Yesterday we posed the question, “Is the blistering rally in S&P/ASX 200 Index (ASX: XJO) bank shares overdone?”

Today we have our answer.

It’s not.

At least, not yet.

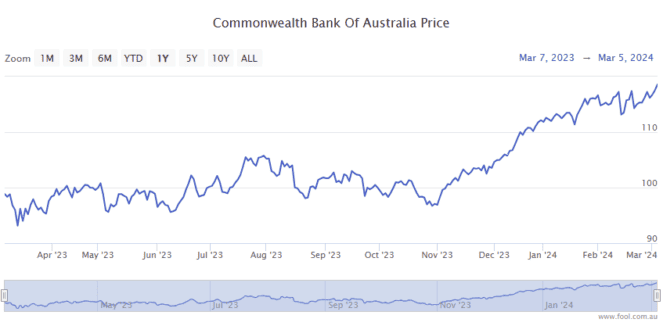

The big four bank stocks have been on fire over the past half year.

And despite a growing chorus of financial analysts concerned with valuations and cautioning that the rally is getting ahead of itself, all the big four banks are in the green again today.

In fact, all four are notching fresh 52-week highs.

Here’s how the big four ASX 200 bank shares are tracking at the time of writing today and over the past six months:

- Australia and New Zealand Banking Group Ltd (ASX: ANZ) shares are up 0.3% today and up 17.1% in six months at $29.12

- National Australia Bank Ltd (ASX: NAB) shares are up 0.7% today and up 20.3% in six month at $37.45

- Westpac Banking Corp (ASX: WBC) shares are up 0.3% today and up 27.9% in six months at $27.01

- Commonwealth Bank of Australia (ASX: CBA) shares are up 0.8% today and up 18.2% in six months at $119.23

For some context the ASX 200 is up 0.3% today and has gained 8.2% over six months.

And it’s not just the big banks themselves posting new highs.

The VanEck Vectors Australian Banks ETF (ASX: MVB) is up 0.7% today. That sees the exchange-traded fund (ETF) up 18.7% in six months and trading at a fresh all-time high.

MVB is exclusively invested in Aussie banks.

Atop the big four ASX 200 bank shares, it holds Macquarie Group Ltd (ASX: MQG), Bendigo and Adelaide Bank Ltd (ASX: BEN) and Bank of Queensland Ltd (ASX: BOQ).

And yes, all three of these bank stocks are also marching higher today!

What’s sending ASX 200 bank shares to new highs?

Atop the broader market strength today, investors are upping their bets on interest rate cuts from the Reserve Bank of Australia (RBA) following yesterday’s weak economic growth figures.

Data from the ABS indicated Australia’s GDP grew by 0.2% in the fourth quarter of 2023 and 1.5% over the full year. And that tepid growth only came thanks to the supersized immigration intake driving a rapid population increase. Per capita GDP actually declined 1.0% from 2022.

That could bolster the case for earlier rate cuts, which could in turn help ASX 200 bank shares boost their earnings if they opt not to pass those full cuts on to borrowers.

The Aussie banks also look to be catching some tailwinds out of the United States.

Yesterday, US Federal Reserve chair Jerome Powell remained cagey on just when the world’s top central bank will begin easing.

But he excited investors when he said (quoted by Reuters), “We expect inflation to come down, the economy to keep growing. If that’s the case, it will be appropriate for interest rates to come down significantly over the coming years.

Separately, Powell fuelled exuberance for US bank stocks, and potentially ASX 200 bank shares, when he indicated that existing plans to make US banks hold more capital were likely to be scaled back.

As you’d expect, this came as welcome news to the US banking industry, which believes it is already sufficiently capitalised to withstand any potential financial shocks.

The post Why are the big 4 ASX 200 bank shares leaping to new 52-week highs today appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- CBA share price marching higher amid ‘difficult news’

- Buy these ASX dividend stocks with yields of 5% to 7.5%

- How investing $100 per week can create $2,000 in annual ASX dividend income

- Is the blistering rally in ASX 200 bank shares overdone?

- ANZ shares push higher amid asset sale and dividend bump hopes

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Macquarie Group. The Motley Fool Australia has positions in and has recommended Bendigo And Adelaide Bank and Macquarie Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/EufyrAY