Quality ASX shares going for cheap — that’s what everyone wants, right?

Yet it’s easier said than done to pick a portfolio full of those.

If it were easy, everyone would do it and be rich.

The reality is that no one, not even experts who invest for a living, knows for certain what their share purchases will do.

However, we can manage the risk by looking for certain traits.

Does management have a long track record of growing the company? How dominant is the business in its field and how strong are its rivals? Are there external factors that are favourable for the future? Is it profitable and have manageable debt?

Let’s check out three cheap ASX shares that tick a lot of these boxes:

These ASX shares are down despite beating expectations

Johns Lyng Group Ltd (ASX: JLG) has been a long-time favourite among professional investors, but it has taken an almost 13% haircut over the past fortnight.

The analysts at QVG Capital explained the negative reaction was in response to the half-year results.

“Johns Lyng actually beat earnings expectations and increased full year guidance,” they said in a memo to clients.

“Unfortunately, the devil was in the detail and the detail showed the US business didn’t grow in the half.”

The US market is seen as one of the big drivers of growth for Johns Lyng, so investors punished it for the lack of progress.

But with earnings still growing, the QVG team is sticking by the insurance repairer, retaining the largest investment in the fund.

Reassuringly, nine out of 11 analysts are still rating Johns Lyng shares as buy, according to broking platform CMC Invest.

A dominant position in its field

After showing off boom numbers in January, Resmed CDI (ASX: RMD) shares have deflated more than 7%.

One reason for the dip might be that the stock went ex-dividend in early February.

Regardless, the share price is now at a nice discount for those willing to buy for the long run.

Even after last year’s dramas about the threat of Ozempic on ResMed’s addressable market, the stock has risen more than 90% over the past five years.

The company is the dominant player in the sleep apnoea treatment industry, and its nearest competitor Koninklijke Philips NV (AMS: PHIA) is still dealing with the consequences of a safety recall on its products.

On CMC Invest right now, 19 out of 26 analysts recommend ResMed as a buy.

Cheap ASX shares for the electrification of fossil fuel engines

For something a bit different, Global X Battery Tech & Lithium ETF (ASX: ACDC) seems cheap at the moment.

Of course, ASX lithium shares, like all mining stocks, are liable to be very volatile and cyclical.

But with an exchange-traded fund (ETF) such as this, one can invest in the whole sector as a theme.

And this is a theme that seems to have irresistible tailwinds in the long run.

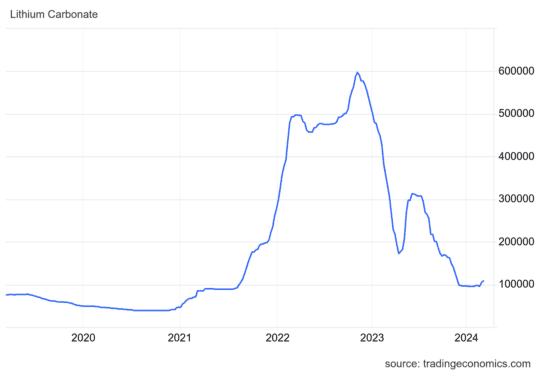

After the global lithium carbonate price reached almost 600,000 CNY per tonne in late 2022, it was all a bit of a disaster in 2023. Now it’s hovering just above 108,000 CNY per tonne.

With demand set to grow for years as the world seeks to reduce its carbon emissions, it seems like the lithium price will likely be higher in 10 years time, especially from the current depression.

The share price for the Global X Battery Tech & Lithium ETF itself is about 16% down from June last year, so is trading at a decent discount.

The post 3 reliable ASX shares you can buy at a discount appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here are the top 10 ASX 200 shares today

- Morgans names more of the best ASX 200 shares to buy in March

- 2 classic ASX 200 shares you can buy for cheap now to hold for years

- Seeking retirement income from ASX bank shares at 52-week highs? What I’d buy instead

- 3 excellent ASX ETFs to buy in March

Motley Fool contributor Tony Yoo has positions in Johns Lyng Group and ResMed. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Global X Battery Tech & Lithium ETF, Johns Lyng Group, and ResMed. The Motley Fool Australia has positions in and has recommended ResMed. The Motley Fool Australia has recommended Global X Battery Tech & Lithium ETF and Johns Lyng Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/VC4c3SM