If you’ve picked up a paper today or scrolled through a newsfeed, this ASX 200 stock has probably journeyed into your view.

Today, the spotlight is on Perpetual Ltd (ASX: PPT) as details of its talks with Kohlberg Kravis Roberts & Co, known as KKR & Co Inc (NYSE: KKR), boil to the surface.

After much speculation, the Australian investment group revealed the outcome of its strategic review this morning.

The review, which sought to ‘unlock additional value for shareholders’, has yielded a few notable changes, including arguably the biggest change for the company in its more than century-long existence.

In response, the Perpetual share price is tumbling 7% to $22.35.

Historic change for 138-year-old Australian brand

At the end of Perpetual’s review, the decision has been made to sell the wealth management and corporate trust businesses. The Sydney-based firm will focus solely on being a global multi-boutique asset manager.

It’s a verdict that will see Perpetual depart from its 138-year-old roots. The company was originally formed as a trustee company in 1885, managing the estates of many Australians before getting started in the fund management game in the 1980s.

Asset management powerhouse KKR has agreed to acquire the businesses from the ASX 200 stock via a scheme of arrangement. Perpetual will receive a total cash consideration of A$2.175 billion in return, valuing the businesses at 13.7 times the last 12 months’ earnings before interest, taxes, depreciation, and amortisation (EBITDA).

Commenting on the outcome of Perpetual’s review, group chair Tony D’Aloisio said:

[…] The Board has concluded that becoming a standalone asset management business, rather than a complex diversified financial services conglomerate which is difficult for the market to value, will provide better long-term value for Perpetual shareholders.

The board unanimously recommends the proposal to shareholders, labelling it as a ‘positive and compelling outcome’.

What will become of the ASX 200 stock?

Perpetual will continue to exist on the ASX if the deal goes forward — but the company will look a little different.

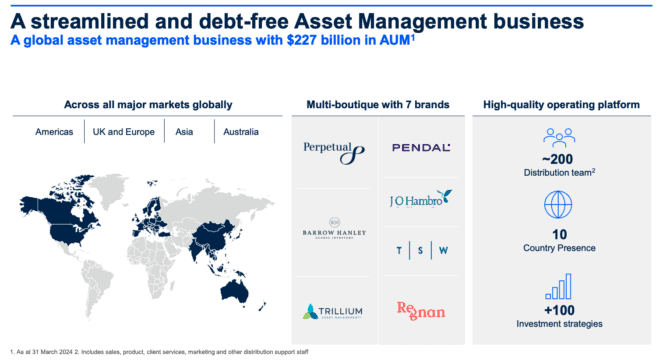

Management describes the remaining operations as a debt-free asset manager with scale. As shown below, Perpetual will hold $227 billion in assets under management post-sale via its brands: Perpetual, Pendal, Barrow Hanley, Trillium, etc.

However, the Perpetual brand will be owned by KKR. A licensing agreement will allow the company to continue using the label for up to seven years, although the plan is to rebrand by the end of 2025.

The deal is slated to be completed by February next year.

Lastly, another blow for the ASX 200 stock today could relate to a management change. Today’s release also revealed CEO and managing director Rob Adams will retire at the end of a transition period. A global search has commenced to find a replacement.

The post Why this ASX 200 stock is making front-page news across the country appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 5 May 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why Judo Capital, NAB, Paladin Energy, and Perpetual shares are falling today

- Perpetual shares freeze and thaw as corporate suitor circles

- Why Boss Energy, Pacific Smiles, Perpetual, and ResMed shares are racing higher

- Why Chalice Mining, Cleanaway, Kogan, and Perpetual shares are sinking today

Motley Fool contributor Mitchell Lawler has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended KKR. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.