This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Rockstar artificial-intelligence (AI) stock Nvidia (NASDAQ: NVDA) likely has many investors tied in knots right now. Those who have thus far avoided shares of the company, which makes computer chips critical in AI’s development, have missed out on 200% returns over the past year alone. Now, shares have fallen a bit from their highs, which may leave investors wondering if the run is over or if this is just a pause before the stock’s next leg higher.

Unfortunately, nobody can tell you the answer. However, this Fool has done the due diligence to prepare you for what might happen. Is Nvidia a stock to buy now? Here is what you need to know.

Nvidia stock remains cheap at first glance

The investment thesis for Nvidia is straightforward. Technology companies building massive data centers to run powerful artificial intelligence (AI) models are choosing Nvidia’s chips — so much so that experts estimate Nvidia’s market share for AI chips is as high as 90%. Nvidia has won this war with a quality product and proprietary software that helps developers easily configure the chips for AI applications.

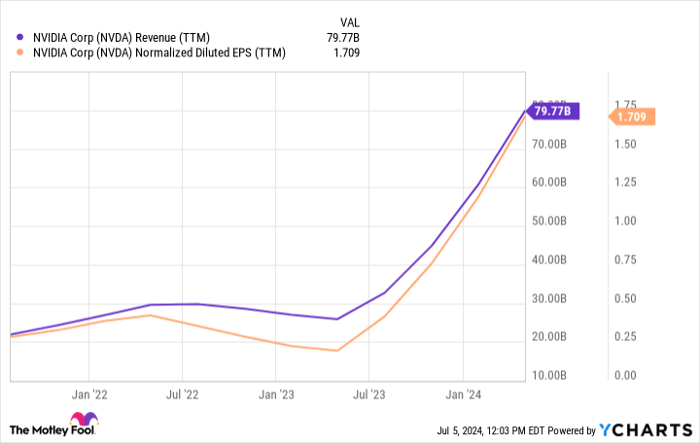

The result has been eye-popping growth that has fueled the stock’s meteoric rise over the past few years:

NVDA Revenue (TTM) data by YCharts

Money could continue flowing into AI. Experts predict that America’s data center footprint could double by 2030. Lisa Su, CEO of rival company AMD, expects the AI chip market to grow to over $400 billion over the next few years. Better AI models may require increasingly better chips. CEO Jensen Huang has stated that Nvidia is aiming for annual AI chip releases.

Analysts believe continued AI chip demand will drive Nvidia’s earnings growth by an average of 38% annually for the next three to five years. The stock’s forward P/E is 48 today. That’s a steep price tag, but it is one that Nvidia could easily grow into if it performed up to analysts’ expectations.

There are potential risks in this promising tale

It’s a hopeful story, but things could get ugly if it doesn’t go according to plan. Nvidia has grown remarkably fast; total revenue has more than doubled in short order. Maintaining that revenue (and growing it) requires that AI chip demand lives up to the hype and that Nvidia continues owning the lion’s share of that market.

There are several realistic scenarios in which this might not happen. Nvidia gets a large chunk of its AI sales from a few large technology companies. What if those companies decide to design custom in-house chips instead? Or, what if these companies reach a point where they’re not getting a good enough return on investment on these chips? This isn’t for fun; AI must make these companies a ton of money to justify spending billions of dollars.

None of these questions even factor in the reality that AMD, Intel, and others will all be gunning for Nvidia’s market share. Nvidia could retain its market share but face pricing pressure if competitors dramatically undercut its pricing with comparable chips.

How should investors approach Nvidia stock?

Everyone buying Nvidia stock now is banking on future growth, not what has already happened. Ultimately, the risk to investors is that Nvidia fails to deliver for whatever reason. And because of how giant Nvidia’s leap has been so far, going backward could be especially painful.

That doesn’t mean investors should avoid the stock entirely. As shown above, the stock could still perform well if the company’s growth continues. The key is not chasing the stock, and keeping Nvidia to a small percentage of a diversified portfolio.

Nvidia is the perfect opportunity for dollar-cost averaging, building an investment with small, repeated purchases. Slowly accumulating shares means you won’t be all-in to the stock too soon. You can steadily increase your investment as Nvidia shows it can maintain its growth. Let the company earn your investment dollars. It also would be less costly to pull your investment and move on if Nvidia gets in trouble.

In this scenario, it’s heads-you-win, tails-you-win. That’s smart investing.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Is Nvidia stock a buy now? appeared first on The Motley Fool Australia.

Should you invest $1,000 in Nvidia right now?

Before you buy Nvidia shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Nvidia wasn’t one of them.

The online investing service heâs run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

See The 5 Stocks *Returns as of 24 June 2024

More reading

- Could Nvidia stock help you become a millionaire?

- Is Nvidia stock going to $144?

- Nvidia’s stock is up 160% in 2024, but is it a bubble waiting to pop?

- Can Nvidia stock cross $1,000 again after the stock split?

- One day, Nvidia stock will go down. Here’s how to keep it from hurting your portfolio

Justin Pope has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Advanced Micro Devices and Nvidia. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended Intel and has recommended the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool Australia has recommended Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply