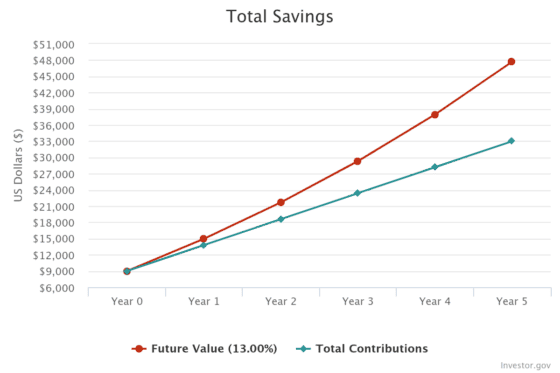

You don’t have to invest large sums of money into the share market to generate meaningful ASX dividend income.

If you’re willing to be patient, then making small investments on a regular basis can grow into something substantial thanks to the power of compounding.

Compounding is what happens when you earn interest on top of interest, or returns on top of returns in the case of ASX shares.

Creating $2,000 in annual dividend income

Over the long-term, share markets have generated average returns of approximately 10% per annum.

While there’s no guarantee that this will be the case in the future, it is reasonable to target such a level of return, so we will base our assumptions on it.

With that in mind, if you were to invest $100 per month into ASX shares and earned the market return, you would have a portfolio valued at $40,000 after 15 years.

Once your portfolio has reached that level, it’s possible that you could adjust your holdings so that they average a dividend yield of 5%. This isn’t too hard to accomplish. For example, ASX shares such as Accent Group Ltd (ASX: AX1) and Westpac Banking Corp (ASX: WBC) offer yields comfortably above 5% at present.

Doing so, would mean that your portfolio generates $2,000 in ASX dividend income for the year. All without having to lift a finger.

But it won’t stop there.

Growing your income

If your portfolio also continues to grow at the market rate, you would see the value of your portfolio increase an additional 5% each year after dividend withdrawals.

So, without making any further contributions, your portfolio would grow to be worth $65,000 in 10 years and $83,000 in 15 years.

If you were to generate a 5% dividend yield on portfolios of these sizes, your annual ASX dividend income would become $3,250 and $4,150, respectively.

All in all, I believe this demonstrates how it is possible to generate a meaningful and growing source of passive income from modest investments.

The post How investing $100 per week can create $2,000 in annual ASX dividend income appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Is the blistering rally in ASX 200 bank shares overdone?

- Why Accent, Cettire, Dicker Data, and Iress shares are dropping today

- Why is the Accent share price sinking 6% today?

- Forget Westpac and buy these ASX dividend shares

- Got $5,000? Buy and hold these ASX value stocks for years

Motley Fool contributor James Mickleboro has positions in Westpac Banking Corporation. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended Accent Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/MqfkXmc