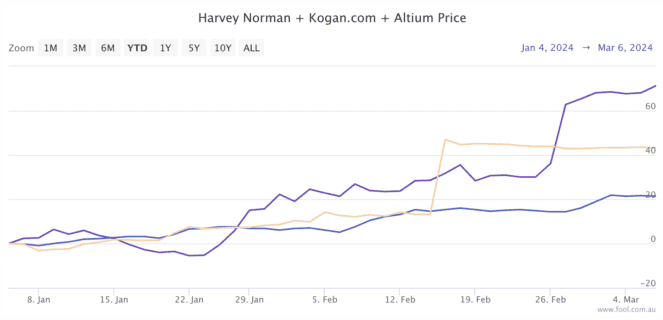

Charter Hall Long Wale REIT (ASX: CLW) is another REIT. It owns a variety of different properties including distribution centres and logistics, food manufacturing, pubs and bottle shops, service stations, telecommunication exchanges, Bunnings properties and so on.

Charter Hall Long Wale REIT pays a distribution every three months in February, May, August and November.

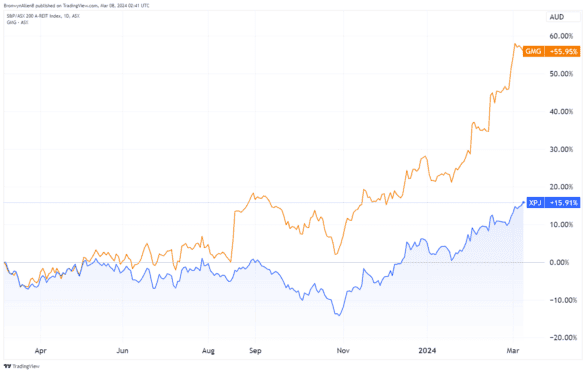

GQG Partners Inc (ASX: GQG) is a fund manager that’s rapidly growing its funds under management (FUM), leading to profit and dividend growth.

GQG pays a dividend in March, June, September and December.

Should monthly income matter?

Receiving dividends every month is an appealing outcome, but there are more ASX dividend shares out there than just the few I have mentioned today. A lot of dividend payers don’t pay every quarter, but I still think they’re worth owning.

I’d rather own a portfolio of names that pay every six months (or even once a year), ensuring I’ve made the best investments, rather than trying to purposefully choose ones just based on the months they pay. Even so, regular readers will know that I like all three of these ASX dividend shares.

Foolish takeaway

By spreading $10,000 across the three names I mentioned, we can create a decent cash flow every month. I like their potential and they could all grow profit in the years ahead.

The post Got $10,000 to invest? How to turn it into monthly income appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why Cettire, GQG, Mesoblast, and Nine Entertainment shares are falling today

- Want passive income? This high-yielding ASX dividend stock pays cash every quarter

- Up 7%: This All Ords stock reported some big ASX news today

- Cash kings: 2 top ASX dividend shares that pay quarterly

- With a P/E ratio of 15, is this ASX All Ords share price too low to ignore?

Motley Fool contributor Tristan Harrison has positions in Rural Funds Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has positions in and has recommended Rural Funds Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/47YReVE