Retail data released today shows a boost in sales, but the news offers little comfort for one troubled ASX stock.

According to the Australian Bureau of Statistics, retail turnover increased 0.6% in May. As my colleague Bernd Struben noted, retailers won’t be celebrating yet, with much of the growth attributed to shoppers cashing in on discounted end-of-year sales.

It’s a relatively uninspiring update for ASX retail shares. The data indicates an industry still hobbled by high interest rates, an environment that has partially slain another Australian business today.

Which ASX stock is looking for a lifeline?

The outcome of a strategic review at Booktopia Group Ltd (ASX: BKG) has been announced after the company entered a trading halt on 13 June.

Australia’s largest online bookstore has entered voluntary administration.

As per the announcement, Booktopia is now in the hands of specialist advisory and restructuring firm McGrathNicol.

Partners Keith Crawford, Matthew Caddy, and Damien Pasfield are the acting administrators conducting an ‘urgent assessment’ of Booktopia’s options, including a sale or recapitalisation of the company.

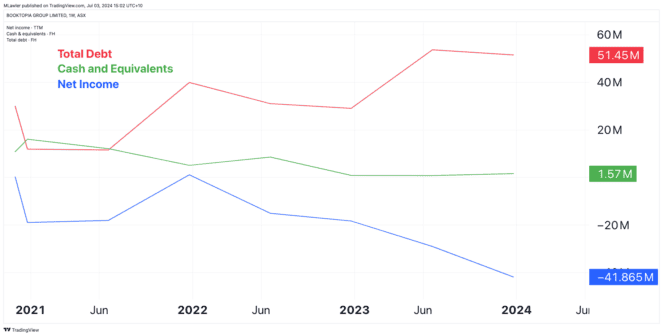

The dire situation follows more than three years of lacklustre performance since the stock popped onto the ASX. During this time, the company’s debt has grown alongside a dwindling cash pile, consumed by unprofitable operations, as depicted in the chart above.

On 31 March 2024, Booktopia had $212,000 in cash and $959,000 in undrawn finance facilities. However, based on recent negative free cash flows, this would be enough to last a month or two.

What’s next?

Trading in Booktopia shares will remain suspended while the administrators try to revive the struggling business. By Monday, 15 July, a meeting with creditors, entities to which Booktopia owes money, will occur.

The ASX stock is down 72% over the last year. For those who have been invested since its public debut, shares are 98.4% lower, last trading at 4.5 cents apiece.

The post Down 70% in a year, this ASX stock has just entered voluntary administration appeared first on The Motley Fool Australia.

Should you invest $1,000 in Booktopia Group Limited right now?

Before you buy Booktopia Group Limited shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Booktopia Group Limited wasn’t one of them.

The online investing service heâs run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

See The 5 Stocks

*Returns as of 24 June 2024

More reading

- AML3D share price surges another 38% today! What’s going on?

- 3 top ASX retirement shares to buy for FY25

- Down 22% in FY24, what’s in store for Domino’s Pizza shares in FY25?

- Why the CSL share price could be ‘undervalued’ at $293

- 2 ASX coal shares smashing new 52-week highs on Wednesday

Motley Fool contributor Mitchell Lawler has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended Booktopia Group. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply