The Insurance Australia Group Ltd (ASX: IAG) interim dividend announced last month was 67% higher than last year, at 10 cents per share.

That’s some very nice turbocharged passive income, right there.

And analysts say it’s only going to get better from here.

IAG dividend trajectory

So, IAG investors will be receiving their 10 cents per share on 27 March.

What’s next?

Well, consensus expectations published on CommSec today are for IAG to pay a total dividend of 25 cents in 2024. That means the final dividend, to be announced in August, should be about 15 cents per share.

Last year, 15 cents was what IAG paid in dividends for the entire year. So, you get the drift. IAG dividends are on the increase.

Based on the IAG share price of $6.23 at the time of writing, a total dividend of 25 cents this year would equate to a dividend yield of 4%.

This is nothing spectacular — 4% is the average dividend yield for S&P/ASX 200 (ASX: XJO) stocks.

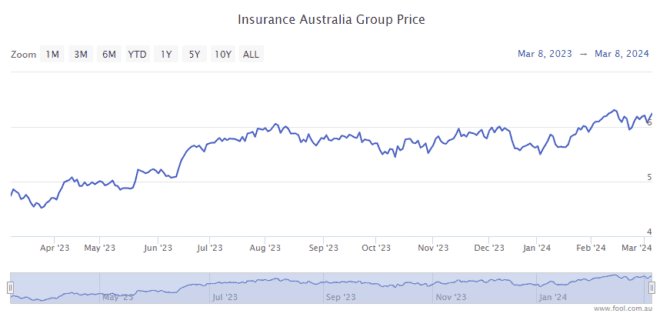

But we need to remember that the IAG share price has had a significant run-up of late. Over the past 12 months, it’s up 30%. That sort of price growth is obviously going to lower the yield.

What about future IAG dividends?

The consensus forecast is for IAG to pay a total annual dividend of 30 cents in 2025 and 32 cents in 2026. That means yields of 4.8% and 5.1%.

That’s better!

And don’t forget about the franking on top. In 2023, the annual dividend had 30% franking attached. The recent interim dividend for 2024 had 40% franking attached.

Should you buy?

After 30% share price growth, some investors might like to wait for the next pullback in price.

To give you some guidance, the consensus rating is currently a hold. The rating was downgraded from a moderate buy this week.

Goldman Sachs has a 12-month share price target of $6 on IAG shares. So, the broker reckons IAG shares are already trading above value today.

Over to you.

The post Here’s the IAG dividend forecast through to 2026 appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Passive income watch: The ASX stocks dishing out the biggest dividend boosts this earnings season

- IAG shares go ex-dividend tomorrow: Should you buy now?

- Why Inghams, IAG, Neuren Pharmaceuticals, and Pro Medicus shares are sinking today

- IAG share price sinks 6% despite huge dividend boost and buyback

- 5 things to watch on the ASX 200 on Friday

Motley Fool contributor Bronwyn Allen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Goldman Sachs Group. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/8Iahf60