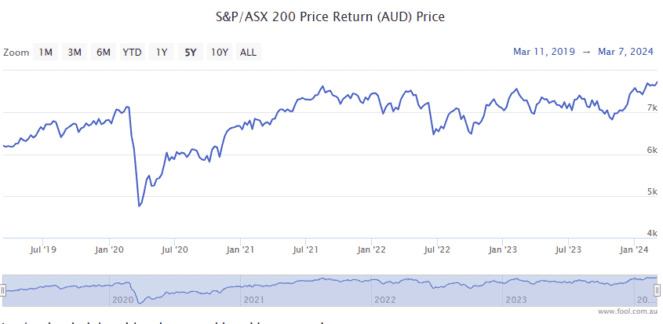

The record-breaking streak for the S&P/ASX 200 Index (ASX: XJO) continues apace today.

March is proving to be a good month for resetting high water marks.

The benchmark index reached a new intraday high of 7745.6 points on Friday, 1 March. And the ASX 200 notched another new intraday high of 7769.1 points on Monday, 4 March.

In early morning trade on Friday, the index comprised of the top 200 listed Aussie companies is up 0.5% at 7,802.0 points.

Though if the past two weeks are anything to go by, that record may not stand for long!

Here’s what helping drive the record-breaking run today.

What’s sending the ASX 200 into new record territory?

A lot of stars have aligned to set up this bull run.

First, we’re seeing very solid earnings results from most of the big companies, despite the headwinds from sticky inflation and high interest rates.

Growing hopes for a so-called ‘soft landing’, both in Australia, the EU and the United States, are also helping propel the ASX 200 to new highs.

With inflation coming off the boil and continuing to show signs of moderation, US Federal Reserve chair Jerome Powell stirred investor optimism this week that rate cuts in the world’s top economy are not far off.

“We’re waiting to become more confident that inflation is moving sustainably at 2%,” Powell said. “When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction.”

On 20 March the Fed will update the market on its outlook for interest rates, with three rate cuts still on the table for 2024.

And a third tailwind that looks to be pushing the ASX 200 into record territory is the increased infrastructure spending plans announced by China’s government this week.

China is the top destination for numerous Australian goods and commodities, including our top export iron ore. More stimulus from the world’s number two economy could bode well for those big exporting stocks and their shareholders.

One ASX stock to track the record-breaking run

Investors looking to mirror the performance of the ASX 200 might want to look into the BetaShares Australia 200 ETF (ASX: A200).

The exchange-traded fund (ETF) aims to track the performance of the benchmark index. And it comes with a very low annual fee of 0.04%.

Over the past four and half months, the ETF has actually outpaced the benchmark.

Since 30 October the ASX 200 has gained 14.8%, while the A200 ETF is up 15.8% over that same period.

If you prefer to pick individual blue-chip stocks with the potential to outperform the benchmark, make sure to do some thorough research first.

If you’re not comfortable with that, or feeling time-poor, then make sure to seek out some professional advice.

The post ASX 200 soars to another new all-time high on Friday! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 13 ASX 200 shares with ex-dividend dates next week

- 5 things to watch on the ASX 200 on Friday

- Here are the top 10 ASX 200 shares today

- 5 things to watch on the ASX 200 on Thursday

- Would Warren Buffett buy ASX shares in a raging bull market?

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/ChQk30E