Chalice Mining Ltd (ASX: CHN) has been one of the ASX’s standout performers over the past year.

The Chalice share price is up 7.11% today to $2.56, extending a strong run that has seen the stock climb 16% over the past week.

Zooming out, the gains are even more eye-catching. Chalice shares are up 45% over the past month and an impressive 120% over the past 12 months.

After such a powerful run, the key question is whether there is still upside from here.

Let’s break it down.

Gonneville project continues to drive momentum

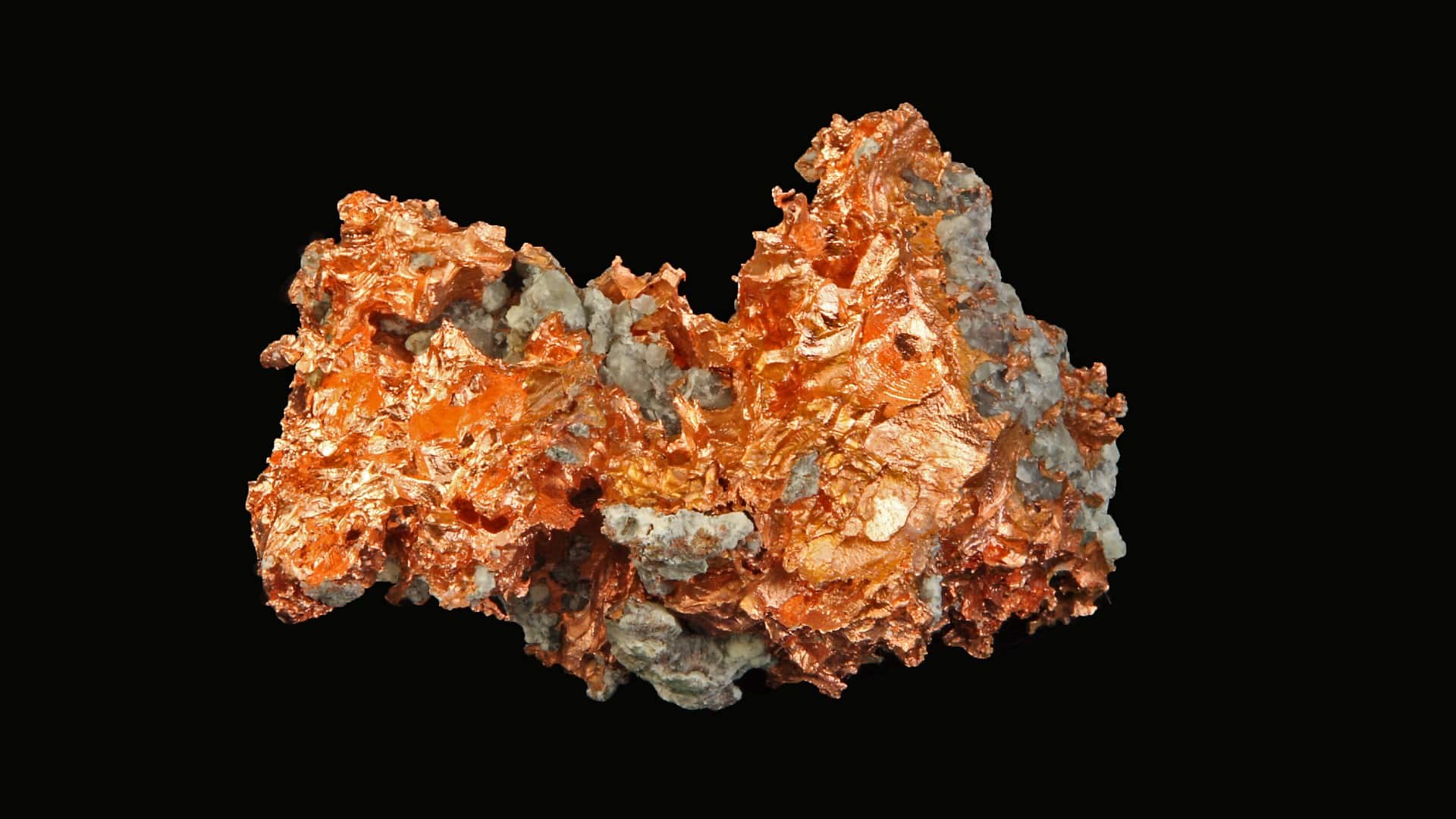

The key driver behind Chalice’s share price surge is its Gonneville palladium-nickel-copper project in Western Australia.

Gonneville is a globally significant critical minerals discovery, containing palladium, nickel, copper, cobalt and platinum group elements. These metals are essential for electric vehicles, renewable energy infrastructure and advanced manufacturing.

Last month, Chalice released a pre-feasibility study (PFS) for the project. The study outlined a long-life, large-scale operation with strong forecast economics.

According to the PFS, Gonneville has the potential to generate substantial cash flow over its mine life, with relatively low operating costs and a competitive capital profile. Importantly, the study confirmed that the project remains technically and economically viable at current commodity prices.

The project has also received strong government backing. Gonneville has been granted Major Project Status by the federal government and recognised as a Strategic Project by the WA government. That support can help streamline approvals and reduce development risk over time.

Strong commodity backdrop adds support

Chalice’s recent rally has also been helped by improving sentiment across key commodities.

Copper prices have pushed towards record highs, driven by strong demand from electrification and data centre buildouts. Nickel prices have also surged to multi-year highs amid supply concerns and policy changes in Indonesia.

This gives Chalice exposure to a mix of critical minerals that are seeing favourable long term demand trends.

Risks investors should keep in mind

Despite the strong share price performance, Chalice is still a pre-production company. Earnings remain negative, and the path to first production will require further studies, approvals and funding.

It is also worth noting that Chalice shares can be volatile and sensitive to changes in commodity prices and broader market sentiment.

Foolish bottom line

Chalice Mining’s 120% rally has been driven by solid progress at Gonneville and a supportive commodity backdrop.

While the easy gains may now be behind it, further upside could come from continued project de risking and strong metals prices.

For investors with a long-term view and a tolerance for volatility, Chalice remains a stock worth watching closely.

The post This ASX mining stock is up 120% in a year. Can the rally continue? appeared first on The Motley Fool Australia.

Should you invest $1,000 in Chalice Gold Mines Limited right now?

Before you buy Chalice Gold Mines Limited shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Chalice Gold Mines Limited wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

* Returns as of 1 Jan 2026

.custom-cta-button p {

margin-bottom: 0 !important;

}

More reading

- Buy, hold, sell: How does Morgans rate these ASX shares?

- Insiders are buying Xero and these ASX shares this month

- Why Chalice Mining, Predictive Discovery, Premier Investments, and St Barbara shares are sinking today

- These speculative ASX stocks could rise 90% to 140%

Motley Fool contributor Aaron Teboneras has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply